Question: Which items did HP decide to exclude from 2013 full-year GAAP net earnings to arrive at Non-GAAP net income? (a) For the period ended 0ctober

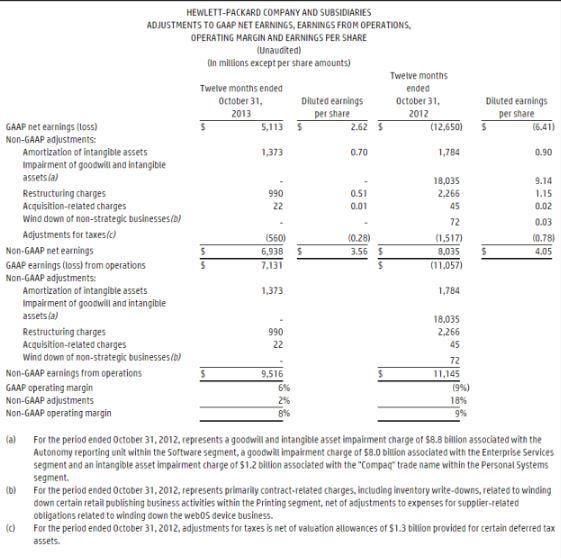

Which items did HP decide to exclude from 2013 full-year GAAP net earnings to arrive at Non-GAAP net income?

(a) For the period ended 0ctober 31, 2012, represents a goodwill and intangible asset impaiment charge of $8,8 billion associated with the Autonomy reporting enit within the Sortware segmeat, a goodwill impairment charge of 58.0 bililon associated with the Enterprise Services segment and an intanglble asset impaiment charge of $1.2 biltion associated with the "Compac" trade name within the Personal 5y stems segment. (b) For the period ended 0 ctober 31,2012 , represents primarily contract-related charges, lnctuding inventery write-downs, related to winding down certain retail publishing business activities within the Printing segment, net of adjustments to expenses for supplier-telated obligations fetated to winding down the web05 device business. For the period ended 0ctober 31,2012 , adjustments for taxes is net of valuation allowances of 51.3 billion provided for certain deferred tax assets. (a) For the period ended 0ctober 31, 2012, represents a goodwill and intangible asset impaiment charge of $8,8 billion associated with the Autonomy reporting enit within the Sortware segmeat, a goodwill impairment charge of 58.0 bililon associated with the Enterprise Services segment and an intanglble asset impaiment charge of $1.2 biltion associated with the "Compac" trade name within the Personal 5y stems segment. (b) For the period ended 0 ctober 31,2012 , represents primarily contract-related charges, lnctuding inventery write-downs, related to winding down certain retail publishing business activities within the Printing segment, net of adjustments to expenses for supplier-telated obligations fetated to winding down the web05 device business. For the period ended 0ctober 31,2012 , adjustments for taxes is net of valuation allowances of 51.3 billion provided for certain deferred tax assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts