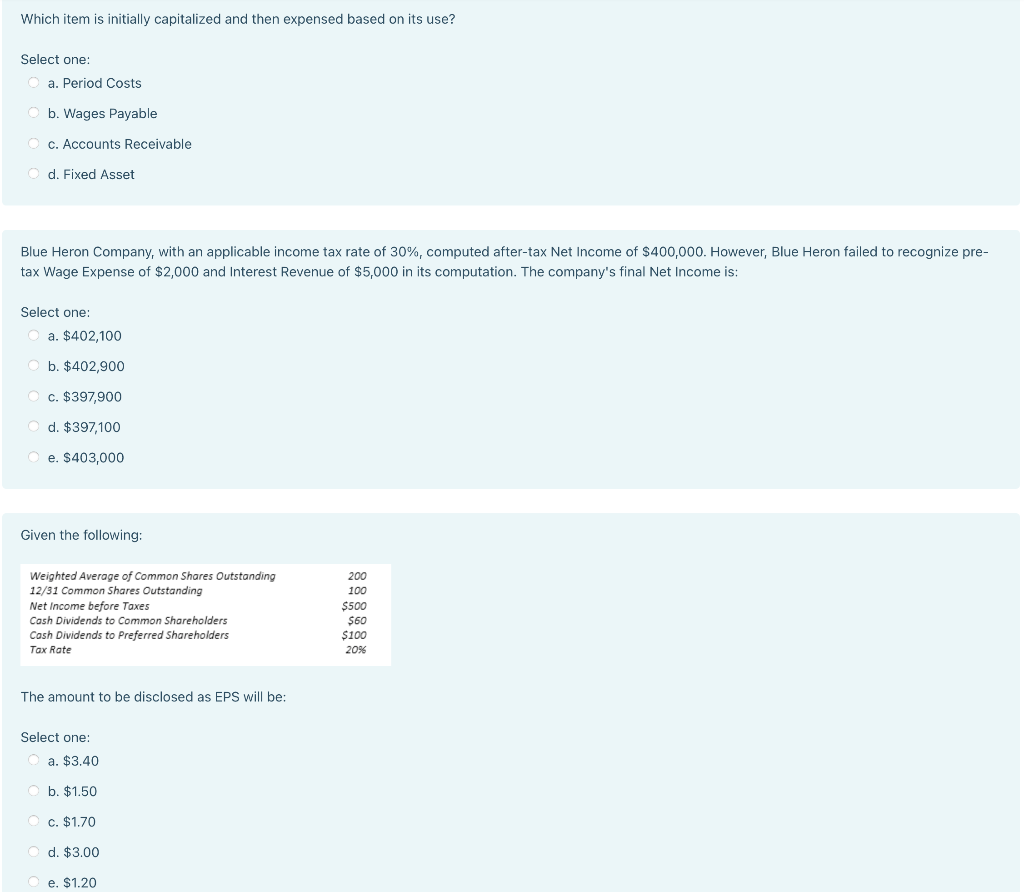

Question: Which item is initially capitalized and then expensed based on its use? Select one: a. Period Costs b. Wages Payable c. Accounts Receivable d. Fixed

Which item is initially capitalized and then expensed based on its use? Select one: a. Period Costs b. Wages Payable c. Accounts Receivable d. Fixed Asset Blue Heron Company, with an applicable income tax rate of 30%, computed after-tax Net Income of $400,000. However, Blue Heron failed to recognize pre- tax Wage Expense of $2,000 and Interest Revenue of $5,000 in its computation. The company's final Net Income is: Select one: a. $402,100 b. $402,900 c. $397,900 d. $397,100 e. $403,000 Given the following: Weighted Average of common Shares Outstanding 12/31 Common Shares Outstanding Net Income before Taxes Cash Dividends to Common Shareholders Cash Dividends to Preferred Shareholders Tax Rate 200 100 $500 $60 $100 20% The amount to be disclosed as EPS will be: Select one: a. $3.40 b. $1.50 c. $1.70 d. $3.00 e. $1.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts