Question: Which of the following is NOT a difference between Activity-Based Costing and Traditional Costing? Group of answer choices ABC excludes some manufacturing costs from the

Which of the following is NOT a difference between Activity-Based Costing and Traditional Costing?

Group of answer choices

ABC excludes some manufacturing costs from the cost object, where Traditional Costing does not.

ABC traces or allocates direct materials, direct labor, and overhead costs to cost objects, where Traditional Costing does not.

ABC uses a variety of activities to allocate overhead, where Traditional tends to use volume-related activities.

ABC includes some nonmanufacturing costs in the cost object, where Traditional Costing does not.

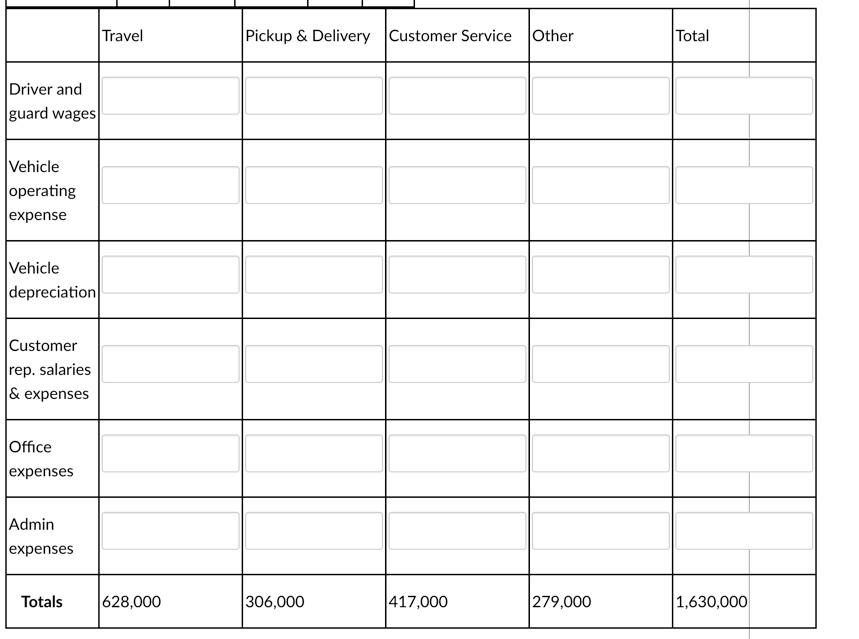

2. Given the following information, complete the first stage of allocation for the ABC method. Do NOT use dollar signs ($).

| Cost Pool Description | Estimated Cost |

| Driver and guard wages | $720,000 |

| Vehicle operating expense | 280,000 |

| Vehicle depreciation | 120,000 |

| Customer Rep. Salaries | 160,000 |

| Office expenses | 30,000 |

| Admin expenses | 320,000 |

|

| Travel | Pickup & Delivery | Customer Service | Other | Total |

| Driver and guard wages | 50% | 35% | 10% | 5% | 100% |

| Vehicle operating expense | 70% | 5% | 0% | 25% | 100% |

| Vehicle depreciation | 60% | 15% | 0% | 25% | 100% |

| Customer rep. salaries | 0% | 0% | 90% | 10% | 100% |

| Office expenses | 0% | 20% | 30% | 50% | 100% |

| Admin expenses | 0% | 5% | 60% | 35% | 100% |

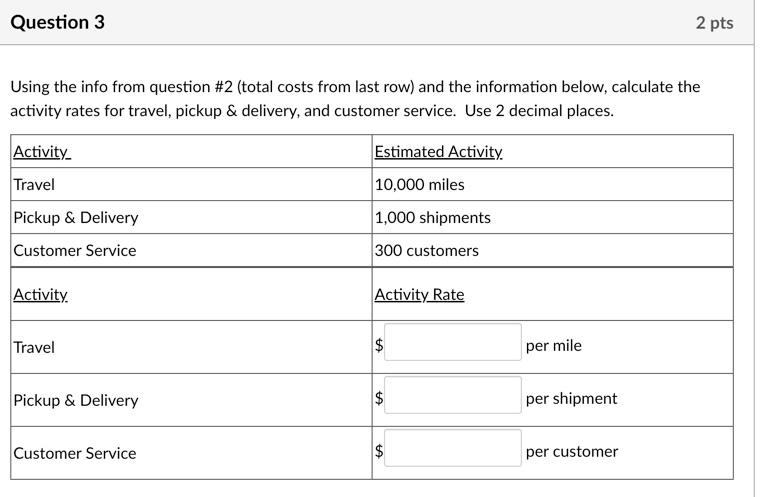

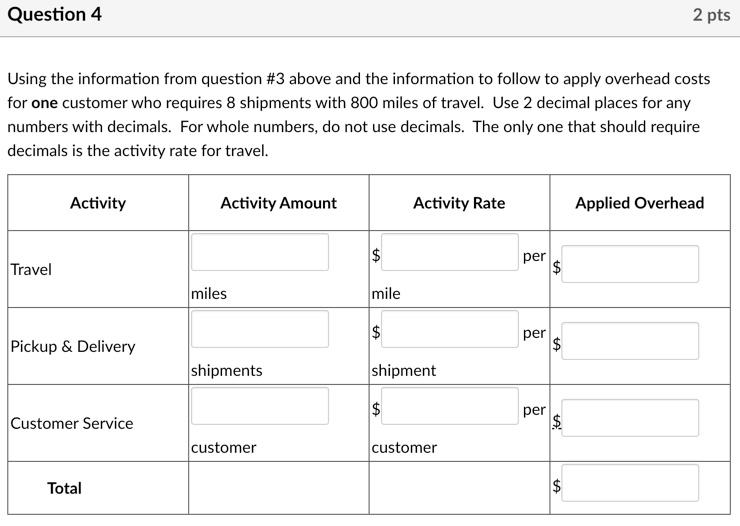

Travel Pickup & Delivery Customer Service Other Total Driver and guard wages Vehicle operating expense Vehicle depreciation Customer rep. salaries & expenses Office expenses Admin expenses Totals 628,000 306,000 417,000 279,000 1,630,000 Question 3 2 pts Using the info from question #2 (total costs from last row) and the information below, calculate the activity rates for travel, pickup & delivery, and customer service. Use 2 decimal places. Activity Estimated Activity. 10,000 miles Travel Pickup & Delivery Customer Service 1,000 shipments 300 customers Activity. Activity Rate Travel $ per mile Pickup & Delivery $ per shipment Customer Service $ per customer Question 4 2 pts Using the information from question #3 above and the information to follow to apply overhead costs for one customer who requires 8 shipments with 800 miles of travel. Use 2 decimal places for any numbers with decimals. For whole numbers, do not use decimals. The only one that should require decimals is the activity rate for travel. Activity Activity Amount Activity Rate Applied Overhead $ Travel per $ $ miles mile per Pickup & Delivery $ shipments shipment $ per Customer Service $ customer customer Total $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts