Question: which is the correct answer? Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, so

which is the correct answer?

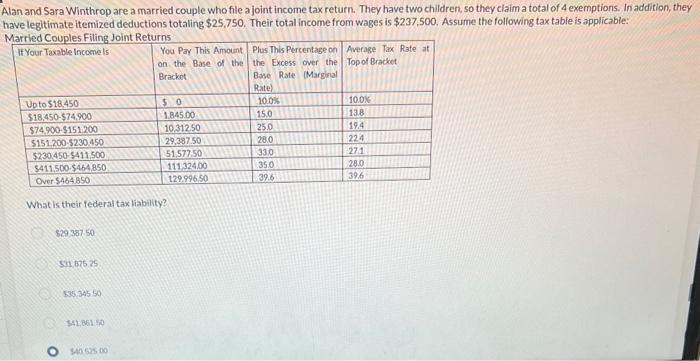

Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, so they claim a total of 4 exemptions. In addition, they ave legitimate itemized deductions totaling $25,750. Their total income from wages is $237,500. Assume the following tax table is applicable: Markiad Cniurloe Filina Inint Retuirne What is their federal tax liability? 52935750 311. 87525 505.32550 341,861.40 1445250

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock