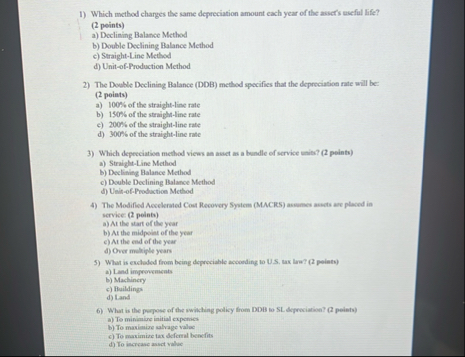

Question: Which method charges tbe same depreciation amount each year of the assers useful life? ( 2 peints ) a ) Declining Balance Method b )

Which method charges tbe same depreciation amount each year of the assers useful life?

peints

a Declining Balance Method

b Double Declining Balance Method

c StraightLine Method

UnilofProduction Method

The Double Declining Ralance DDB method specifies that the depreciatioes rate will be: points

a of the straightlise rate

b of the straighline rate

c of the straightline rate

d of the straightline rate

Which depecciative method views an aset as a buedle of service mis? peints

a StruightLine Method

b Declining Balance Method

c Double Doetining Palanoe Mecthod

d UnitofProductice Method

The Modified Aecelersied Cout Recovery System MACRS anmeses ansts aee placed in service pelnta

At the tart of the year

b At the midpoint of the your

c At the end of the year

d Over milkiple years

What is exdaded friom being depreciable acooeding to USS, ux lum? pointy

a Land impervancats

b Machinery

c Pribling

d Land

What is the papose of the uwikhing policy from DDB io SL depreciution? peints

a To minimise initial expences

b To maximize alfage value

c To maximise tax defomel benefits

d To increanc asoct value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock