Question: Which decision making method would be most appropriate for a project that has a short, defined lifespan, does not involve millions of dollars, and the

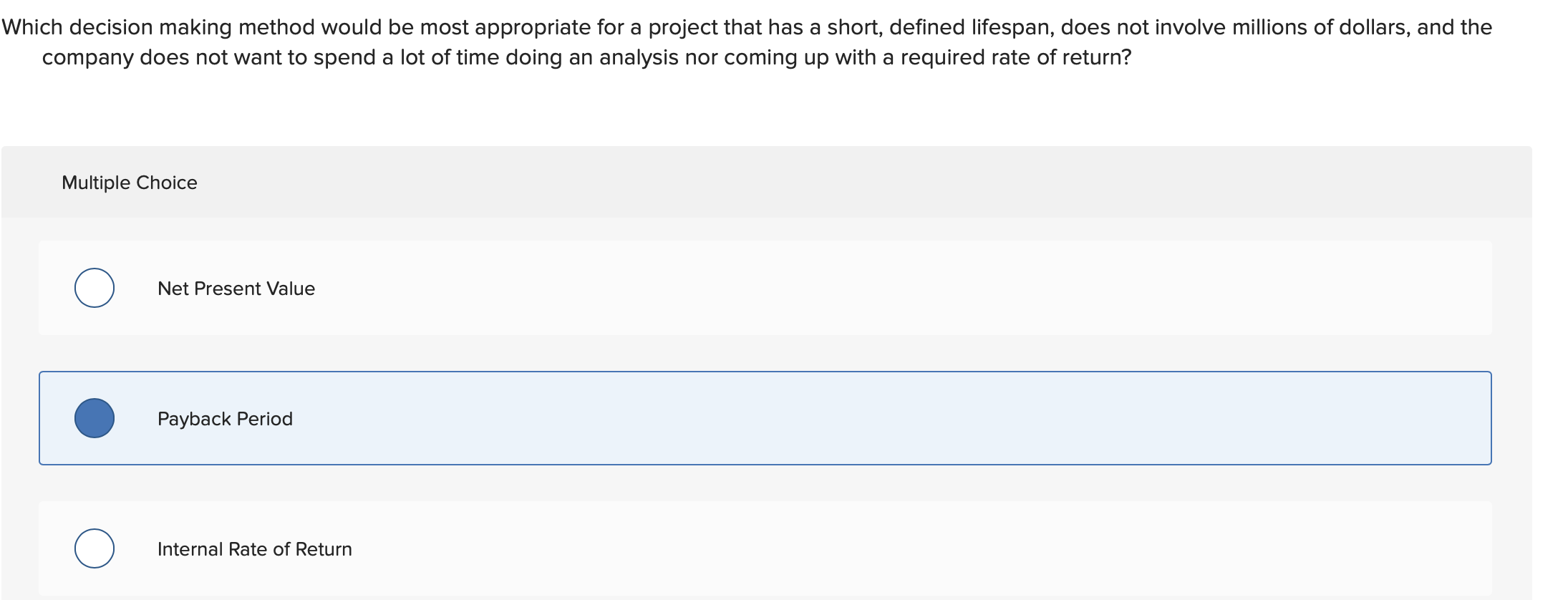

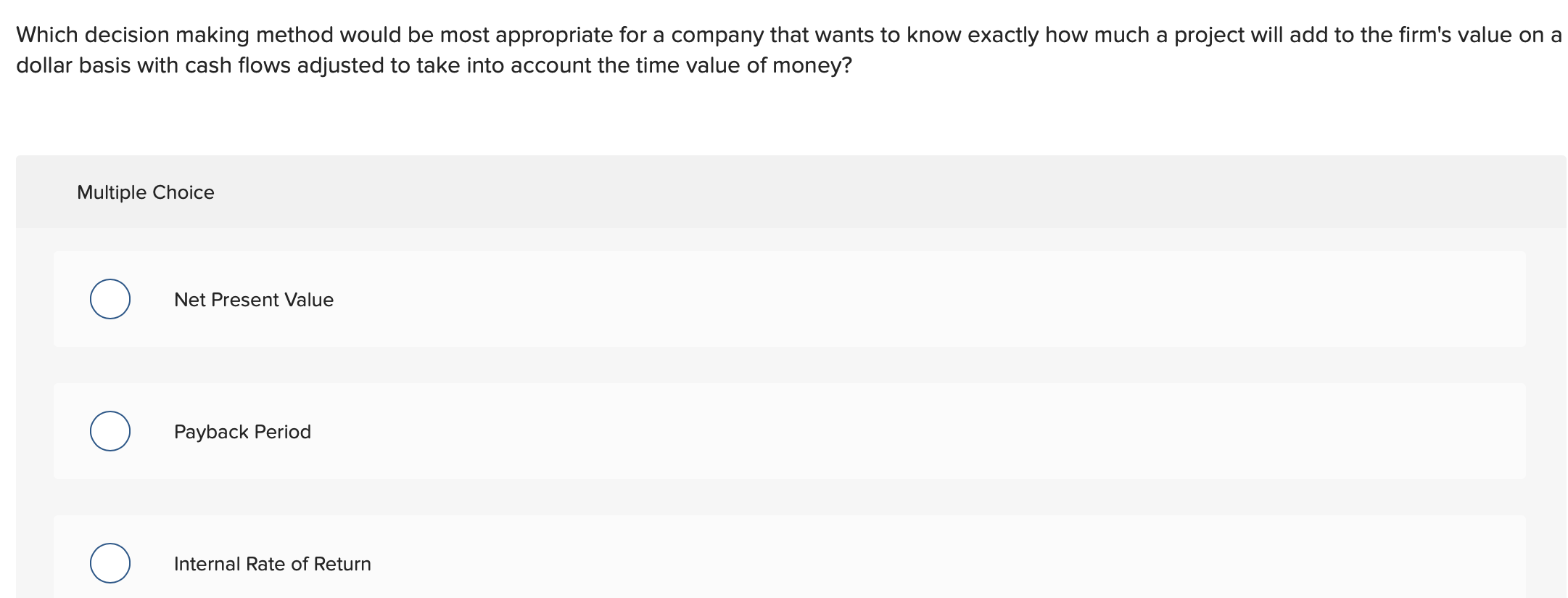

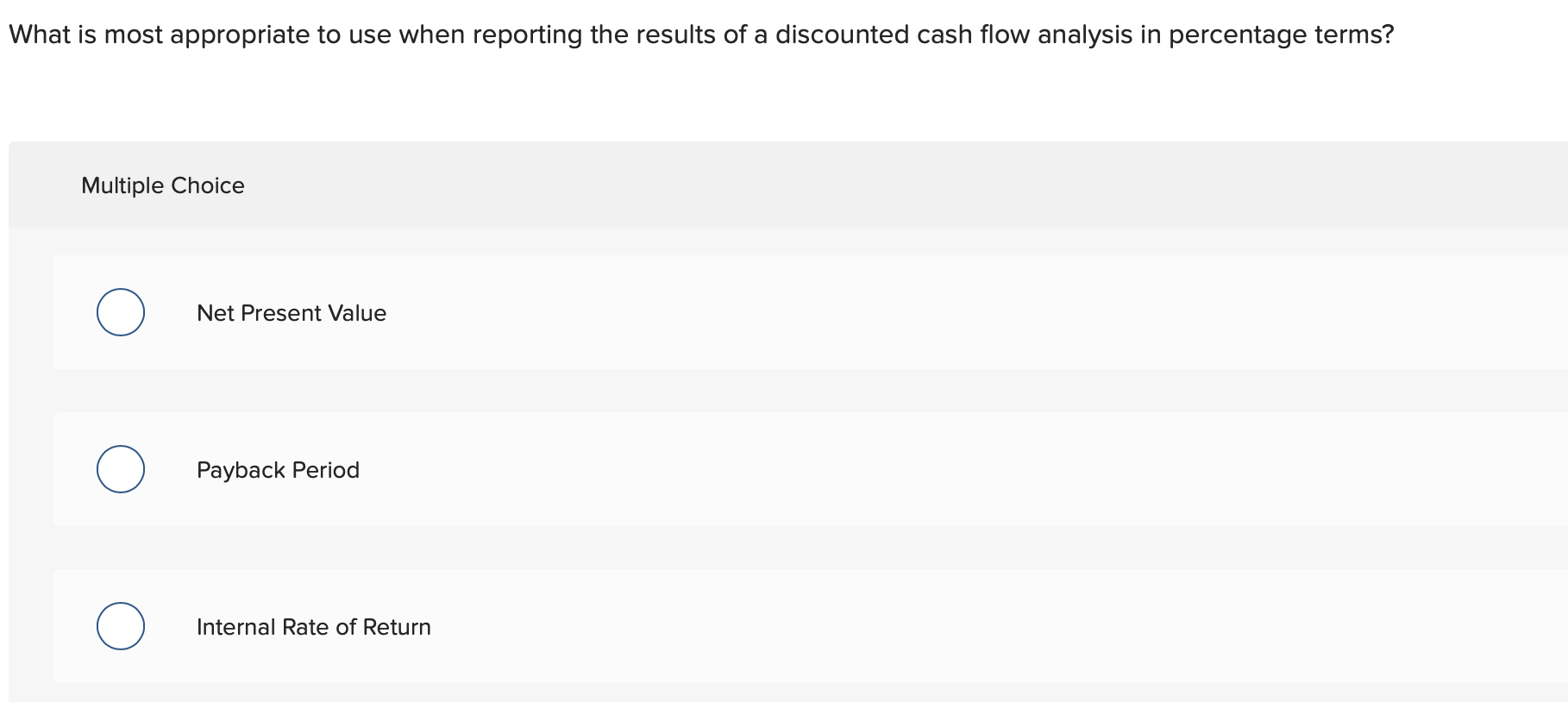

Which decision making method would be most appropriate for a project that has a short, defined lifespan, does not involve millions of dollars, and the company does not want to spend a lot of time doing an analysis nor coming up with a required rate of return? Multiple Choice Net Present Value Payback Period Internal Rate of Return Which decision making method would be most appropriate for a company that wants to know exactly how much a project will add to the firm's value on a dollar basis with cash flows adjusted to take into account the time value of money? Multiple Choice Net Present Value Payback Period Internal Rate of Return What is most appropriate to use when reporting the results of a discounted cash flow analysis in percentage terms? Multiple Choice Net Present Value Payback Period o Internal Rate of Return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts