Question: Which number do I use for EBIT? AutoSave . Off) Financials_MilestoneThree - Search (Alt+Q) Traci Coolbroth File Home Insert Draw Page Layout Formulas Data Review

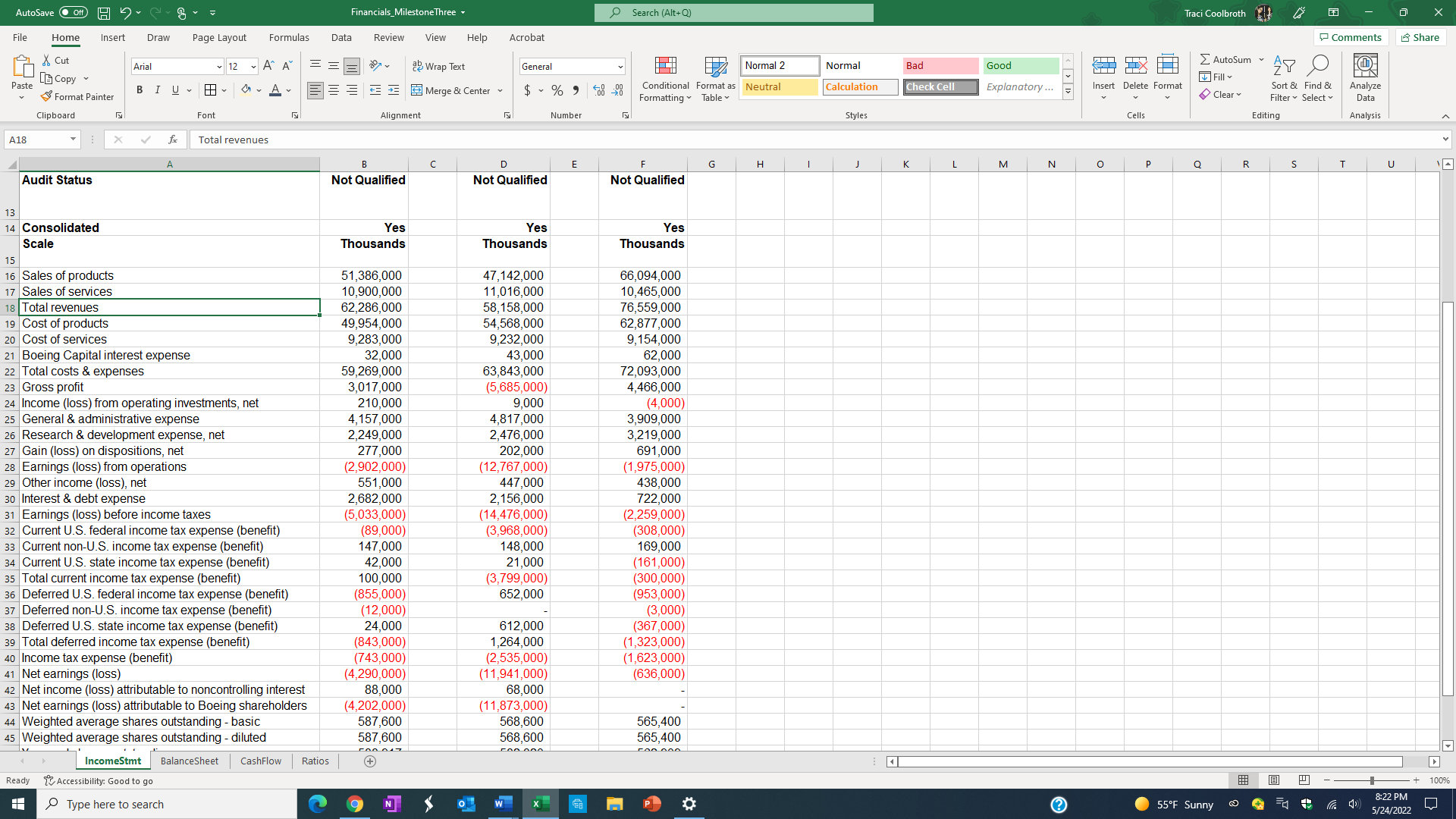

Which number do I use for EBIT?

AutoSave . Off) Financials_MilestoneThree - Search (Alt+Q) Traci Coolbroth File Home Insert Draw Page Layout Formulas Data Review View Help Acrobat Comments 15 Share & Cut Arial 12 ~ A A = = =1 ab Wrap Text General Normal 2 Normal Bad Good 2 AutoSum AY O Paste [ Copy ~ Fill BIU E = E Merge & Center $ ~ % 2 00 20 Conditional Format as Neutral Calculation Check Cell Explanatory ... nsert Delete Format Sort & Find & Analyze Format Painter Formatting Table Clear Filter ~ Select Data Clipboard Font Alignment Number Styles Cells Editing Analysis A18 X V Total revenues A C E G H J K L M N O P Q R S T U Audit Status Not Qualified Not Qualified Not Qualified 13 14 Consolidated Yes Yes Yes Scal Thousands Thousands Thousands 15 16 Sales of products 51,386,000 47,142,000 66,094,000 17 Sales of services 10,900,000 11,016,000 10,465,000 18 Total revenues 62,286,000 58, 158,000 76,559,000 19 Cost of products 49,954,000 54,568,000 62,877,000 20 Cost of services 9,283,000 9,232,000 9, 154,000 21 Boeing Capital interest expense 32.000 43.000 62,000 22 Total costs & expenses 59,269,000 63,843,000 72,093,000 23 Gross profit 3,017,000 (5,685,000 4,466,000 24 Income (loss) from operating investments, net 210,000 9,000 (4,000 25 General & administrative expense 4, 157,000 4,817,000 3,909,000 26 Research & development expense, net 2,249,000 2.476,000 3,219,000 27 Gain (loss) on dispositions, net 277,000 202,000 691,000 28 Earnings (loss) from operations (2,902,000) (12,767,000) (1,975,000) 29 Other income (loss), net 551,000 447,000 438,000 30 Interest & debt expense 2,682,000 2, 156,000 722,000 31 Earnings (loss) before income taxes (5,033,000) (14,476,000 (2,259,000 32 Current U.S. federal income tax expense (benefit) (89,000) (3,968,000) (308,000) 33 Current non-U.S. income tax expense (benefit) 147,000 8.000 169,000 34 Current U.S. state income tax expense (benefit) 42,000 21,000 (161,000) 35 Total current income tax expense (benefit) 100,000 (3,799,000) (300,000 36 Deferred U.S. federal income tax expense (benefit) (855,000) 652,000 (953,000 37 Deferred non-U.S. income tax expense (benefit) 12,000) (3,000) 38 Deferred U.S. state income tax expense (benefit) 24,000 612,000 (367,000) 39 Total deferred income tax expense (benefit) (843,000) 1,264,000 (1,323,000) 40 Income tax expense (benefit) (743,000) (2,535,000) (1,623,000) 41 Net earnings (loss) (4,290,000) (11,941,000) (636,000) 42 Net income (loss) attributable to noncontrolling interest 88,000 68,000 43 Net earnings (loss) attributable to Boeing shareholders (4,202,000) (11,873,000) 44 Weighted average shares outstanding - basic 587,600 568,600 565,400 45 Weighted average shares outstanding - diluted 587,600 568,600 565,400 IncomeStmt BalanceSheet | CashFlow Ratios + Ready Accessibility: Good to go - + 100% Type here to search 9 N w X ?) 55OF Sunny @ (1) 8:22 PM 5/24/2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts