Question: Which expense accounts might be overstated? How difficult would it be to overstate them? What would be the effect on Koss's value if expenses were

Which expense accounts might be overstated? How difficult would it be to overstate them? What would be the effect on Koss's value if expenses were overstated?

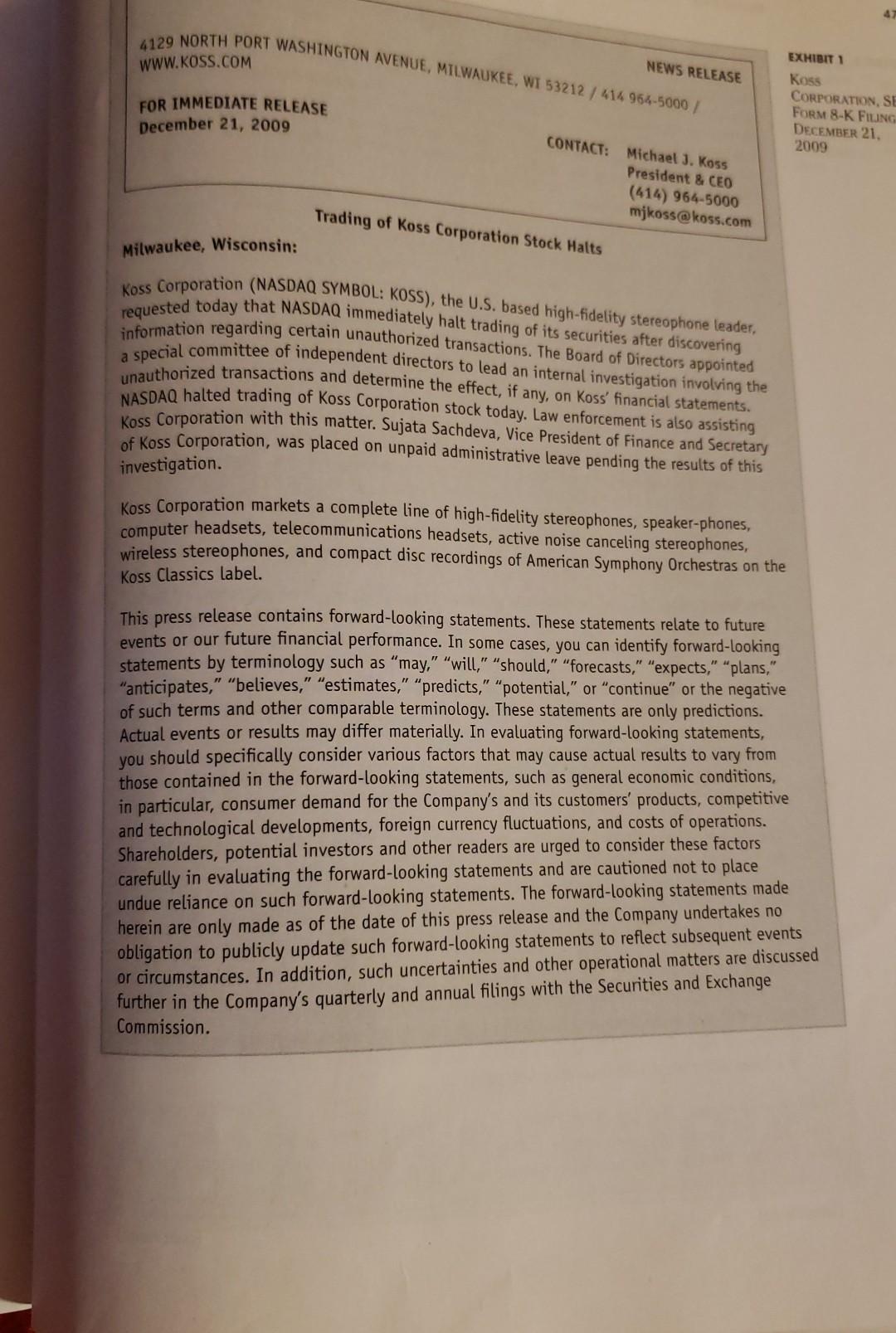

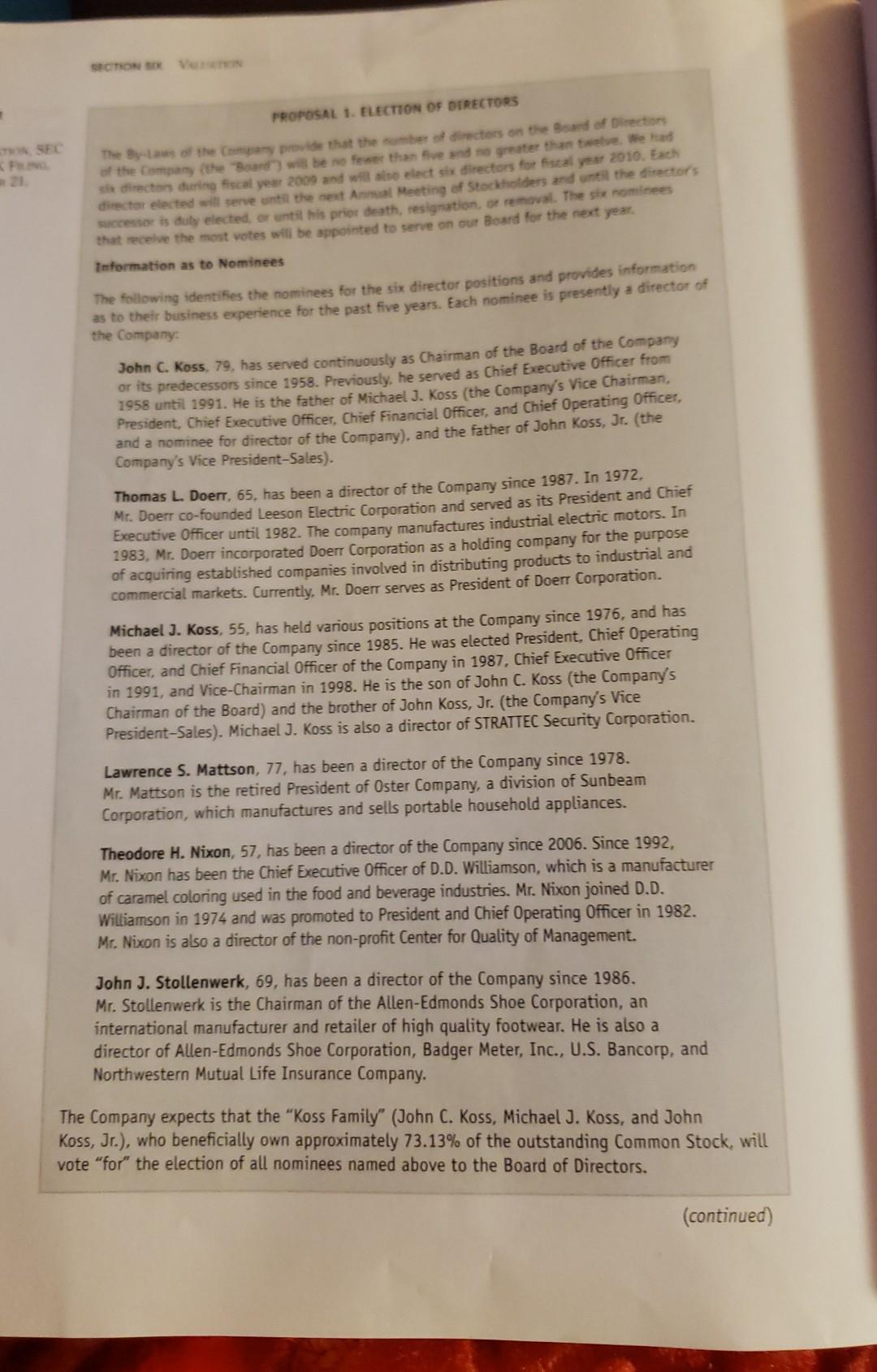

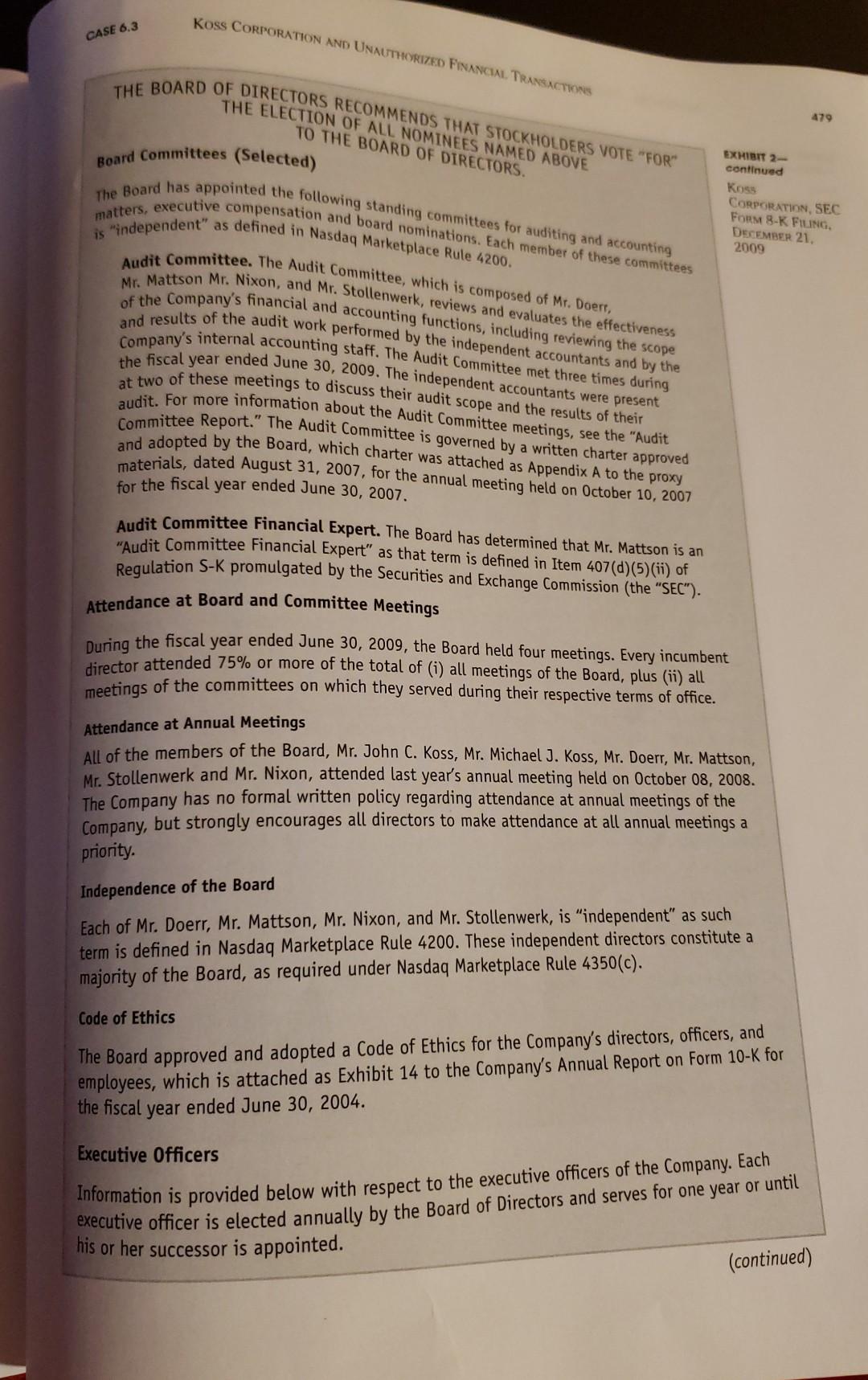

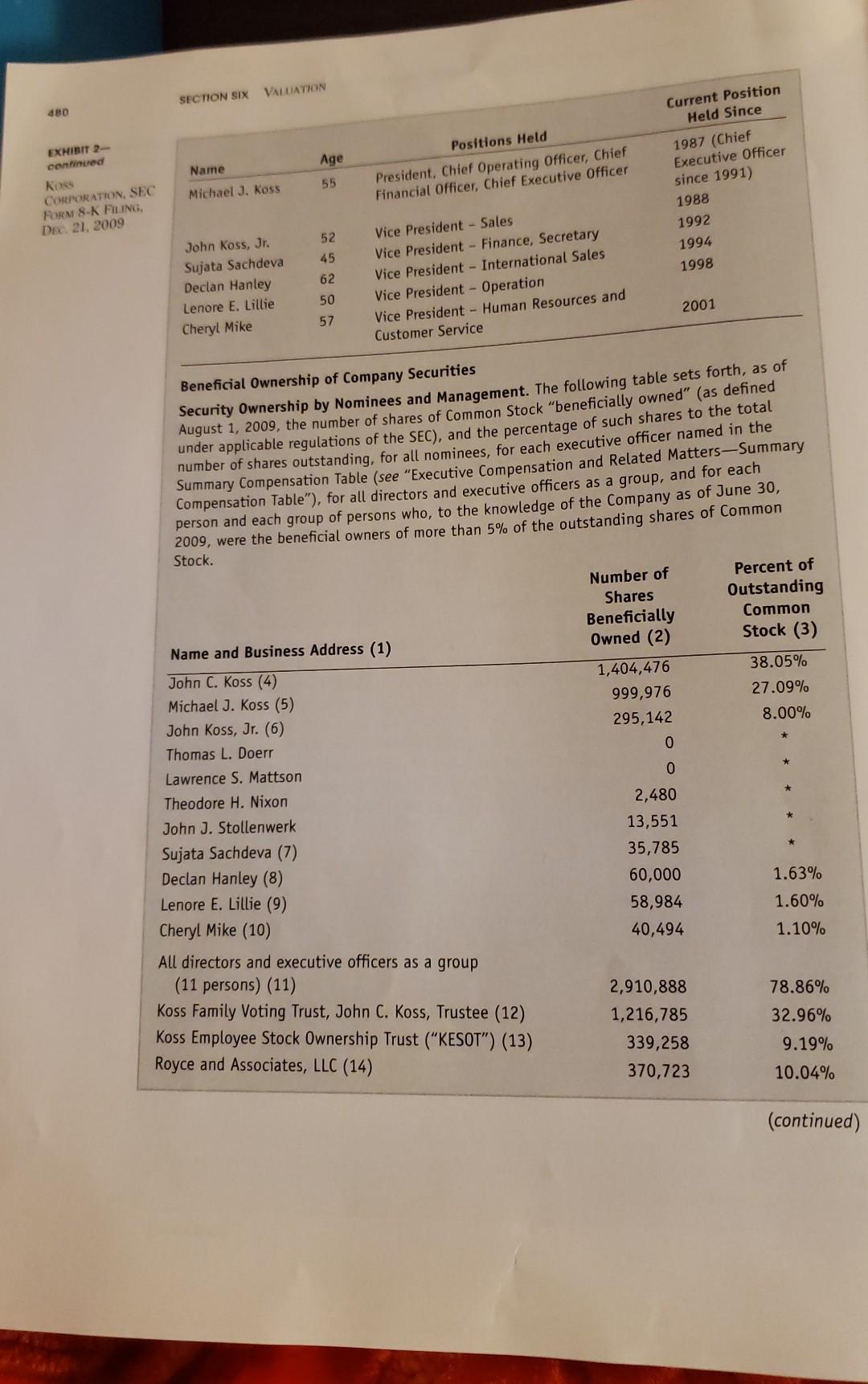

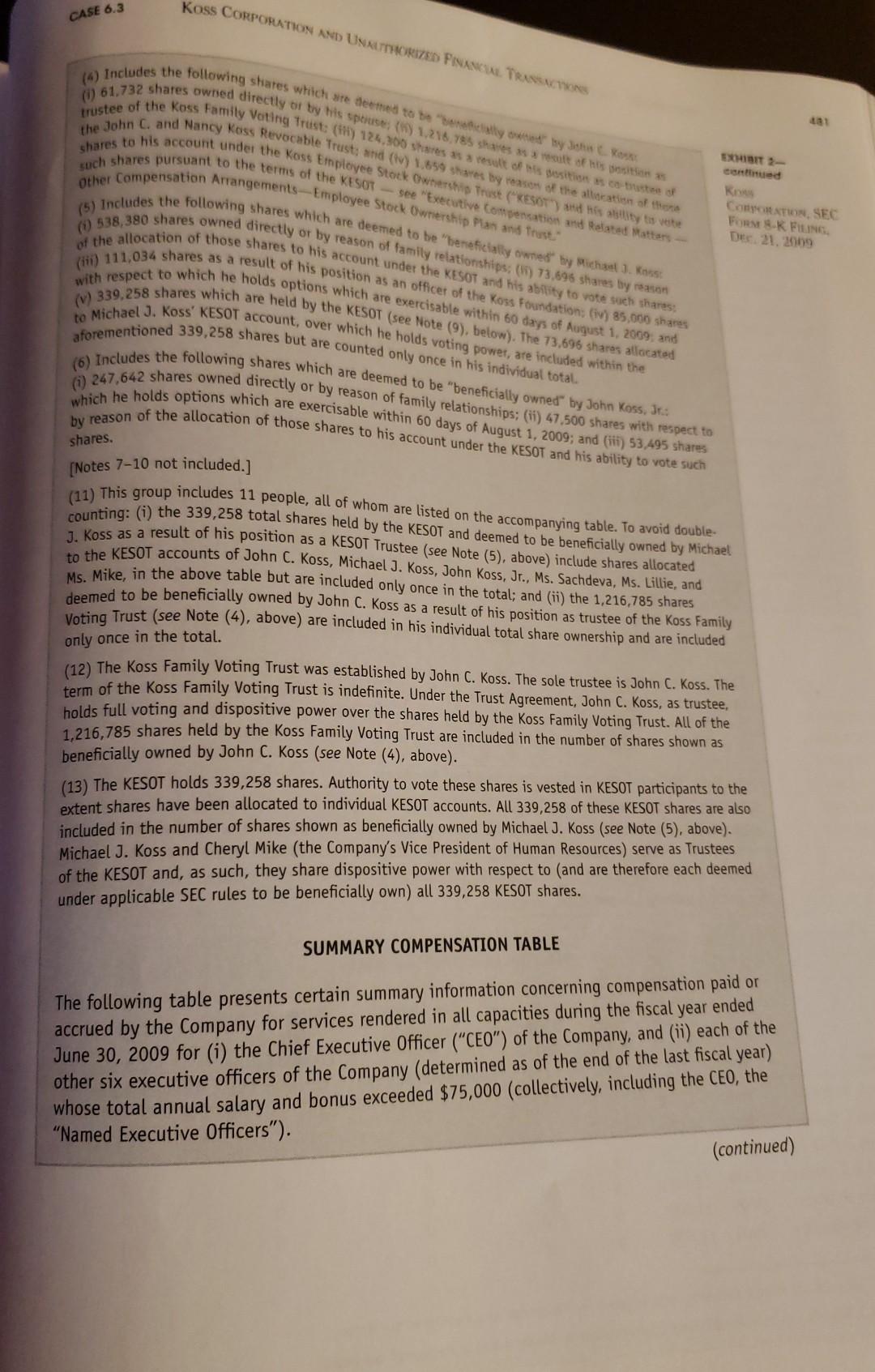

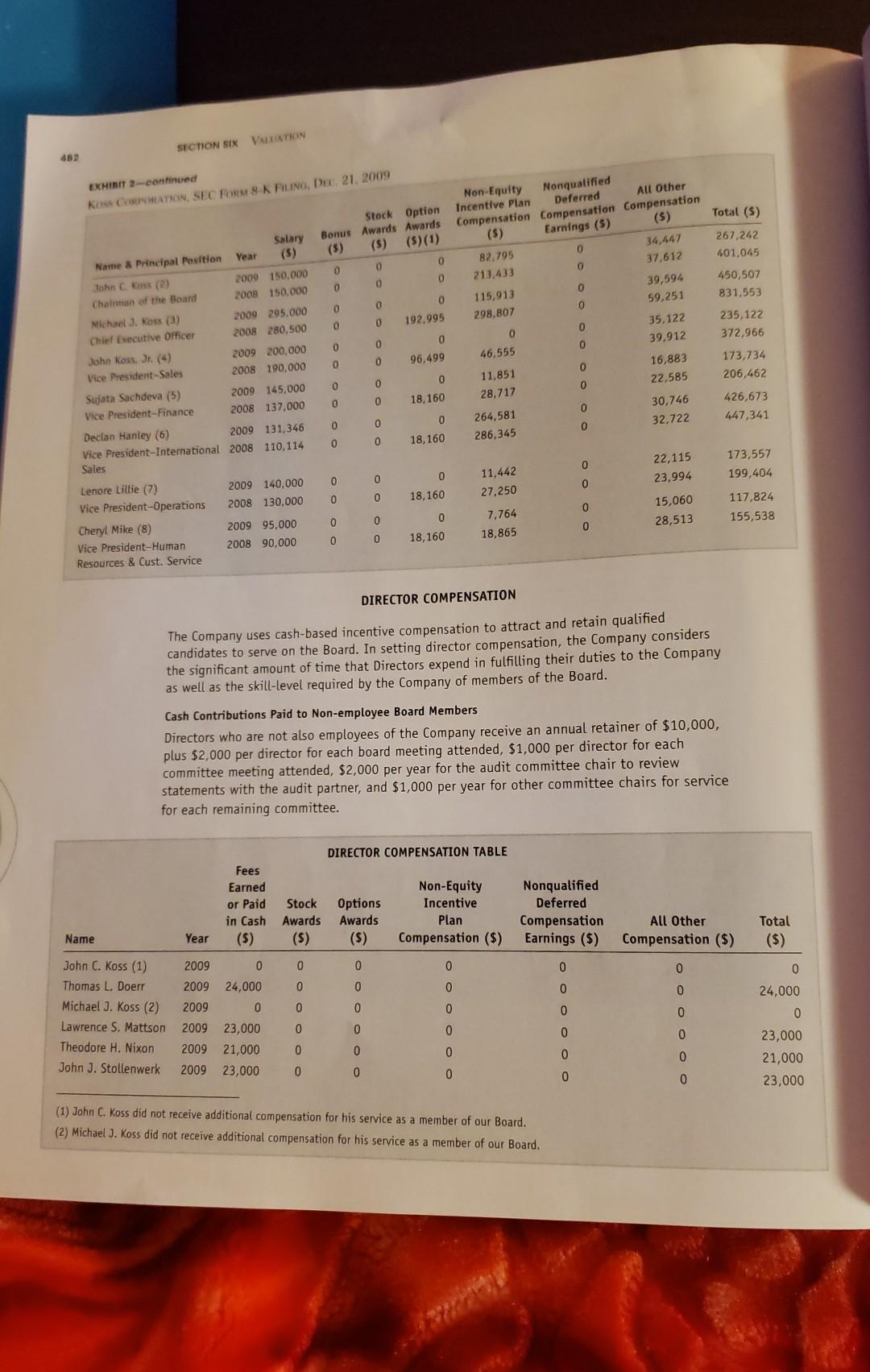

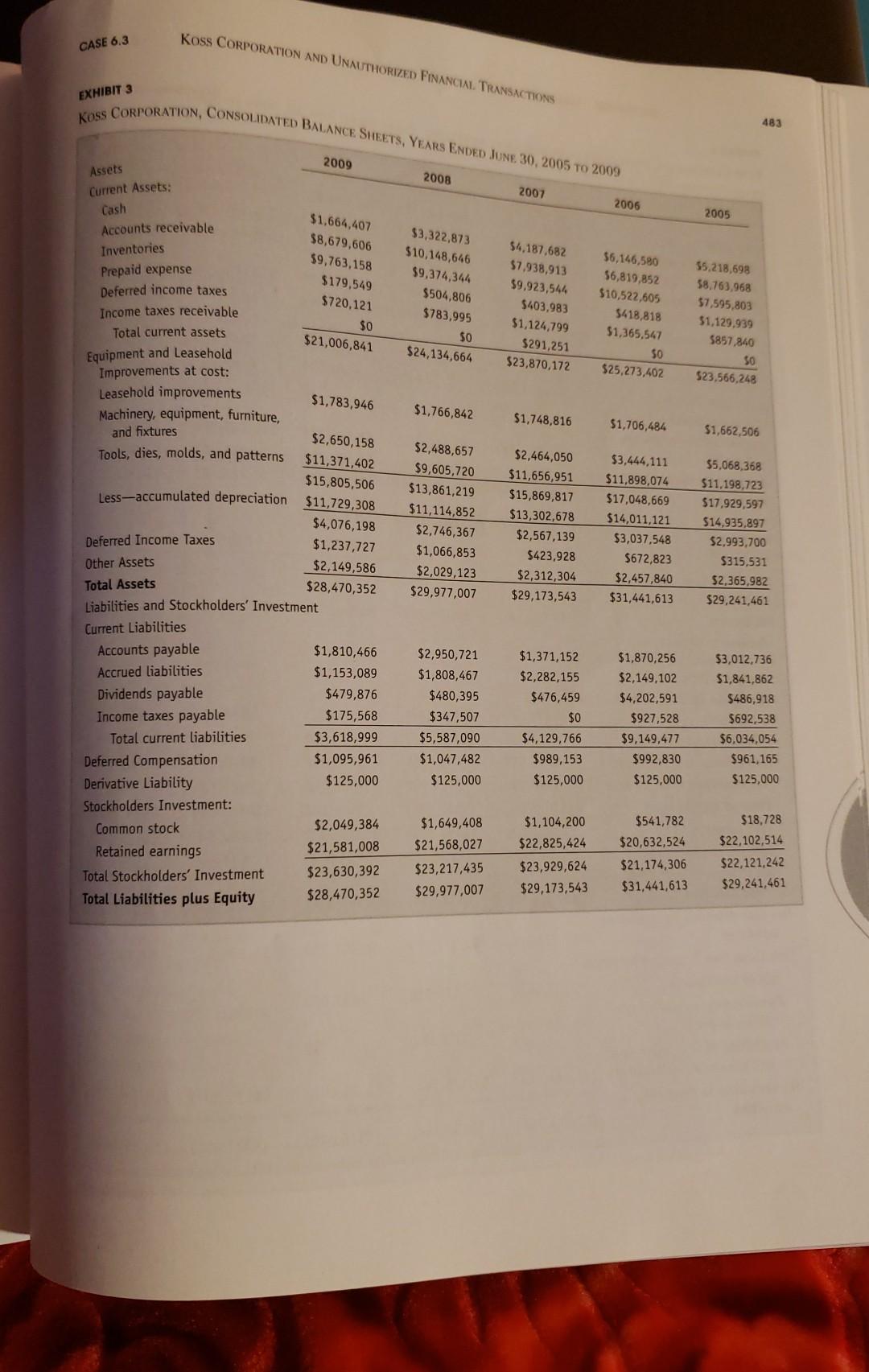

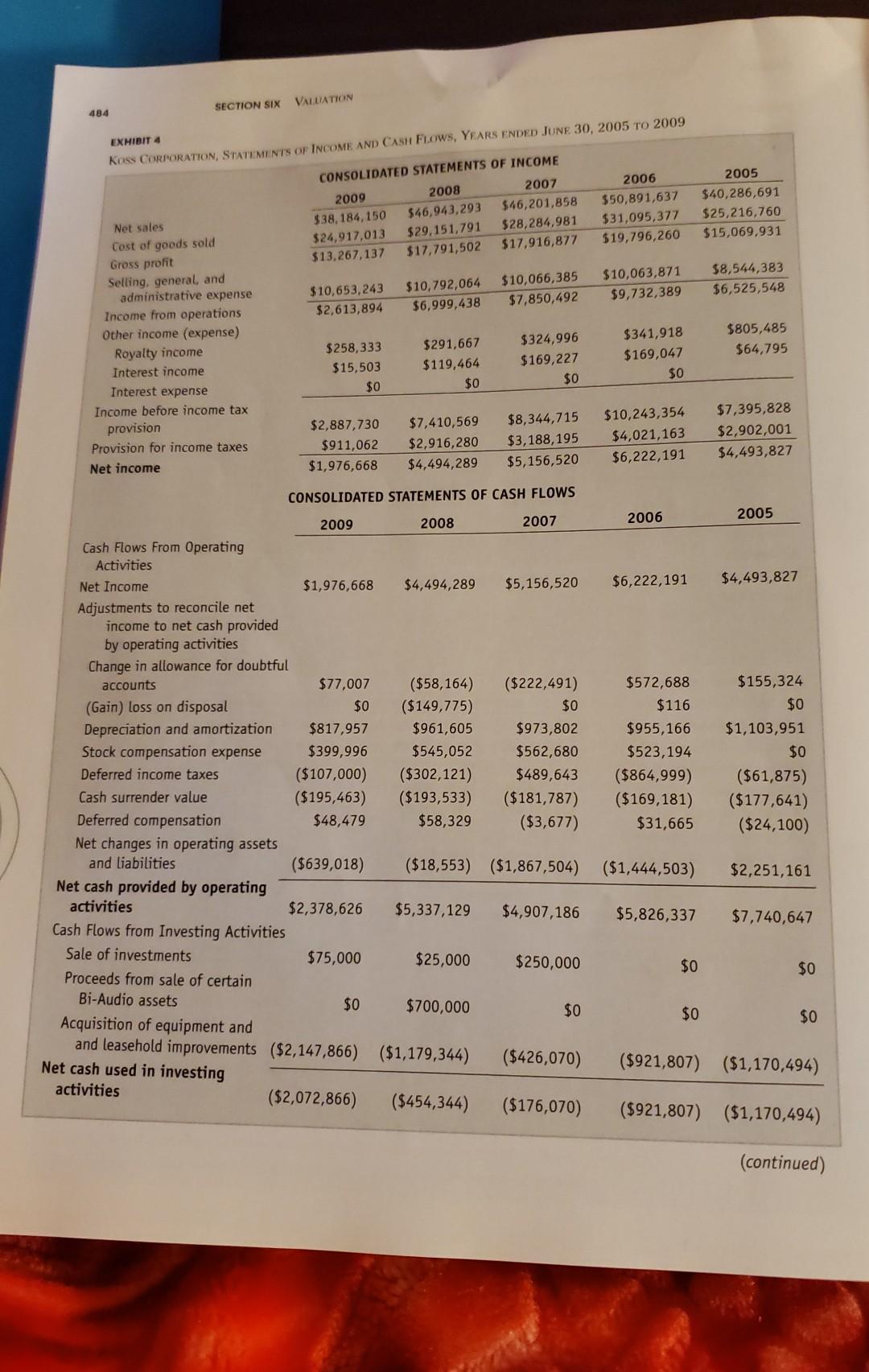

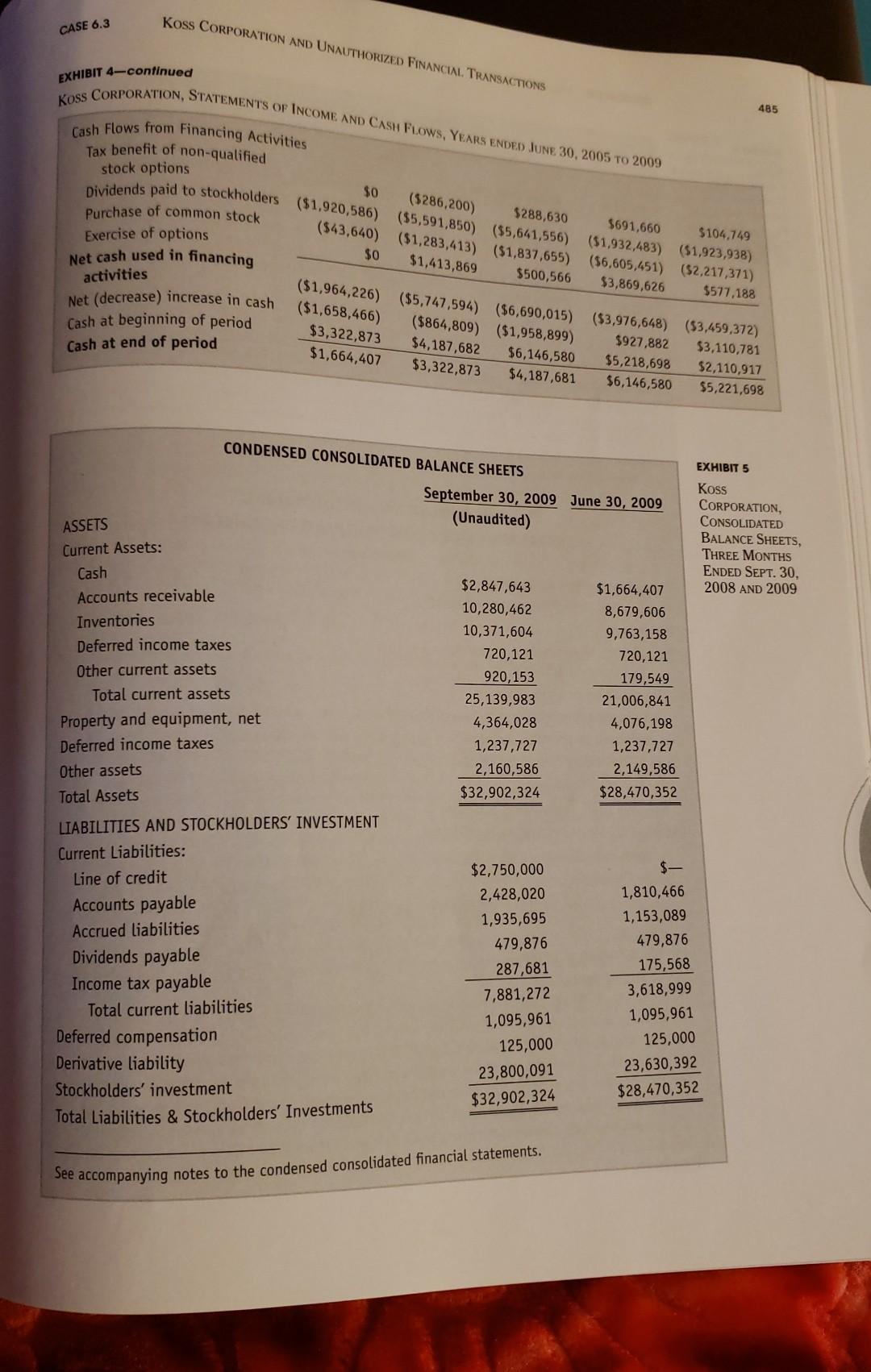

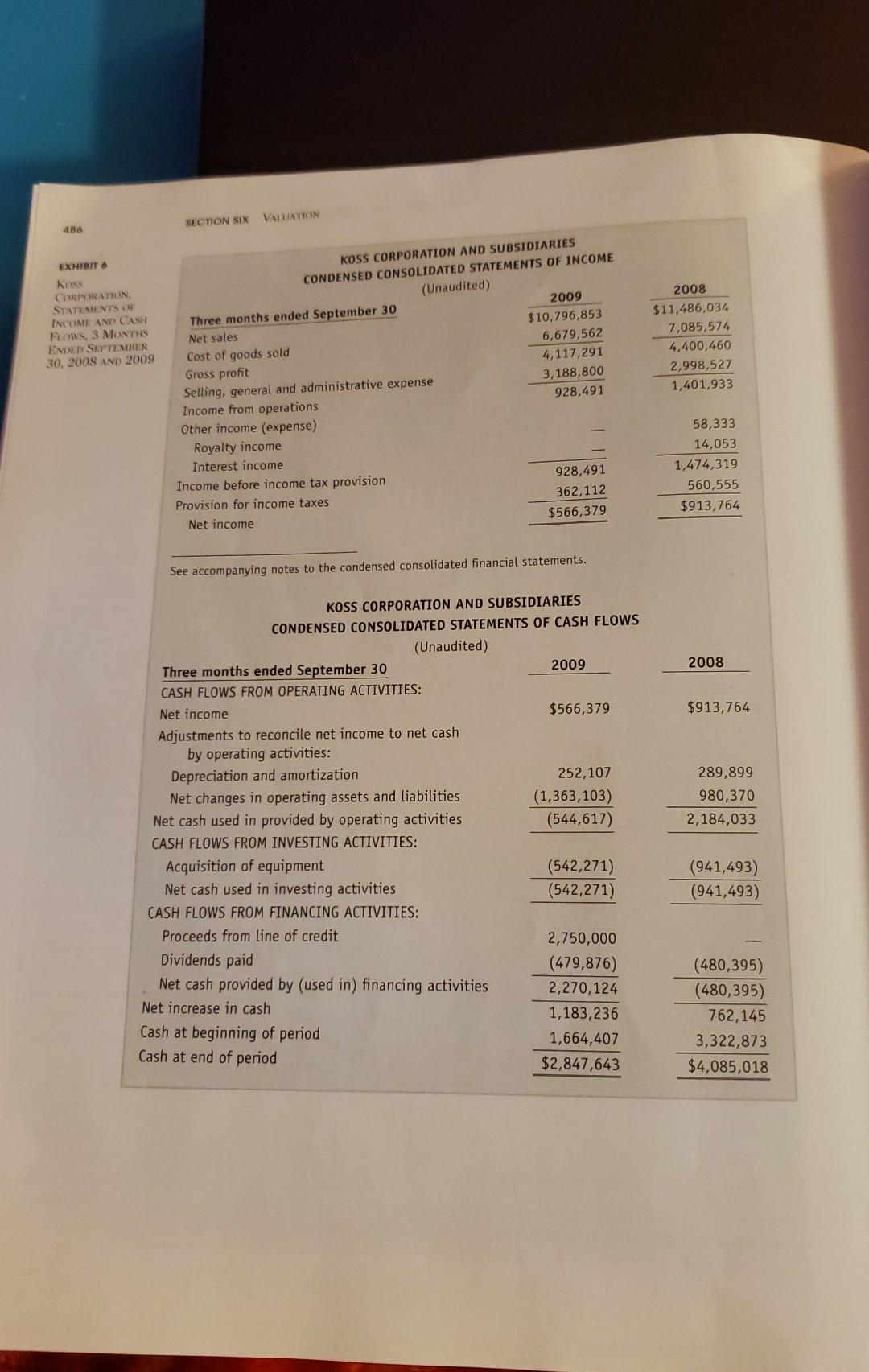

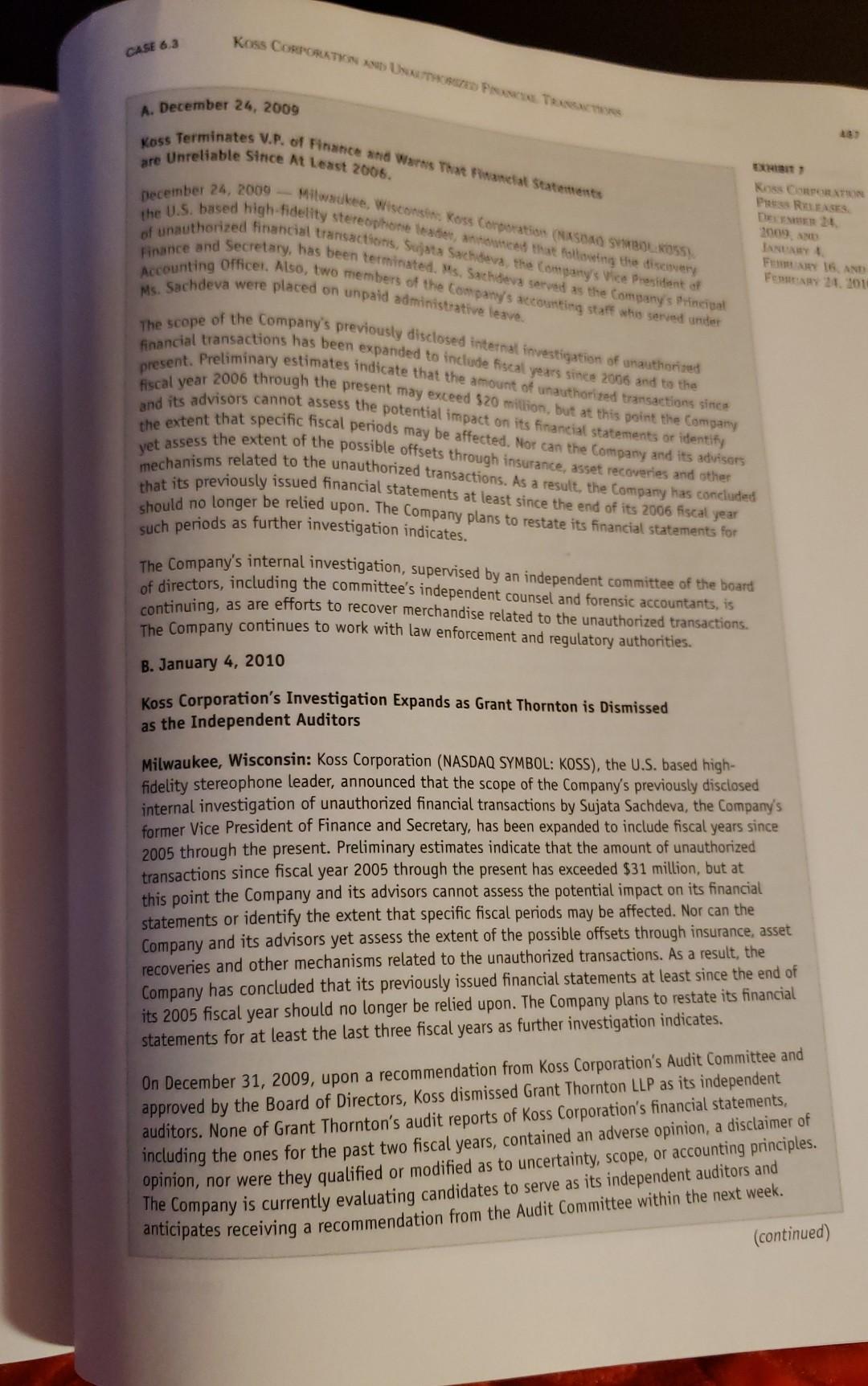

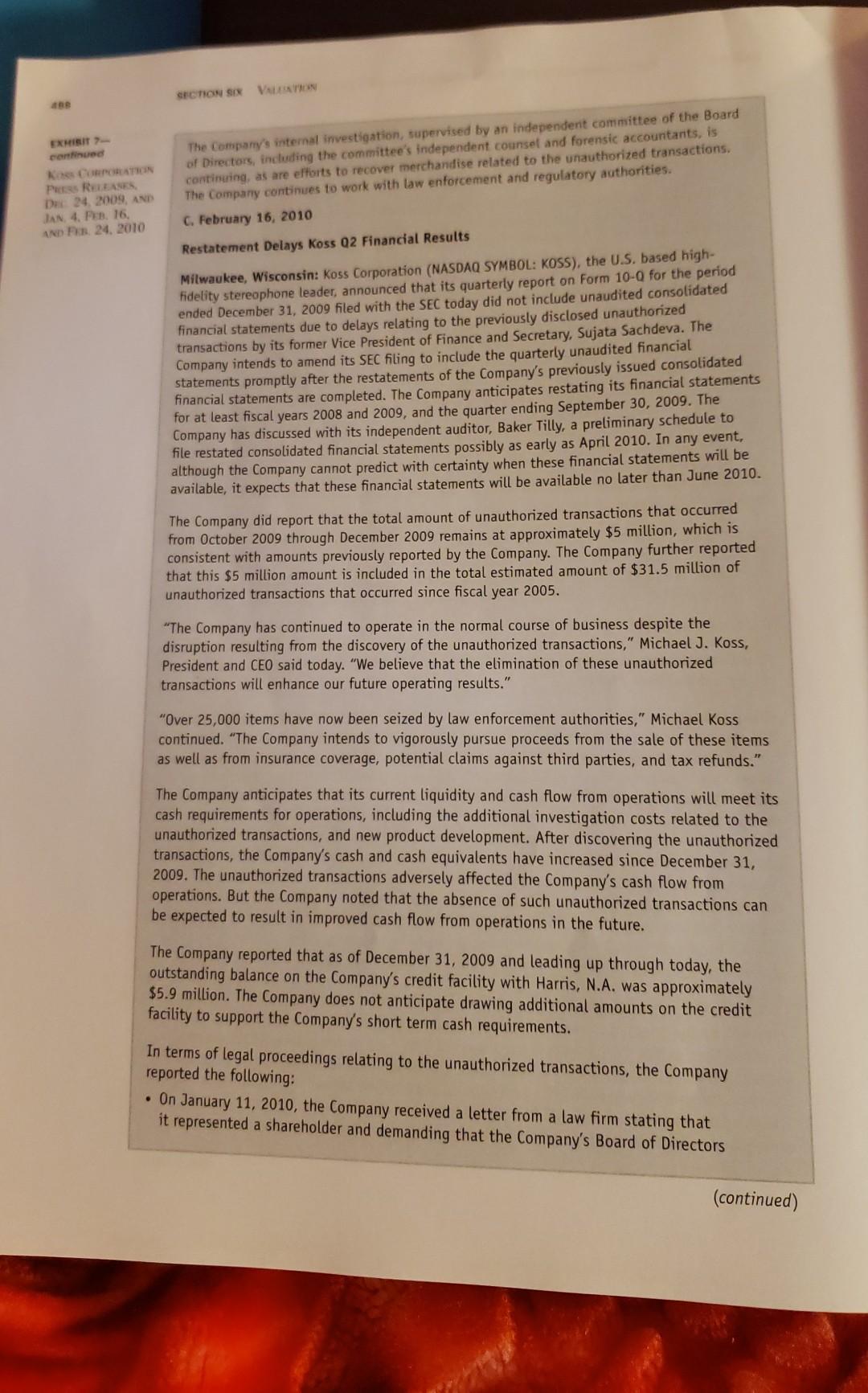

CASE 6.3 Koss Corporation and Unauthorized Financial Transactions the Beatles were visions to hospital patients. Several years later he teamed up with a friend, Martin In 1953, John C. Koss founded the Koss Corporation and began renting tele- Lange, to develop audio products. In 1958, they began building a model 390 stereo phonograph (record player) and a model SP-3 stereophone in Mr. Koss's basement. The phonograph offered few advantages over existing products, but the SP 3, the world's first stereo headphone, was an immediate success. In 1962, Koss introduced the Pro4 stereophone, an even higher-quality headset that became the recording industry standard. Music sensations such as Tony Bennett and photographed using the Pro4. In 1969, a Pro4 was installed on Air Force One. By 1983, Koss employed more than 850 people in locations throughout the world. In 1991, John C. Koss retired from active management, and his oldest son, Michael J. Koss, became president and CEO. Unauthorized Financial Transactions On December 21, 2009, Lisa Cohen, managing general partner of Barrington Capital LLC, a small Barrington, Illinois, hedge fund, noticed an announcement that Koss Corporation had requested a halt in the trading of its shares until it could learn the extent and effect of unauthorized financial transactions. Ms. Cohen immedi- ately downloaded Koss's press release (Exhibit 1). Aside from the notice about unauthorized transactions, a halt in trading, and the fact that Koss's CFO was on unpaid administrative leave pending the outcome of its investigation, the press release contained only a standard disclaimer about forward-looking statements. Ms. Cohen next downloaded Koss's 2009 proxy statement (excerpts in Exhibit 2) and learned that Koss was still controlled by the founding family. John C. Koss Sr., the founder, and his son, Michael, were board members, along with four executives from medium-size Midwest manufacturing firms. Koss appeared to be a highly sta- ble firm in terms of board membership and executive leadership. Three nonfamily directors had been on the board for between 22 and 31 years, the fourth joined in 2006. Nonfamily executives had been with the firm for between 9 and 18 years. Ms. Cohen had an associate download Koss's annual financial statements for the years ended June 30, 2005 through 2009 (Exhibits 3 and 4), and the three months ended September 30, 2009 (Exhibit 5 and 6). The following day, December 22, 2009, the Milwaukee Journal Sentinel quoted a fed- eral criminal complaint charging Koss's CFO, Sujata Sachdeva, with spending hundreds of thousands of dollars at high-end clothing stores. The complaint alleged that the spending came to light when American Express contacted Koss CEO Michael J. Koss and informed him the CFO was paying down her balances with large wire transfers from a Koss bank account. According to the complaint, spending included $1,358,322 1. Koss corporate history, Koss museum. http://www.koss.com/koss/kossweb.nsf/kmuseum?openform. 2. Ibid. SECTION SIX 874 VALUATION at Valentina, $670,000 at Au Courant, and $649,000 at Zita, three clothing boutiques north of Milwaukee. The article mentioned a possible $4.5 million embezzlement, a very large amount for a firm with 2009 revenue of only $38.2 million. Ms. Cohen's first thought was that cash was overstated, but a quick glance at Koss's September 30, 2009, balance sheet (Exhibit 5) showed that overstated cash was not a major problem. She assumed the unauthorized transactions must have reduced cash on Koss's balance sheet. The cash withdrawals would have been offset with some combination of debits that (1) overstated asset accounts, (2) increased expense accounts, (3) increased loss accounts, (4) increased owners' equity- other comprehensive losses, (5) decreased revenues, or (6) understated liabilities. Other comprehensive income did not appear on Koss's balance sheets, and Koss's 2009 10-K did not mention other comprehensive income, so Ms. Cohen ruled out item 4. Koss's income statements also showed no losses, so Ms. Cohen assumed Koss had overstated asset accounts, understated liability accounts, offset the cash withdrawals by increasing expenses or reducing revenues, or some combination of those problems. Given that investors often over- or underreact to this type of news, Ms. Cohen assumed she might have an opportunity to either short Koss's stock or place a large buy order when trading resumed. Two days later, December 24, 2009, Koss issued a press release stating that unauthorized transactions since 2006 might exceed $20 million, but those losses might be offset by insurance or asset recoveries (Exhibit 7A). At that point, Ms. Cohen decided on a target price for when Koss resumed trading. If the stock traded at 20% above her target price, she would short the shares; if it traded at 20% below her target price, she would buy shares. On January 4, 2010, Koss issued a press release stating that unauthorized transactions since 2005 may have exceeded $31 million (Exhibit 7B), which gave Ms. Cohen even more confidence in her decision and led to a change in her target price. On January 11, 2010, trading resumed. The price quickly dropped from about $5.50 per share ($81.2 million market value) when trading was suspended to about $4.10 per share ($60.5 million market value). Trading volume was about 110,000 shares on that day, within three days Ms. Cohen established her investment position and then waited for price changes or additional news. On January 15, 2010, The Business Journal of Milwaukee published an interview with Valentina's owner:4 "You find yourself dumbfounded," Valentina owner Tony Chirchirillo said of the news. "We never expected anything like this."... She seemed to be "a very nice person" who placed special orders for designer gowns and garments that cost between $2,000 and $8,000, he said. Chirchirillo said he and his wife, Cheryl, and daughter, Gina Frakes, who run the store, assumed "she came from money" and that her job at Koss, plus her husband Ramesh Sachdeva's position as a prominent pediatrician, provided the spending money. The Chirchirillos ... are now planning the future of the business with the "devastating" loss of their bigge customer. . . . "It threw everything upside down, Chirchirillo said. 3. Romell, Rick, "American Express alerted Koss about executive's spending spree," Milwaukee Wisconsin Journal Sentinel, December 22, 2009. http://www.jsonline.com/business/79905827.html. 4. Kirchen, Rich, "Fall from grace: Most shocked by Sachdeva's embezzlement case," The Business Journal of Milwaukee, January 15, 2010. http://milwaukee.bizjournals.com/milwaukee/stories/2010/01/18/ story2.html?b=1263790800-2737281&page=2 Koss CORPORATION AND UNAUTHORIZED FINANCIAL. TRANSACTIONS CASE 6.3 The Milwaukee division of the FBI issued a January 20, 2010. press release announcing wire fraud. The press release included the following additional information that a grand jury returned an indictment charging Sujata Sachdeva with six counts of The indictment also seeks the forfeiture of property alleged to have been purchased with the proceeds of Sachdeva's fraud should she be convicted in this matter. Among this property is her residence located in Mequon, Wisconsin, a 2007 Mercedes Benz, and clothing, jewelry, art objects, and household items seized from Sachdeud's home and two storage units she maintained in Milwaukee. In addition, the indictment seks the forfeiture of various items of clothing, jewelry, art objects, and other items currently in the possession of hoe merchants in the Milwaukee area, as well as a hand-carved door and a vacation ownership interest in a resort properly That same day the Milwaukee Journal Sentinel article reported that a mental plea Stephen E. Kravit, a well-known Milwaukee criminal defense attorney and former federal prosecutor who is not connected to the case, said the short length of the indictment is an indication that prosecutors expect Sachdeva to try to work out a plea was likely: agreement rather than go to trial. "Normally, the prosecutors would have laid out way more charges if they expected it to go to trial," Kravit said. A plea agreement would put Sachdeva in a more favorable position for sentencing, he said. Asked whether he would seek a plea bargain, Hart (Michael F. Hart, Mrs. Sachdeva's defense attorney) said only, These are early stages of an ongoing process." The "unusual behaviors" Hart cited Wednesday include Sachdeva's apparent practice of buying expensive clothing and then leaving it at the shops or placing it in storage. A federal search warrant made public this week detailed a huge cache of goods- including 461 boxes of shoes, 34 fur coats and 65 racks of clothingallegedly stored by Sachdeva in rented space in the Third Ward. Merchants also have acknowledged that they stored paid-for clothing for Sachdeva. "It is unusual to say the least to buy items of clothing and never pick them up from the store, " Hart said. Does that sound like rational behavior to you?" In a January 29, 2010, court hearing, Mrs. Sachdeva pleaded not guilty to accusations that she embezzled $31 million. According to the Journal Sentinel, Sachdeva's husband, pediatrician and Children's Hospital of Wisconsin executive Ramesh Sachdeva, also was present Friday, sitting in the third row at the back of the small courtroom. After the hearing, he shook hands with two FBI agents and Jacobs (prosecutor, Assistant U.S. Attorney Matt Jacobs) and said, "Thank you. Jacobs said later that he believed it was simple courtesy that prompted Ramesh Sach- deva to thank the prosecutor and the FBI agents. "I think he's appreciative that we're treating his wife in a professional way," Jacobs said. 5. Department of Justice Press Release, U.S. Attorney's Office, Eastern District of Wisconsin, January 20, 2010. http://milwaukee.fbi.gov/dojpressrel/pressrel10/mw012010.htm. 3. Hajewski, Doris, and Rick Romell , "Mental plea in Koss case likely, " Journal Sentinel, January 20, 2010. http://www.jsonline.com/business/82194642.html. Journal Sentinel, March 30, 2010. http://www.jsonline.com/business/83040142.html. 1. Hajewski, Doris, and Rick Romell, Former Koss executive pleads not guilty to embezzlement," 476 SECTION SIX VALLATION On February 16, 2010, Koss issued a press release (Exhibit 7C) announcing that its Form 10-Q for the six months ended December 31, 2009, did not contain financial statements. The press release stated that "the absence of such unauthorized transac- tions can be expected to result in improved cash flow from operations in the future." It also mentioned class action law suits against various Koss executives and directors. Although the 10-Q omitted financial statements, it did mention that law officials had seized more than 25,000 items and released preliminary estimates of the amounts of the unauthorized transactions since 2005: FY 2005: $2,195,477 FY 2006: $2,227,669 FY 2007: $3,160,310 FY 2008: $5,040,968 FY 2009: $8,485,937 Q1 FY 2010: $5,326,305 Q1 FY 2010: $4,917,005 On February 24, 2010, Koss issued a press release (Exhibit 7D) stating that a law suit had been filed against Michael Koss, John Koss Sr., the other Koss directors, Sujata Sachdeva, Grant Thornton LLP, and Koss Corporation (as a nominal defendant). By the end of March Koss's stock price increased to $5.86 per share, for a market valuation of $86.5 million. Required 1. Why was Ms. Cohen not concerned that cash was overstated? 2. Which asset accounts might be overstated? How difficult would it be to overstate them? What would be the effect on Koss's value if assets were overstated? 3. Which liability accounts might be understated? How difficult would it be to understate them? What would be the effect on Koss's value if liabilities were understated? 4. Which expense accounts might be overstated? How difficult would it be to overstate them? What would be the effect on Koss's value if expenses were overstated? 5. How difficult would it be to understate revenues? What would be the effect on Koss's value if revenues were understated? 6. Of the possible errors (asset or expense overstatements, liability or revenue understatements), which is the most likely error? Which is least likely? Why? 7. What is the likely effect of the pending lawsuits on Koss Corporation's value? Explain. 8. Did the alleged embezzlement likely start in 2005, or earlier? Explain. 9. Was stability in Koss's management and board a strength or weakness in terms of corporate governance? Explain. 10. Evaluate Koss's compensation structure for its executives and its board. Did that compensation structure influence corporate governance? Explain. 47 NEWS RELEASE 4129 NORTH PORT WASHINGTON AVENUE, MILWAUKEE, WI 53212 / 414 964-5000 WWW.KOSS.COM FOR IMMEDIATE RELEASE December 21, 2009 EXHIBIT) Koss CORPORATION, SE FORM 8-K FIUNG DECEMBER 21, 2009 CONTACT: Michael J. Koss President & CEO (414) 964-5000 mjkoss@koss.com Trading of Koss Corporation Stock Halts Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high-fidelity stereophone leader, requested today that NASDAQ immediately halt trading of its securities after discovering information regarding certain unauthorized transactions. The Board of Directors appointed a special committee of independent directors to lead an internal investigation involving the unauthorized transactions and determine the effect, if any, on Koss' financial statements. NASDAQ halted trading of Koss Corporation stock today. Law enforcement is also assisting Koss Corporation with this matter. Sujata Sachdeva, Vice President of Finance and Secretary of Koss Corporation, was placed on unpaid administrative leave pending the results of this investigation. Koss Corporation markets a complete line of high-fidelity stereophones, speaker-phones, computer headsets, telecommunications headsets, active noise canceling stereophones, wireless stereophones, and compact disc recordings of American Symphony Orchestras on the Koss Classics label. " This press release contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "forecasts," "expects," "plans," "anticipates," "believes," "estimates," "predicts," "potential," or "continue" or the negative of such terms and other comparable terminology. These statements are only predictions. Actual events or results may differ materially. In evaluating forward-looking statements, you should specifically consider various factors that may cause actual results to vary from those contained in the forward-looking statements, such as general economic conditions, in particular, consumer demand for the Company's and its customers' products, competitive and technological developments, foreign currency fluctuations, and costs of operations. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this press release and the Company undertakes no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances. In addition, such uncertainties and other operational matters are discussed further in the Company's quarterly and annual filings with the Securities and Exchange Commission. SECTION SOV SEC PROPOSAL 1. ELECTION OF DIRECTORS The laws of the Company provide that theme of directors on the Board of Directors of the Company (the Board will be no fewer than five and no greater than twee we had sh directors during fiscal year 2009 and will stoelect six directors for fiscal year 2010. Each director elected will serve until the next Annual Meeting of stockholders and until the director's successor is duly elected or until his prior death, resignation or removal. The six nominees that receive the most votes will be appointed to serve on our Board for the next year. Information as to Nominees The following identifies the nominees for the six director positions and provides information as to their business experience for the past five years. Each nominee is presently a director of the Company: John C. Koss, 79, has served continuously as Chairman of the Board of the Company or its predecessors since 1958. Previously, he served as Chief Executive Officer from 1958 until 1991. He is the father of Michael J. Koss (the Company's Vice Chairman, President, Chief Executive Officer, Chief Financial Officer, and Chief Operating Officer, and a nominee for director of the Company), and the father of John Koss, Jr. (the Company's Vice President-Sales). Thomas L. Doerr, 65, has been a director of the Company since 1987. In 1972, Mr. Doerr co-founded Leeson Electric Corporation and served as its President and Chief Executive Officer until 1982. The company manufactures industrial electric motors. In 1983, Mr. Doerr incorporated Doerr Corporation as a holding company for the purpose of acquiring established companies involved in distributing products to industrial and commercial markets. Currently, Mr. Doerr serves as President of Doerr Corporation. Michael J. Koss, 55, has held various positions at the Company since 1976, and has been a director of the Company since 1985. He was elected President, Chief Operating Officer, and Chief Financial Officer of the Company in 1987, Chief Executive Officer in 1991, and Vice-Chairman in 1998. He is the son of John C. Koss (the Company's Chairman of the Board) and the brother of John Koss, Jr. (the Company's Vice President-Sales). Michael J. Koss is also a director of STRATTEC Security Corporation. Lawrence S. Mattson, 77, has been a director of the Company since 1978. Mr. Mattson is the retired President of Oster Company, a division of Sunbeam Corporation, which manufactures and sells portable household appliances. Theodore H. Nixon, 57, has been a director of the Company since 2006. Since 1992, Mr. Nixon has been the Chief Executive Officer of D.D. Williamson, which is a manufacturer of caramel coloring used in the food and beverage industries. Mr. Nixon joined D.D. Williamson in 1974 and was promoted to President and Chief Operating Officer in 1982. Mr. Nixon is also a director of the non-profit Center for Quality of Management. John J. Stollenwerk, 69, has been a director of the Company since 1986. Mr. Stollenwerk is the Chairman of the Allen-Edmonds Shoe Corporation, an international manufacturer and retailer of high quality footwear. He is also a director of Allen-Edmonds Shoe Corporation, Badger Meter, Inc., U.S. Bancorp, and Northwestern Mutual Life Insurance Company. The Company expects that the "Koss Family" (John C. Koss, Michael J. Koss, and John Koss, Jr.), who beneficially own approximately 73.13% of the outstanding Common Stock, will vote "for" the election of all nominees named above to the Board of Directors. (continued) Koss CORPORATION AND UNAUTHORIZED FINANCIAL TRANSACTIONS CASE 6.3 THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE "FOR" THE ELECTION OF ALL NOMINEES NAMED ABOVE TO THE BOARD OF DIRECTORS. 479 Board Committees (Selected) EXHIBIT 2- continued Koss CORPORATION, SEC FORM 8-K FIUNG, DECEMBER 21. 2009 matters, executive compensation and board nominations. Each member of these committees The Board has appointed the following standing committees for auditing and accounting is "independent" as defined in Nasdaq Marketplace Rule 4200. Audit Committee. The Audit Committee, which is composed of Mr. Doert, Mr. Mattson Mr. Nixon, and Mr. Stollenwerk, reviews and evaluates the effectiveness of the Company's financial and accounting functions, including reviewing the scope and results of the audit work performed by the independent accountants and by the Company's internal accounting staff. The Audit Committee met three times during the fiscal year ended June 30, 2009. The independent accountants were present audit. For more information about the Audit Committee meetings, see the "Audit Committee Report." The Audit Committee is governed by a written charter approved and adopted by the Board, which charter was attached as Appendix A to the proxy materials, dated August 31, 2007, for the annual meeting held on October 10, 2007 for the fiscal year ended June 30, 2007. Audit Committee Financial Expert. The Board has determined that Mr. Mattson is an Audit Committee Financial Expert" as that term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the Securities and Exchange Commission (the "SEC). Attendance at Board and Committee Meetings During the fiscal year ended June 30, 2009, the Board held four meetings. Every incumbent director attended 75% or more of the total of (i) all meetings of the Board, plus (ii) all meetings of the committees on which they served during their respective terms of office. Attendance at Annual Meetings All of the members of the Board, Mr. John C. Koss, Mr. Michael J. Koss, Mr. Doerr, Mr. Mattson, Mr. Stollenwerk and Mr. Nixon, attended last year's annual meeting held on October 08, 2008. The Company has no formal written policy regarding attendance at annual meetings the Company, but strongly encourages all directors to make attendance at all annual meetings a priority. Independence of the Board Each of Mr. Doerr, Mr. Mattson, Mr. Nixon, and Mr. Stollenwerk, is "independent" as such term is defined in Nasdaq Marketplace Rule 4200. These independent directors constitute a majority of the Board, as required under Nasdaq Marketplace Rule 4350(c). Code of Ethics The Board approved and adopted a Code of Ethics for the Company's directors, officers, and employees, which is attached as Exhibit 14 to the Company's Annual Report on Form 10-K for the fiscal year ended June 30, 2004. Executive Officers Information is provided below with respect to the executive officers of the Company. Each executive officer is elected annually by the Board of Directors and serves for one year or until his or her successor is appointed. (continued) SECTION SIX VALUATION 480 Age EXHIBIT 2 continued knes CORPORATION, SEC FORM 8-K FILING, Dec 27, 2009 Name Michael J. Koss Positions Held President, Chief Operating Officer, Chief Financial Officer, Chief Executive Officer 55 Current Position Held Since 1987 (Chief Executive Officer since 1991) 1988 1992 1994 1998 John Koss, Jr. Sujata Sachdeva Declan Hanley Lenore E. Lillie Cheryl Mike 52 45 62 50 57 Vice President - Sales Vice President - Finance, Secretary Vice President - International Sales Vice President - Operation Vice President - Human Resources and Customer Service 2001 Beneficial Ownership of Company Securities Security Ownership by Nominees and Management. The following table sets forth, as of August 1, 2009, the number of shares of Common Stock "beneficially owned" (as defined under applicable regulations of the SEC), and the percentage of such shares to the total number of shares outstanding, for all nominees, for each executive officer named in the Summary Compensation Table (see "Executive Compensation and Related Matters-Summary Compensation Table"), for all directors and executive officers as a group, and for each person and each group of persons who, to the knowledge of the Company as of June 30, 2009, were the beneficial owners of more than 5% of the outstanding shares of Common Stock. Number of Shares Beneficially Owned (2) Percent of Outstanding Common Stock (3) Name and Business Address (1) 1,404,476 999,976 295,142 0 38.05% 27.09% 8.00% 0 John C. Koss (4) Michael J. Koss (5) John Koss, Jr. (6) Thomas L. Doerr Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk Sujata Sachdeva (7) Declan Hanley (8) Lenore E. Lillie (9) Cheryl Mike (10) All directors and executive officers as a group (11 persons) (11) Koss Family Voting Trust, John C. Koss, Trustee (12) Koss Employee Stock Ownership Trust ("KESOT") (13) Royce and Associates, LLC (14) 2,480 13,551 35,785 60,000 58,984 40,494 1.63% 1.60% 1.10% 2,910,888 1,216,785 339,258 370,723 78.86% 32.96% 9.19% 10.04% (continued) Koss CORPORATION AND USE THORIZED PISANG TRANSVIS CASE 6.3 ta (4) Includes the following shares which are deemed to be benyttet har (0) 61,732 shares owned directly or try his sptus 1.218.785 sheet of his trustee of the Koss Family Voting Trust: (41) 124.300 Street of Boston o-trust EXCHT 2 continued the John C. and Nancy Ross Revocable Trust; and (w) 1.659 Shres by reason of the altration of the ke shares to his account under the Koss Employee Stock Ownership Trust("KESOT") and his ability to ConTION, SEC such shares pursuant to the terms of the KESOT- see "Executive Compensation and Related Matters FORMS-K FING Other Compensation Arrangements --Employee Stock Ownership Plan and Trust." De 21.2009 (5) Includes the following shares which are deemed to be "beneficially owned by Michael J. Kost of the allocation of those shares to his account under the KESOT and his ability to vote such shares: ( 538,380 shares owned directly or by reason of family relationships: () 73,696 shares by raton with respect to which he holds options which are exercisable within 60 days of August 1, 2009, and (1) 111,034 shares as a result of his position as an officer of the Ross Foundation: (iv) 85,000 shares (V) 339,258 shares which are held by the KESOT (see Note (9), below). The 73,696 shares allocated aforementioned 339,258 shares but are counted only once in his individual total to Michael J. Koss' KESOT account, over which he holds voting power, are included within the (6) Includes the following shares which are deemed to be "beneficially owned by John Koss, Jr. (1) 247,642 shares owned directly or by reason of family relationships; (ii) 47.500 shares with respect to which he holds options which are exercisable within 60 days of August 1, 2009; and (iii) 53,495 shares by reason of the allocation of those shares to his account under the KESOT and his ability to vote such shares. [Notes 7-10 not included.] (11) This group includes a 7 people , all of whom are listed on the accompanying table. To avoid double- counting: (i) the 339,258 total shares held by the KESOT and deemed to be beneficially owned by Michael J. Koss as a result of his position as a KESOT Trustee (see Note (5), above) include shares allocated to the KESOT accounts of John C. Koss, Michael J. Koss, John Koss , Jr., Ms. Sachdeva, Ms. Lillie, and Ms. Mike, in the above table but are included only once in the total; and (ii) the 1,216,785 shares deemed to be beneficially owned by John C. Koss as a result of his position as trustee of the Koss Family Voting Trust (see Note (4), above) are included in his individual total share ownership and are included only once in the total. (12) The Koss Family Voting Trust was established by John C. Koss. The sole trustee is John C. Koss. The term of the Koss Family Voting Trust is indefinite. Under the Trust Agreement, John C. Koss, as trustee. holds full voting and dispositive power over the shares held by the Koss Family Voting Trust. All of the 1,216,785 shares held by the Koss Family Voting Trust are included in the number of shares shown as beneficially owned by John C. Koss (see Note (4), above). (13) The KESOT holds 339,258 shares. Authority to vote these shares is vested in KESOT participants to the extent shares have been allocated to individual KESOT accounts. All 339,258 of these KESOT shares are also included in the number of shares shown as beneficially owned by Michael J. Koss (see Note (5), above). Michael J. Koss and Cheryl Mike (the Company's Vice President of Human Resources) serve as Trustees of the KESOT and, as such, they share dispositive power with respect to (and are therefore each deemed under applicable SEC rules to be beneficially own) all 339,258 KESOT shares. SUMMARY COMPENSATION TABLE The following table presents certain summary information concerning compensation paid or accrued by the Company for services rendered in all capacities during the fiscal year ended June 30, 2009 for (i) the Chief Executive Officer ("CEO") of the Company, and (ii) each of the other six executive officers of the Company (determined as of the end of the last fiscal year) whose total annual salary and bonus exceeded $75,000 (collectively, including the CEO, the "Named Executive Officers"). (continued) SECTION SIX VALLATION 482 EXHIBIT 2-continued Kos CORPORATION, SEC FORM 8K FLING, DE 21, 2009 Total (5) Stock Option Bonus Awards Awards (5) (5) (5) (1) 0 0 0 267,242 401,045 450,507 831,553 0 0 0 0 0 0 Non-Equity Nonqualified All Other Deferred Incentive Plan Compensation Compensation Compensation (5) Earnings (5) (5) 82.795 0 34,447 37.612 0 213.433 39,594 0 115,913 59,251 0 298,807 0 0 35,122 46,555 0 39,912 11,851 0 16,883 28,717 0 22,585 264,581 0 30,746 286,345 0 32,722 192,995 0 0 0 0 Salary Name & Principal Position Year (5) John C. Koss (2) 2009 150,000 Chairman of the Board 2008 150,000 Michael J. Koss (3) 2009 295.000 Chief Executive Officer 2008 280,500 John Ross, J. (4) 2009 200.000 Vice President-Sales 2008 190,000 Sujata Sachdeva (5) 2009 145,000 Vice President-Finance 2008 137,000 Declan Hanley (6) 2009 131,346 Vice President-International 2008 110.114 Sales 0 235,122 372,966 173,734 206,462 0 0 96,499 0 0 0 0 0 18,160 426,673 447,341 0 0 0 0 18,160 0 0 22,115 23,994 173,557 199,404 0 0 0 11,442 27,250 0 2009 140,000 2008 130,000 0 0 18,160 0 117,824 155,538 15,060 28,513 0 Lenore Lillie (7) Vice President-Operations Cheryl Mike (8) Vice President-Human Resources & Cust. Service 0 7,764 18,865 2009 95,000 2008 90,000 0 0 18,160 DIRECTOR COMPENSATION The Company uses cash-based incentive compensation to attract and retain qualified candidates to serve on the Board. In setting director compensation, the Company considers the significant amount of time that Directors expend in fulfilling their duties to the Company as well as the skill-level required by the Company of members of the Board. Cash Contributions Paid to Non-employee Board Members Directors who are not also employees of the Company receive an annual retainer of $10,000, plus $2,000 per director for each board meeting attended, $1,000 per director for each committee meeting attended, $2,000 per year for the audit committee chair to review statements with the audit partner, and $1,000 per year for other committee chairs for service for each remaining committee. DIRECTOR COMPENSATION TABLE Fees Earned or Paid in Cash ($) Stock Awards ($) Options Awards ($) Non-Equity Incentive Plan Compensation ($) Nonqualified Deferred Compensation Earnings ($) All Other Compensation ($) Total ($) Name Year 0 0 0 0 0 0 0 0 0 0 0 24,000 0 0 0 0 John C. Koss (1) Thomas L. Doerr Michael J. Koss (2) Lawrence S. Mattson Theodore H. Nixon John J. Stollenwerk 2009 0 2009 24,000 2009 0 2009 23,000 2009 21,000 2009 23,000 0 0 0 0 0 0 0 0 0 0 0 0 23,000 21,000 23,000 0 0 0 0 0 (1) John C. Koss did not receive additional compensation for his service as a member of our Board. (2) Michael J. Koss did not receive additional compensation for his service as a member of our Board. Koss CORPORATION AND UNAUTHORIZED FINANCIAL TRANSACTIONS CASE 6.3 EXHIBIT 3 Koss CORPORATION, CONSOLIDATED BALANCE SHEETS, YEARS ENDED JUNE 30, 2005 TO 2009 2009 2008 2007 2006 483 2005 Assets Current Assets: Cash Accounts receivable Inventories Prepaid expense Deferred income taxes Income taxes receivable Total current assets Equipment and Leasehold Improvements at cost: Leasehold improvements Machinery, equipment, furniture, and fixtures Tools, dies, molds, and patterns $1,664,407 $8,679,606 $9,763,158 $179,549 $720,121 $0 $21,006,841 $3,322,873 $10,148,646 $9,374,344 $504,806 $783,995 $0 $24,134,664 $4,187,682 $7,938,913 $9.923,544 $403,983 $1,124,799 $291,251 $23,870,172 56,146,580 56,819,852 $10,522,605 $418,818 $1,365,547 50 $25,273,402 55,218,698 58.763,968 57,595,803 51,129,939 5857,840 50 523,566.248 $1,783,946 $1,766,842 $1,748,816 $1,706,484 $1,662,506 Less-accumulated depreciation $2,650,158 $11,371,402 $15,805,506 $11,729,308 $4,076,198 $1,237,727 $2,149,586 $28,470,352 $2,488,657 $9,605,720 $13,861,219 $11,114,852 $2,746,367 $1,066,853 $2,029,123 $29,977,007 $2,464,050 $11,656,951 $15,869,817 $13,302,678 $2,567,139 $423,928 $2,312,304 $29,173,543 $3,444,111 $11,898,074 $17,048,669 $14,011,121 $3,037,548 $672,823 $2,457,840 $31,441,613 $5,068,368 $11,198,723 $17,929,597 $14,935,897 $2,993,700 $315,531 $2,365,982 $29,241,461 Deferred Income Taxes Other Assets Total Assets Liabilities and Stockholders' Investment Current Liabilities Accounts payable $1,810,466 Accrued liabilities $1,153,089 Dividends payable $479,876 Income taxes payable $175,568 Total current liabilities $3,618,999 Deferred Compensation $1,095,961 Derivative Liability $125,000 Stockholders Investment: Common stock $2,049,384 Retained earnings $21,581,008 Total Stockholders' Investment $23,630,392 Total Liabilities plus Equity $28,470,352 $2,950,721 $1,808,467 $480,395 $347,507 $5,587,090 $1,047,482 $125,000 $1,371,152 $2,282,155 $476,459 $0 $4,129,766 $989,153 $125,000 $1,870,256 $2,149,102 $4,202,591 $927,528 $9,149,477 $992,830 $125,000 $3,012,736 $1,841,862 $486,918 $692,538 $6,034,054 $961,165 $125,000 $541,782 $20,632,524 $1,649,408 $21,568,027 $23,217,435 $29,977,007 $1,104,200 $22,825,424 $23,929,624 $29,173,543 $18,728 $22,102,514 $22,121.242 $29,241,461 $21,174,306 $31,441,613 SECTION SIX VALLATION 484 EXHIBIT 4 Koss CORPORATION, STATEMENTS OF INCOME AND CASH FLOWS, YEARS ENDED JUNE 30, 2005 TO 2009 CONSOLIDATED STATEMENTS OF INCOME 2009 2008 2007 $38,184,150 $46,943,293 $46,201,858 $24,917,013 $29,151,791 $28,284,981 $13,267,137 $17,791,502 $17,916,877 2006 $50,891,637 $31,095,377 $19,796,260 2005 $40,286,691 $25,216,760 $15,069,931 $10,792,064 $6,999,438 $10,653,243 $2,613,894 $10,066,385 $7,850,492 $10,063,871 $9,732,389 $8,544,383 $6,525,548 Net sales Cost of goods sold Gross profit Selling, general, and administrative expense Income from operations Other income (expense) Royalty income Interest income Interest expense Income before income tax provision Provision for income taxes Net income $805,485 $64,795 $258,333 $15,503 $0 $291,667 $119,464 $0 $341,918 $169,047 $0 $324,996 $169,227 $0 $2,887,730 $911,062 $1,976,668 $7,410,569 $2,916,280 $4,494,289 $8,344,715 $3,188,195 $5,156,520 $10,243,354 $4,021,163 $6,222,191 $7,395,828 $2,902,001 $4,493,827 CONSOLIDATED STATEMENTS OF CASH FLOWS 2006 2005 $6,222,191 $4,493,827 2009 2008 2007 Cash Flows From Operating Activities Net Income $1,976,668 $4,494,289 $5,156,520 Adjustments to reconcile net income to net cash provided by operating activities Change in allowance for doubtful accounts $77,007 ($58,164) ($222,491) (Gain) loss on disposal $0 ($149,775) $0 Depreciation and amortization $817,957 $961,605 $973,802 Stock compensation expense $399,996 $545,052 $562,680 Deferred income taxes ($107,000) ($302,121) $489,643 Cash surrender value ($195,463) ($193,533) ($181,787) Deferred compensation $48,479 $58,329 ($3,677) Net changes in operating assets and liabilities ($639,018) ($18,553) ($1,867,504) Net cash provided by operating activities $2,378,626 $5,337,129 $4,907,186 Cash Flows from Investing Activities Sale of investments $75,000 $25,000 $250,000 Proceeds from sale of certain Bi-Audio assets $0 $700,000 $0 Acquisition of equipment and and leasehold improvements ($2,147,866) ($1,179,344) ($426,070) Net cash used in investing activities ($2,072,866) ($454,344) ($176,070) $572,688 $116 $955,166 $523,194 ($864,999) ($169,181) $31,665 $155,324 $0 $1,103,951 $0 ($61,875) ($177,641) ($24,100) ($1,444,503) $2,251,161 $5,826,337 $7,740,647 $0 $0 $0 $0 ($921,807) ($1,170,494) ($921,807) ($1,170,494) (continued) Koss CORPORATION AND UNAUTHORIZED FINANCIAL. TRANSACTIONS CASE 6.3 EXHIBIT 4-continued 485 (5286,200) Koss CORPORATION, STATEMENTS OF INCOME. AND CASH FLOWS, YEARS ENDED JUNE 30, 2005 TO 2009 Cash Flows from Financing Activities Tax benefit of non-qualified stock options $0 $288,630 Dividends paid to stockholders ($1,920,586) ($5,591,850) ($5,641,556) ($1,932,483) ($1,923,938) $691,660 $104,749 ($43,640) ($1,283,413) ($1,837.655) ($6,605,451) ($2,217,371) $0 $1,413,869 $500,566 $3,869,626 $577.188 ($1,964,226) ($5,747,594) ($6,690,015) ($3,976,648) (53,459,372) ($1,658,466) ($864,809) ($1,958,899) $927,882 $3,110,781 $3,322,873 $4,187,682 $6,146,580 $5,218,698 $2,110,917 $1,664,407 $3,322,873 $4,187,681 $6,146,580 $5,221,698 Purchase of common stock Exercise of options Net cash used in financing activities Net (decrease) increase in cash Cash at beginning of period Cash at end of period CONDENSED CONSOLIDATED BALANCE SHEETS September 30, 2009 June 30, 2009 (Unaudited) ASSETS Current Assets: Cash EXHIBIT 5 Koss CORPORATION, CONSOLIDATED BALANCE SHEETS, THREE MONTHS ENDED SEPT. 30. 2008 AND 2009 $2,847,643 10,280,462 10,371,604 720,121 920,153 25,139,983 4,364,028 1,237,727 2,160,586 $32,902,324 $1,664,407 8,679,606 9,763,158 720,121 179,549 21,006,841 4,076,198 1,237,727 2,149,586 $28,470,352 Accounts receivable Inventories Deferred income taxes Other current assets Total current assets Property and equipment, net Deferred income taxes Other assets Total Assets LIABILITIES AND STOCKHOLDERS' INVESTMENT Current Liabilities: Line of credit Accounts payable Accrued liabilities Dividends payable Income tax payable Total current liabilities Deferred compensation Derivative liability Stockholders' investment Total Liabilities & Stockholders' Investments $2,750,000 2,428,020 1,935,695 479,876 287,681 7,881,272 1,095,961 125,000 23,800,091 $32,902,324 $- 1,810,466 1,153,089 479,876 175,568 3,618,999 1,095,961 125,000 23,630,392 $28,470,352 See accompanying notes to the condensed consolidated financial statements. VALLATION SECTION SIX 486 EXHIBIT & Kiss CORPORATION STATEMENTS OF INCOME AND CASH FLOWS, 3 MONTHS ENDED SEPTEMBER 30, 2008 AND 2009 2008 $11,486,034 7,085,574 4,400,460 2,998,527 1,401,933 KOSS CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME (Unaudited) 2009 Three months ended September 30 Net sales $10,796,853 Cost of goods sold 6,679,562 Gross profit 4,117,291 Selling, general and administrative expense 3,188,800 Income from operations 928,491 Other income (expense) Royalty income Interest income Income before income tax provision 928,491 Provision for income taxes 362,112 Net income $566,379 58,333 14,053 1,474,319 560,555 $913,764 See accompanying notes to the condensed consolidated financial statements. 2008 $913,764 289,899 980,370 2,184,033 KOSS CORPORATION AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) Three months ended September 30 2009 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $566,379 Adjustments to reconcile net income to net cash by operating activities: Depreciation and amortization 252,107 Net changes in operating assets and liabilities (1,363,103) Net cash used in provided by operating activities (544,617) CASH FLOWS FROM INVESTING ACTIVITIES: Acquisition of equipment (542,271) Net cash used in investing activities (542,271) CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from line of credit 2,750,000 Dividends paid (479,876) Net cash provided by (used in) financing activities 2,270,124 Net increase in cash 1,183,236 Cash at beginning of period 1,664,407 Cash at end of period $2,847,643 (941,493) (941,493) (480,395) (480,395) 762,145 3,322,873 $4,085,018 Koss CORPORATION DU PIST CASE 6.3 A. December 24, 2009 EXHIBIT) Koss Terminates V.P. of Finance and Warns That Financial Statements Ros CORPO are Unreliable Since At Least 2006. P RELEASES DE 21 December 24, 2006 - Mitukee, Wisconsin Ross Corporation (NASDA SYMBOL KOSS) 2009 IANUARY the U.5. based high-fidelity stereopholder, and that following the discovery of unauthorized financial transactions, Sujata Sachdeva, the company's Vice President of FRY 16. AND FERRY 24, 2011 Finance and Secretary, has been terminated. Ms. Sachdeva served as the company's Principal Accounting Officer. Also, two members of the Company's accounting staff who served under Ms. Sachdeva were placed on unpaid administrative leave financial transactions has been expanded to include fiscal years since 2006 and to the The scope of the Company's previously disclosed internal investigation of unauthorized present. Preliminary estimates indicate that the amount of unauthorized transactions since fiscal year 2006 through the present may exceed $20 million, but at this point the Company and its advisors cannot assess the potential impact on its financial statements or identify the extent that specific fiscal periods may be affected. Nor can the Company and its advisors yet assess the extent of the possible offsets through insurance, asset recoveries and other mechanisms related to the unauthorized transactions. As a result, the Company has concluded that its previously issued financial statements at least since the end of its 2006 fiscal year should no longer be relied upon. The company plans to restate its financial statements for such periods as further investigation indicates. The Company's internal investigation, supervised by an independent committee of the board of directors, including the committee's independent counsel and forensic accountants, is continuing, as are efforts to recover merchandise related to the unauthorized transactions. The Company continues to work with law enforcement and regulatory authorities. B. January 4, 2010 Koss Corporation's Investigation Expands as Grant Thornton is Dismissed as the Independent Auditors Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high- fidelity stereophone leader, announced that the scope of the Company's previously disclosed internal investigation of unauthorized financial transactions by Sujata Sachdeva, the Company's former Vice President of Finance and Secretary, has been expanded to include fiscal years since 2005 through the present. Preliminary estimates indicate that the amount of unauthorized transactions since fiscal year 2005 through the present has exceeded $31 million, but at this point the Company and its advisors cannot assess the potential impact on its financial statements or identify the extent that specific fiscal periods may be affected. Nor can the Company and its advisors yet assess the extent of the possible offsets through insurance, asset recoveries and other mechanisms related to the unauthorized transactions. As a result, the Company has concluded that its previously issued financial statements at least since the end of its 2005 fiscal year should no longer be relied upon. The Company plans to restate its financial statements for at least the last three fiscal years as further investigation indicates. On December 31, 2009, upon a recommendation from Koss Corporation's Audit Committee and approved by the Board of Directors, Koss dismissed Grant Thornton LLP as its independent auditors. None of Grant Thornton's audit reports of Koss Corporation's financial statements, including the ones for the past two fiscal years, contained an adverse opinion, a disclaimer of opinion, nor were they qualified or modified as to uncertainty, scope, or accounting principles. The Company is currently evaluating candidates to serve as its independent auditors and anticipates receiving a recommendation from the Audit Committee within the next week. (continued) SECTION SIX VAN EXHISI continued CATION PRELEASES Dec 24, 2009, AND JAN 4, P. 16, AND FER24. 2010 The Company's internal investigation, supervised by an independent committee of the Board of Directors, including the committee's independent counsel and forensic accountants, is continuing, as are efforts to recover merchandise related to the unauthorized transactions, The Company continues to work with law enforcement and regulatory authorities. C. February 16, 2010 Restatement Delays Koss 02 Financial Results Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high- fidelity stereophone leader, announced that its quarterly report on Form 10-Q for the period ended December 31, 2009 filed with the SEC today did not include unaudited consolidated financial statements due to delays relating to the previously disclosed unauthorized transactions by its former Vice President of Finance and Secretary, Sujata Sachdeva. The Company intends to amend its SEC filing to include the quarterly unaudited financial statements promptly after the restatements of the Company's previously issued consolidated financial statements are completed. The Company anticipates restating its financial statements for at least fiscal years 2008 and 2009, and the quarter ending September 30, 2009. The Company has discussed with its independent auditor, Baker Tilly, a preliminary schedule to file restated consolidated financial statements possibly as early as April 2010. In any event, although the Company cannot predict with certainty when these financial statements will be available, it expects that these financial statements will be available no later than June 2010. The Company did report that the total amount of unauthorized transactions that occurred from October 2009 through December 2009 remains at approximately $5 million, which is consistent with amounts previously reported by the Company. The Company further reported that this $5 million amount is included in the total estimated amount of $31.5 million of unauthorized transactions that occurred since fiscal year 2005. "The Company has continued to operate in the normal course of business despite the disruption resulting from the discovery of the unauthorized transactions," Michael J. Koss, President and CEO said today. "We believe that the elimination of these unauthorized transactions will enhance our future operating results." "Over 25,000 items have now been seized by law enforcement authorities," Michael Koss continued. "The Company intends to vigorously pursue proceeds from the sale of these items as well as from insurance coverage, potential claims against third parties, and tax refunds." The Company anticipates that its current liquidity and cash flow from operations will meet its cash requirements for operations, including the additional investigation costs related to the unauthorized transactions, and new product development. After discovering the unauthorized transactions, the Company's cash and cash equivalents have increased since December 31, 2009. The unauthorized transactions adversely affected the Company's cash flow from operations. But the Company noted that the absence of such unauthorized transactions can be expected to result in improved cash flow from operations in the future. The Company reported that as of December 31, 2009 and leading up through today, the outstanding balance on the Company's credit facility with Harris, N.A. was approximately $5.9 million. The Company does not anticipate drawing additional amounts on the credit facility to support the Company's short term cash requirements. In terms of legal proceedings relating to the unauthorized transactions, the Company reported the following: . On January 11, 2010, the Company received a letter from a law firm stating that it represented a shareholder and demanding that the Company's Board of Directors (continued) Koss CORPORATION AND UNAUTHORIES FINANCIAL TRANS CASE 6,3 investigate and take legal action against all response arties to ensure compensation for the Company's losses stemming from the horized transactions. The company's legal counsel has responded preliminarily to the letter indicating that the Board of Directors will determine the appropriate course of action after an independent investigation is 489 completed. EXITIT 1- Ross CPORATION PESS RELEASES Dec 31, 2009, AND JAN F16 AND FER. 24. 2010 On January 15, 2010, a dass action complaint was filed in federal court in Wisconsin against the Company, the Company's President and CEO Michael Koss, and Ms. Sachdeva The suit alleges violations of Section 10(5), Rule 105-5 and Section 20(a) of the Exchange Act relating to the unauthorized transactions and requests an award of compensatory damages in an amount to be proven at trial. On January 26, 2010, the SEC's Division of Enforcement advised the Company that it obtained a formal order of investigation in connection with the unauthorized transactions The Company immediately brought the unauthorized transactions to the SEC staff's attention when they were discovered in December 2009, and is cooperating fully with the ongoing SEC investigation. D. February 24, 2010 Koss Receives Notice of Non-Compliance with NASDAQ Continued Listing Requirements Milwaukee, Wisconsin: Koss Corporation (NASDAQ SYMBOL: KOSS), the U.S. based high- fidelity stereophone leader, received notice from The NASDAQ Stock Market that because Koss's Form 10-Q for the period ended December 31, 2009 contained no financial statements, it is incomplete and does not comply with Listing Rule 5250(c)(1), which requires the timely filing of periodic financial statements. Koss has 60 calendar days, or until April 20, 2010, to submit a plan to regain compliance. If the compliance plan is accepted, NASDAQ can grant an exception of up to 180 calendar days from the filing's due date, or until August 16, 2010, to regain compliance. If the compliance plan is not accepted, Koss will have the opportunity to appeal that decision to a NASDAQ hearings panel. As previously disclosed, because of certain previously reported unauthorized financial transactions, Koss is restating its previously issued financial statements for the fiscal years ended 2008 and 2009, for all quarterly periods during those fiscal years, and for the period ended September 30, 2009. Koss's unaudited consolidated quarterly financial statements for the period ended December 31, 2009 were not available to be included in Koss's quarterly report on Form 10-Q filed on February 16, 2010. Although Koss cannot predict with certainty when the restated consolidated financial statements will be available, Koss anticipates that the restated consolidated financial statements will be available as early as April 2010 but no later than June 2010. The quarterly report on Form 10-Q for the period ended December 31, 2009 will be amended to include the unaudited consolidated quarterly financial statements promptly after the restated consolidated financial statements are available. On February 16 and 18, 2010, separate shareholder derivative suits were filed in Milwaukee County Circuit Court in connection with the previously disclosed unauthorized transactions. The first suit names as defendants Michael Koss, John Koss Sr., the other Koss directors, Sujata Sachdeva, Grant Thornton LLP, and Koss Corporation (as a nominal defendant); the second suit names the same parties except Grant Thornton LLP. Among other things, both suits allege various breaches of fiduciary and other duties, and seek recovery of unspecified damages and other relief. See Ruiz v. Koss, et al., Circuit Court, Milwaukee County, Wisconsin, No. 10CV002422 (February 16, 2010) and Mentkowski v. Koss, et al., Circuit Court, Milwaukee County, Wisconsin, No. 10CV002290 (February 18, 2010)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts