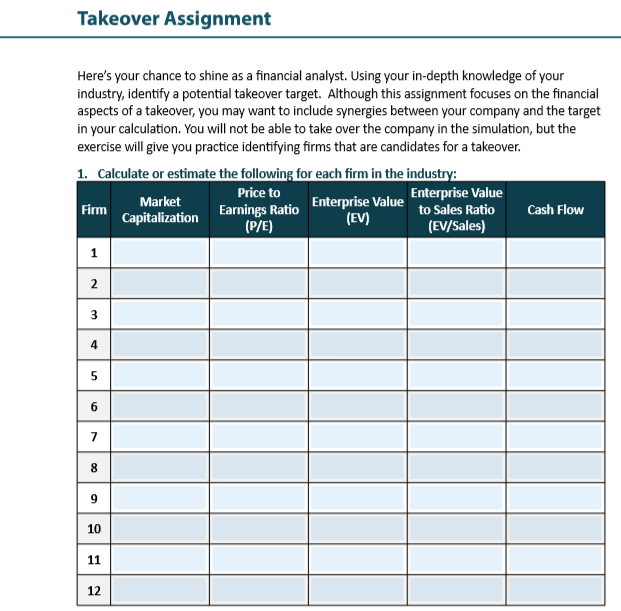

Question: Which competitor would you target for a takeover? Provide a brief rationale for your takeover decision based on the measures you calculated and any other

Which competitor would you target for a takeover? Provide a brief rationale for your takeover decision based on the measures you calculated and any other considerations you used. 3. What would you expect the cost of the takeover to be? How would you finance it?

Which competitor would you target for a takeover? Provide a brief rationale for your takeover decision based on the measures you calculated and any other considerations you used. 3. What would you expect the cost of the takeover to be? How would you finance it?

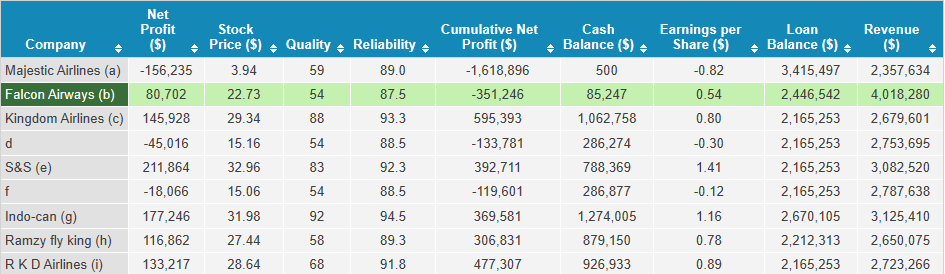

Net Profit Cumulative Net Stock Cash Earnings per Share ($) Loan Revenue Price ($) Quality Reliability Balance (S) Profit ($) Balance (S) Company (S) ($ Majestic Airlines (a) 3.94 59 89.0 500 -0.82 3,415,497 -156,235 -1,618,896 2,357,634 Falcon Airways (b) 80,702 22.73 54 87.5 -351,246 85,247 0.54 2,446,542 4,018,280 Kingdom Airlines (c) 29.34 88 93.3 595,393 0.80 2,165,253 145,928 1,062,758 2,679,601 d -45,016 15.16 54 88.5 -133,781 286,274 -0.30 2,165,253 2,753,695 S&S (e) 32.96 83 92.3 392,711 3,082,520 211,864 788,369 1.41 2,165,253 f -18,066 15.06 54 88.5 -119,601 286,877 -0.12 2,165,253 2,787,638 Indo-can (g) 177,246 31.98 92 94.5 1,274,005 1.16 3,125,410 369,581 2,670,105 Ramzy fly king (h] 2,650,075 116,862 27.44 58 89.3 306,831 879,150 0.78 2,212,313 133,217 28.64 68 91.8 926.933 0.89 2,165,253 RKDAirlines (i) 477,307 2,723,266 Takeover Assignment Here's your chance to shine as a financial analyst. Using your in-depth knowledge of your industry, identify a potential takeover target. Although this assignment focuses on the financial aspects of a takeover, you may want to include synergies between your company and the target in your calculation. You will not be able to take over the company in the simulation, but the exercise will give you practice identifying firms that are candidates for a takeover. 1. Calculate or estimate the following for each firm in the industry: Price to Market Firm Capitalization Earnings Ratio Enterprise Value nterprise Value to Sales Ratio Cash Flow (EV) (P/E) (EV/Sales) 1 2 3 4 5 6 7 8 10 11 12 Net Profit Cumulative Net Stock Cash Earnings per Share ($) Loan Revenue Price ($) Quality Reliability Balance (S) Profit ($) Balance (S) Company (S) ($ Majestic Airlines (a) 3.94 59 89.0 500 -0.82 3,415,497 -156,235 -1,618,896 2,357,634 Falcon Airways (b) 80,702 22.73 54 87.5 -351,246 85,247 0.54 2,446,542 4,018,280 Kingdom Airlines (c) 29.34 88 93.3 595,393 0.80 2,165,253 145,928 1,062,758 2,679,601 d -45,016 15.16 54 88.5 -133,781 286,274 -0.30 2,165,253 2,753,695 S&S (e) 32.96 83 92.3 392,711 3,082,520 211,864 788,369 1.41 2,165,253 f -18,066 15.06 54 88.5 -119,601 286,877 -0.12 2,165,253 2,787,638 Indo-can (g) 177,246 31.98 92 94.5 1,274,005 1.16 3,125,410 369,581 2,670,105 Ramzy fly king (h] 2,650,075 116,862 27.44 58 89.3 306,831 879,150 0.78 2,212,313 133,217 28.64 68 91.8 926.933 0.89 2,165,253 RKDAirlines (i) 477,307 2,723,266 Takeover Assignment Here's your chance to shine as a financial analyst. Using your in-depth knowledge of your industry, identify a potential takeover target. Although this assignment focuses on the financial aspects of a takeover, you may want to include synergies between your company and the target in your calculation. You will not be able to take over the company in the simulation, but the exercise will give you practice identifying firms that are candidates for a takeover. 1. Calculate or estimate the following for each firm in the industry: Price to Market Firm Capitalization Earnings Ratio Enterprise Value nterprise Value to Sales Ratio Cash Flow (EV) (P/E) (EV/Sales) 1 2 3 4 5 6 7 8 10 11 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts