Question: Which of the following is not a common difference between net business income on the books (following GAAP) and net business income on a tax

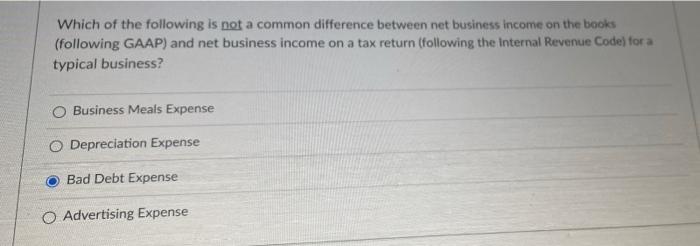

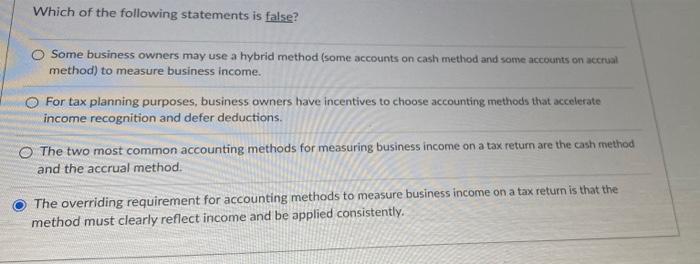

Which of the following is not a common difference between net business income on the books (following GAAP) and net business income on a tax return (following the internal Revenue Code) for a typical business? Business Meals Expense O Depreciation Expense Bad Debt Expense O Advertising Expense Which of the following statements is false? Some business owners may use a hybrid method (some accounts on cash method and some accounts on actual method) to measure business income. For tax planning purposes, business owners have incentives to choose accounting methods that accelerate income recognition and defer deductions. The two most common accounting methods for measuring business income on a tax return are the cash method and the accrual method. The overriding requirement for accounting methods to measure business income on a tax return is that the method must clearly reflect income and be applied consistently

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts