Question: Which discounted cash flow valuation method is most appropriate for a firm or project whose capital structure is expected to change over time? Free cash

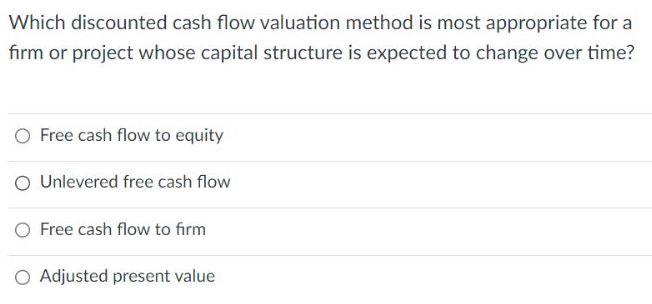

Which discounted cash flow valuation method is most appropriate for a firm or project whose capital structure is expected to change over time? Free cash flow to equity Unlevered free cash flow Free cash flow to firm Adjusted present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts