Question: which journal entry reflects the adjusting entry needed on December 31 ? last year, BOC purchased a building for $1,000,000. The expected life of the

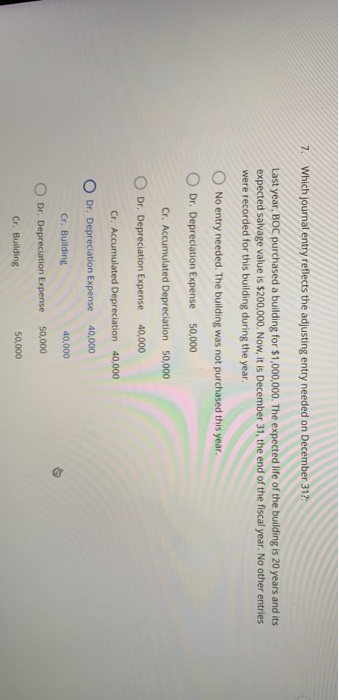

7. Which journal entry reflects the adjusting entry needed on December 317 Last year, BOC purchased a building for $1,000,000. The expected life of the building is 20 years and its expected salvage value is $200,000. Now, it is December 31, the end of the fiscal year. No other entries were recorded for this building during the year. O No entry needed. The building was not purchased this year. O Dr. Depreciation Expense 50,000 Cr. Accumulated Depreciation 50,000 O Dr. Depreciation Expense 40,000 Cr. Accumulated Depreciation 40,000 Dr. Depreciation Expense 40,000 O Cr. Building 40,000 O Dr. Depreciation Expense 50,000 Cr. Building 50,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts