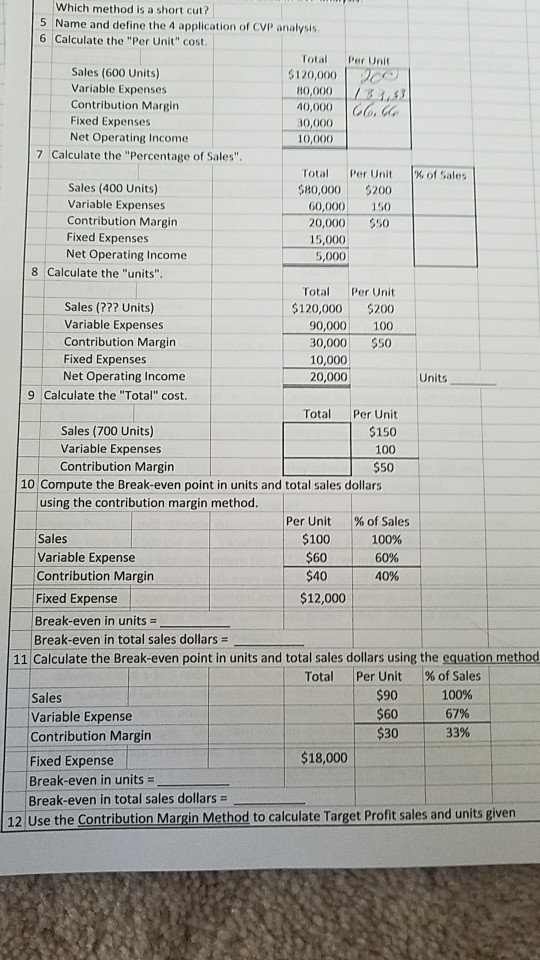

Question: Which method is a short cut? 5 Name and define the 4 application of CVp analysis 6 Calculate the Per Unit cost Total Per Unit

Which method is a short cut? 5 Name and define the 4 application of CVp analysis 6 Calculate the "Per Unit" cost Total Per Unit Sales (600 Units) Variable Expenses Contribution Margirn Fixed Expenses Net Operating Income $120,000 0,000 0,000 Clo, 10,000 0,000 7 Calculate the "Percentage of Sales" Total Per Unit 80,000 $200 0,000 150 20,000 50 1% of Sales Sales (400 Units) Variable Expenses Contribution Margin Fixed Expenses Net Operating Income 15,000 5,000 8 Calculate the "units" Sales (??? Units) Variable Expenses Contribution Margin Fixed Expenses Total Per Unit 120,000 $200 0,000 100 0,000 $50 Net Operating Income 20,000 Units 9 Calculate the "Total" cost Total Per Unit $150 100 $50 Sales (700 Units) Variable Expenses Contribution Margin 10 Compute the Break-even point in units and total sales dollars using the contribution margin method. Per Unit % of Sales Sales Variable Expense Contribution Margirn Fixed Expense Break-even in units - Break-even in total sales dollars $100 : 100% $60 $40 60% 40% $12,000 11 Calculate the Break-even point in units and total sales dollars using the equation method Total Per Unit % of Sales | Sales Variable Expense Contribution Margin $90 $60 $30 100% 67% 33% $18,000 Fixed Expense Break-even in units Break-even in total sales dollars 12 Use the Contribution Margin Method to calculate Target Profit sales and units given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts