Question: which dividend discount model is more appropriate to estimate BWP Trust's share price? Provide your reasons. . Calculate the share price of the BWP Trust

which dividend discount model is more appropriate to estimate BWP Trust's share price? Provide your reasons.

. Calculate the share price of the BWP Trust using the dividend discount model identified in Part 3

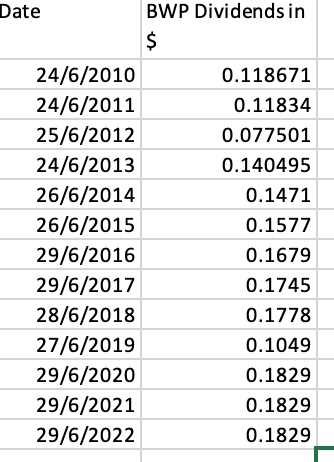

\begin{tabular}{|r|r|} \hline \multicolumn{1}{l|}{ Bate } & BWP Dividends in \\ \hline 24/6/2010 & 0.118671 \\ \hline 24/6/2011 & 0.11834 \\ \hline 25/6/2012 & 0.077501 \\ \hline 24/6/2013 & 0.140495 \\ \hline 26/6/2014 & 0.1471 \\ \hline 26/6/2015 & 0.1577 \\ \hline 29/6/2016 & 0.1679 \\ \hline 29/6/2017 & 0.1745 \\ \hline 28/6/2018 & 0.1778 \\ \hline 27/6/2019 & 0.1049 \\ \hline 29/6/2020 & 0.1829 \\ \hline 29/6/2021 & 0.1829 \\ \hline 29/6/2022 & 0.1829 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline \multicolumn{1}{l|}{ Bate } & BWP Dividends in \\ \hline 24/6/2010 & 0.118671 \\ \hline 24/6/2011 & 0.11834 \\ \hline 25/6/2012 & 0.077501 \\ \hline 24/6/2013 & 0.140495 \\ \hline 26/6/2014 & 0.1471 \\ \hline 26/6/2015 & 0.1577 \\ \hline 29/6/2016 & 0.1679 \\ \hline 29/6/2017 & 0.1745 \\ \hline 28/6/2018 & 0.1778 \\ \hline 27/6/2019 & 0.1049 \\ \hline 29/6/2020 & 0.1829 \\ \hline 29/6/2021 & 0.1829 \\ \hline 29/6/2022 & 0.1829 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts