Question: Which cost flow method results in (1) the highest inventory amount for the balance sheet and (2) the highest cost of goods sold for the

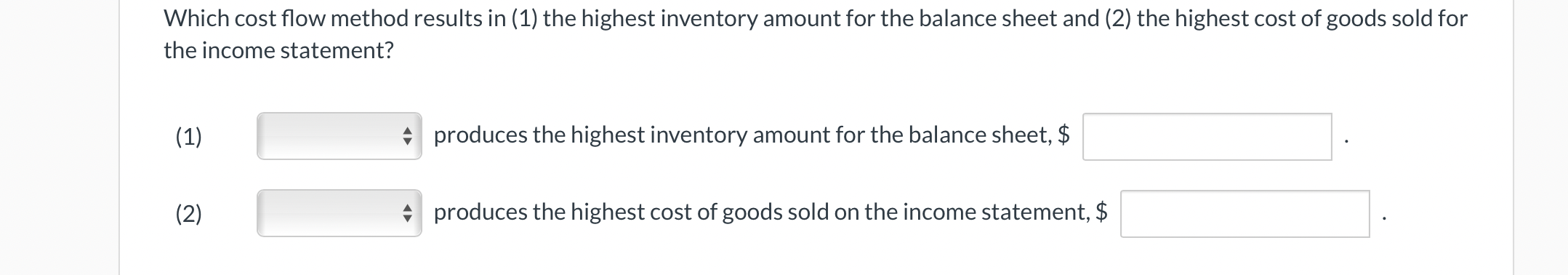

Which cost flow method results in (1) the highest inventory amount for the balance sheet and (2) the highest cost of goods sold for the income statement?

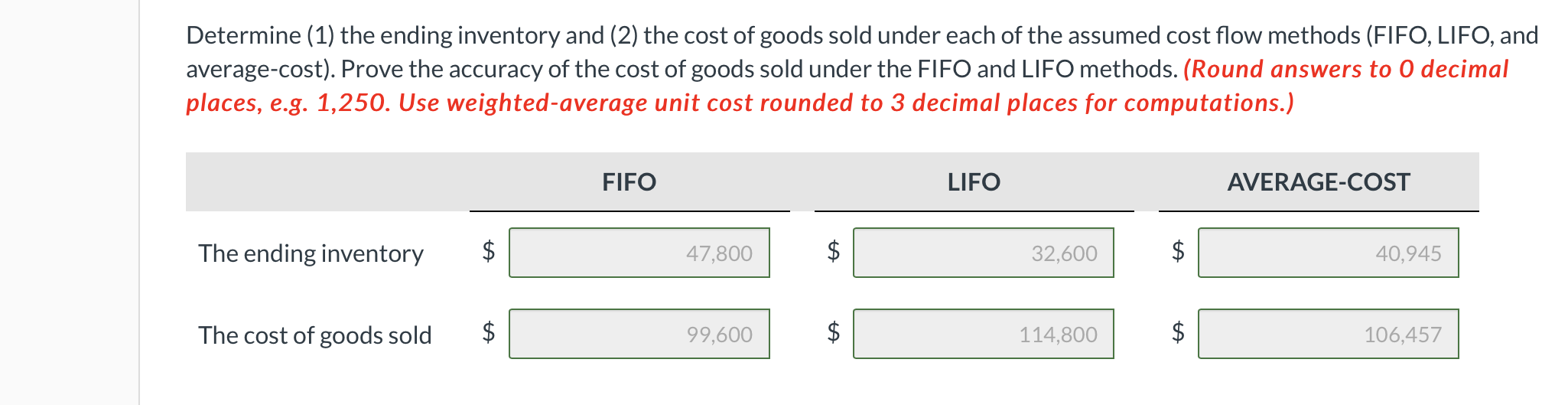

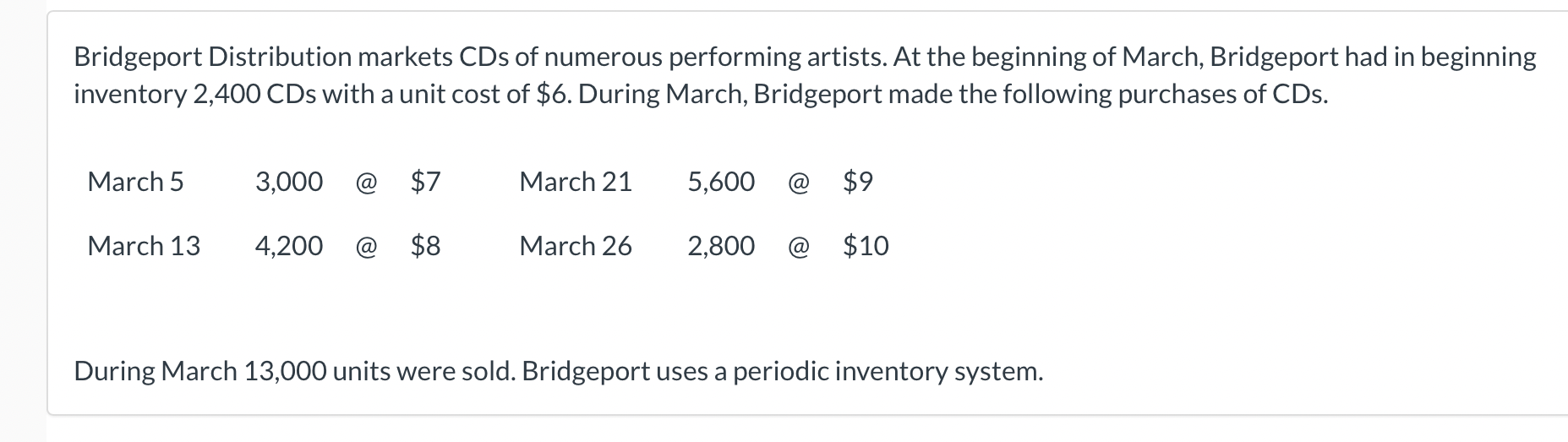

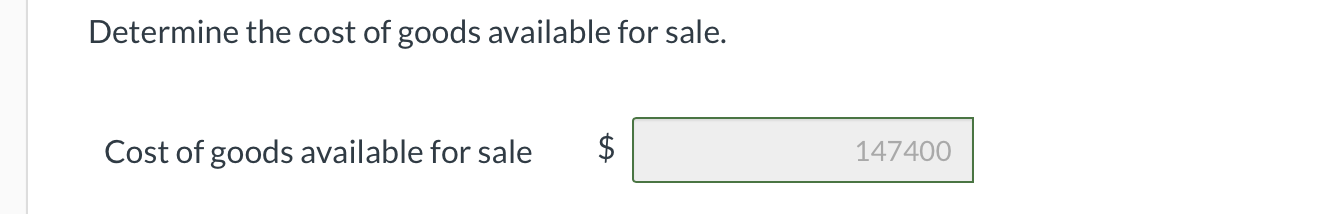

Determine (1) the ending inventory and (2) the cost of goods sold under each of the assumed cost flow methods (FIFO, LIFO, and average-cost). Prove the accuracy of the cost of goods sold under the FIFO and LIFO methods. (Round answers to O decimal places, e.g. 1,250. Use weighted-average unit cost rounded to 3 decimal places for computations.) FIFO LIFO AVERAGE-COST The ending inventory 47,800 $ 32,600 ta 40,945 The cost of goods sold ta 99,600 $ 114,800 $ 106,457 Which cost flow method results in (1) the highest inventory amount for the balance sheet and (2) the highest cost of goods sold for the income statement? (1) ( A produces the highest inventory amount for the balance sheet, $ (2) produces the highest cost of goods sold on the income statement, $ Bridgeport Distribution markets CDs of numerous performing artists. At the beginning of March, Bridgeport had in beginning inventory 2,400 CDs with a unit cost of $6. During March, Bridgeport made the following purchases of CDs. a March 5 3,000 a $7 March 21 5,600 $9 March 13 4,200 a $8 March 26 2,800 @ $10 During March 13,000 units were sold. Bridgeport uses a periodic inventory system. Determine the cost of goods available for sale. Cost of goods available for sale 147400 Calculate weighted-average cost per unit. (Round answer to 3 decimal places, e.g. 2.257.) Weighted average cost per unit $ 8.19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts