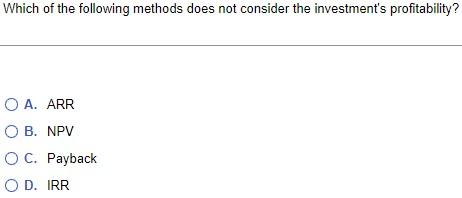

Question: ______________________________________________________________________________________________________________________________________________ ____________________________________________________________ ____________________ ________________________________________________________________________________________________________________________________________________ Which of the following methods does not consider the investment's profitability? A. ARR B. NPV C. Payback D. IRR our rich

______________________________________________________________________________________________________________________________________________

____________________________________________________________

____________________

________________________________________________________________________________________________________________________________________________

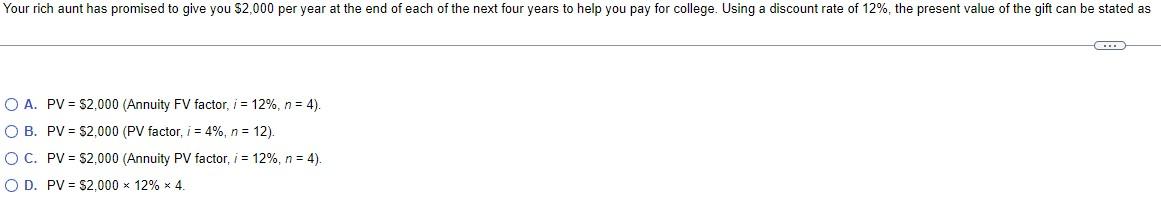

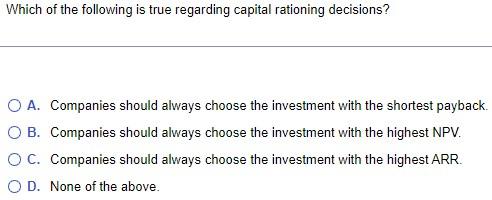

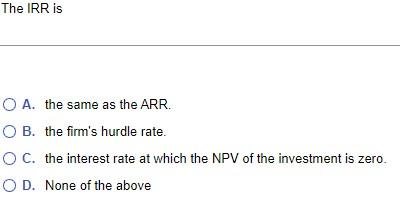

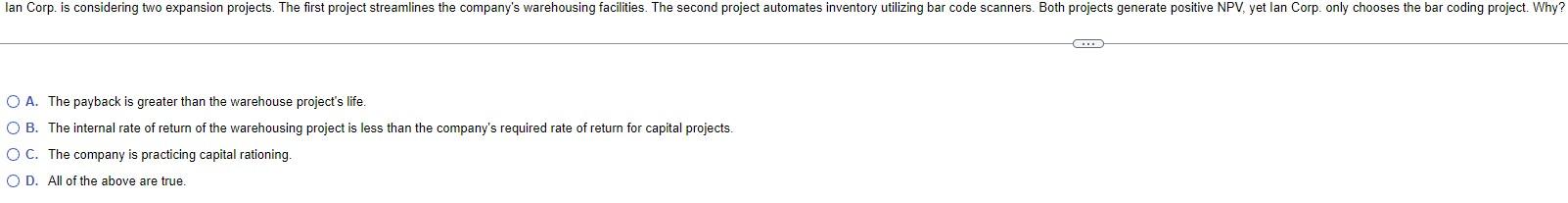

Which of the following methods does not consider the investment's profitability? A. ARR B. NPV C. Payback D. IRR our rich aunt has promised to give you $2,000 per year at the end of each of the next four years to help you pay for college. Using a discount rate of 12%, the present value of the gift can be stated as A. PV=$2,000 (Annuity FV factor, i=12%,n=4 ). B. PV=$2,000 (PV factor, i=4%,n=12 ). C. PV=$2,000 (Annuity PV factor, i=12%,n=4 ). D. PV=$2,00012%4. Which of the following is true regarding capital rationing decisions? A. Companies should always choose the investment with the shortest payback B. Companies should always choose the investment with the highest NPV. C. Companies should always choose the investment with the highest ARR. D. None of the above. The IRR is A. the same as the ARR. B. the firm's hurdle rate. C. the interest rate at which the NPV of the investment is zero. D. None of the above C. The company is practicing capital rationing. D. All of the above are true

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts