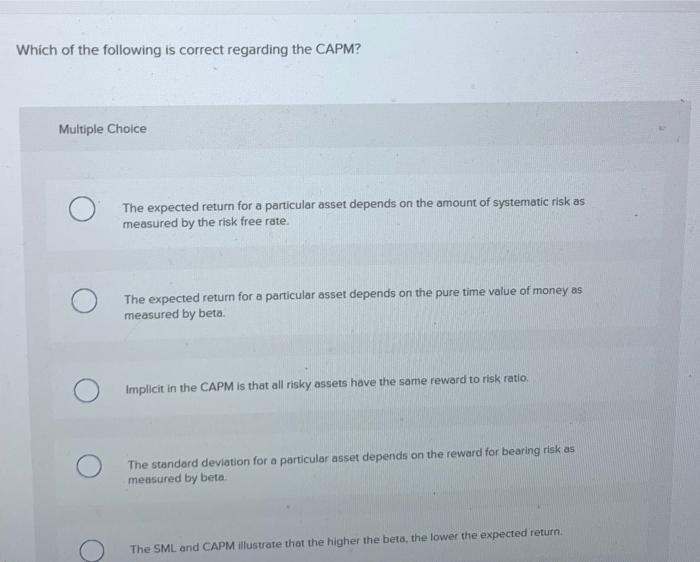

Question: Which of the following is correct regarding the CAPM? Multiple Choice The expected return for a particular asset depends on the amount of systematic risk

Which of the following is correct regarding the CAPM? Multiple Choice The expected return for a particular asset depends on the amount of systematic risk as measured by the risk free rate The expected return for a particular asset depends on the pure time value of money as measured by beta Implicit in the CAPM is that all risky assets have the same reward to risk ratio, The standard deviation for a particular asset depends on the reward for bearing risk as measured by beto The SML and CAPM illustrate that the higher the beta, the lower the expected return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts