Question: Which is true regarding long-term capital gains? Multiple Choice A net long-term gain can be taxed at 28%,25%,20%,15%, or 0%, depending on the type of

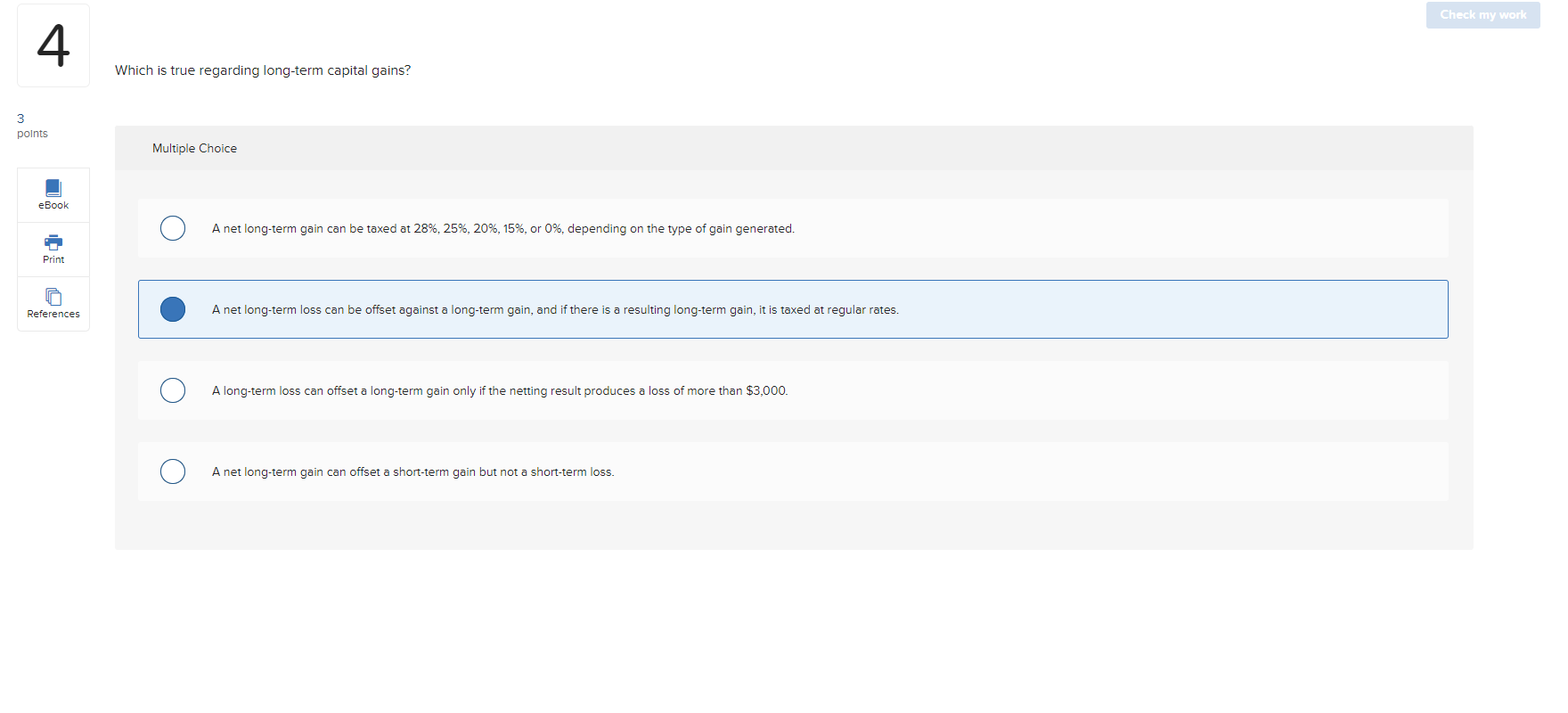

Which is true regarding long-term capital gains? Multiple Choice A net long-term gain can be taxed at 28%,25%,20%,15%, or 0%, depending on the type of gain generated. A net long-term loss can be offset against a long-term gain, and if there is a resulting long-term gain, it is taxed at regular rates. A long-term loss can offset a long-term gain only if the netting result produces a loss of more than $3,000. A net long-term gain can offset a short-term gain but not a short-term loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts