Question: Which of the following describes a difference between a Section 5 2 9 plan and an Educational Savings Account? a . Distributions from Section 5

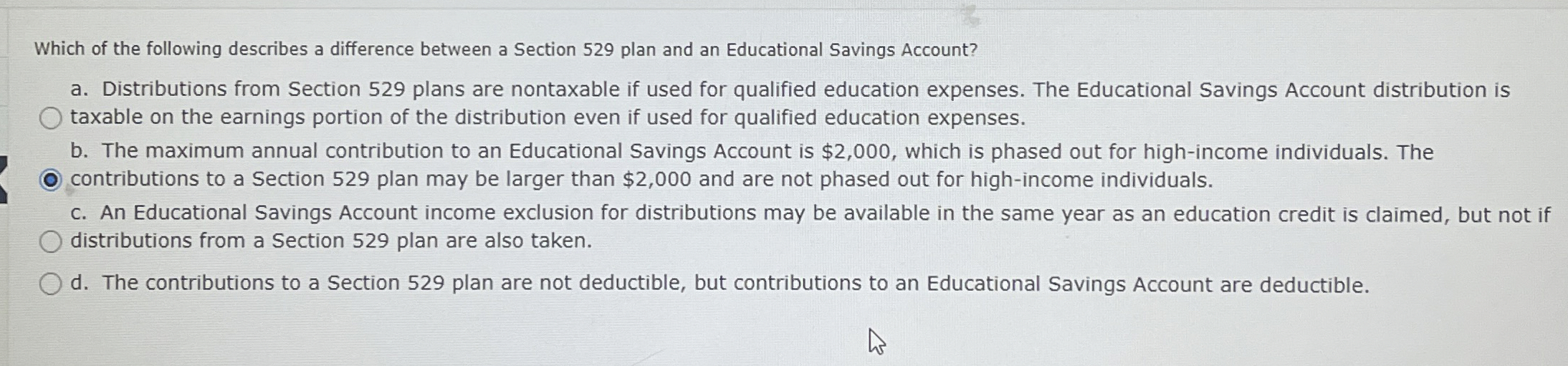

Which of the following describes a difference between a Section plan and an Educational Savings Account?

a Distributions from Section plans are nontaxable if used for qualified education expenses. The Educational Savings Account distribution is

taxable on the earnings portion of the distribution even if used for qualified education expenses.

b The maximum annual contribution to an Educational Savings Account is $ which is phased out for highincome individuals. The

contributions to a Section plan may be larger than $ and are not phased out for highincome individuals.

c An Educational Savings Account income exclusion for distributions may be available in the same year as an education credit is claimed, but not if

distributions from a Section plan are also taken.

d The contributions to a Section plan are not deductible, but contributions to an Educational Savings Account are deductible.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock