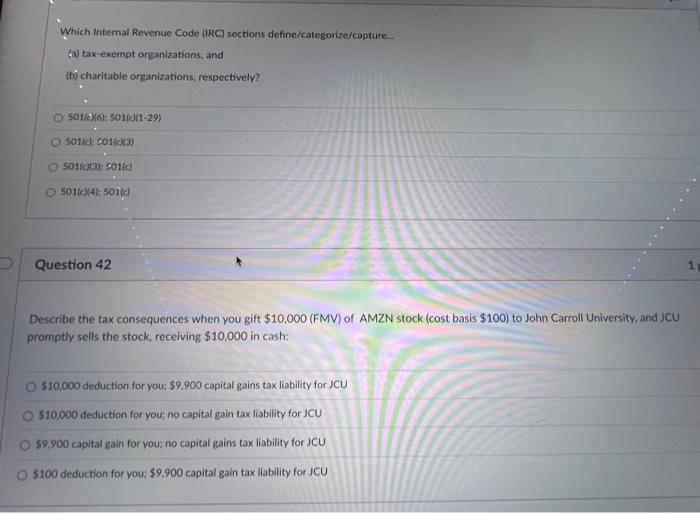

Question: Which Internal Revenue Code (IRC) sections define/categorize/capture... (a) tax-exempt organizations, and (b) charitable organizations, respectively? 501(246).501(c)(129) 501(c):501(c)(3) 501(id3);901(c) 501(c)(4);501(c) Question 42 Describe the tax consequences

Which Internal Revenue Code (IRC) sections define/categorize/capture... (a) tax-exempt organizations, and (b) charitable organizations, respectively? 501(246).501(c)(129) 501(c):501(c)(3) 501(id3);901(c) 501(c)(4);501(c) Question 42 Describe the tax consequences when you gift $10,000 (FMV) of AMZN stock (cost basis $100 ) to John Carroll University, and JCU promptly sells the stock, receiving $10,000 in cash: $10,000 deduction for you; $9,900 capital gains tax liability for JCU $10,000 deduction for you; no capital gain tax liability for JCU $9,900 capital gain for you; no capital gains tax liability for JCU $100 deduction for you; $9,900 capital gain tax liability for JCU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts