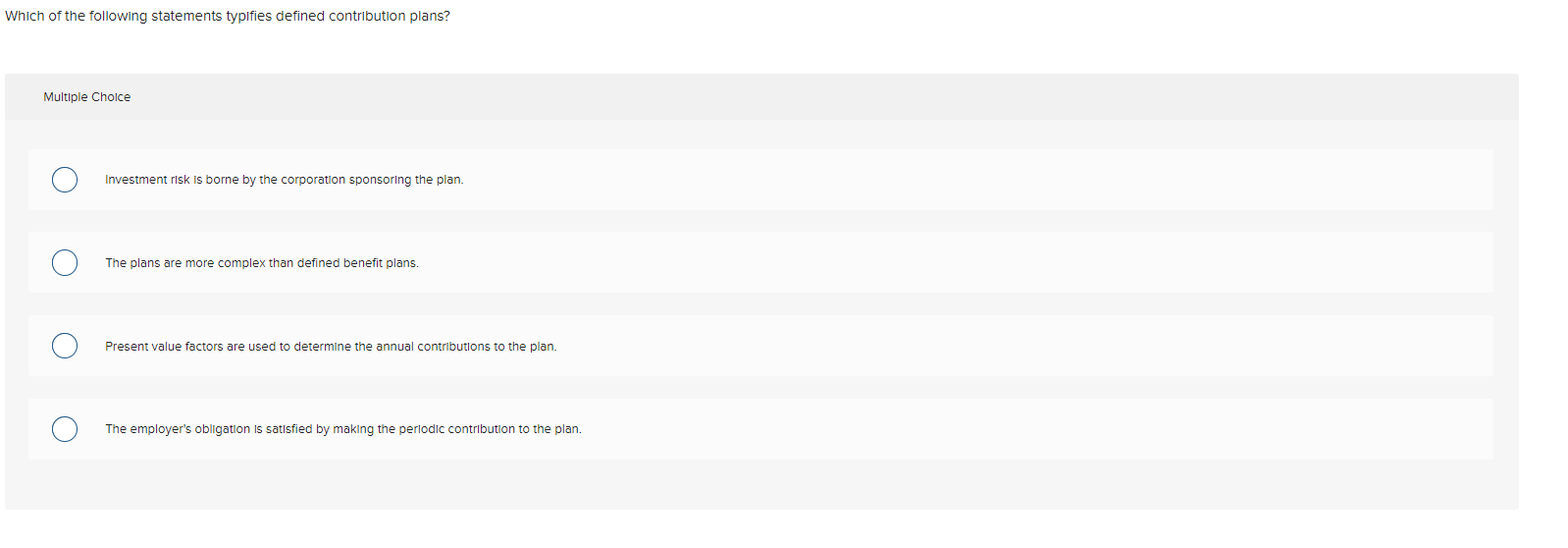

Question: Which of the following statements typifies defined contribution plans? Multiple Choice Investment risk is borne by the corporation sponsoring the plan. The plans are more

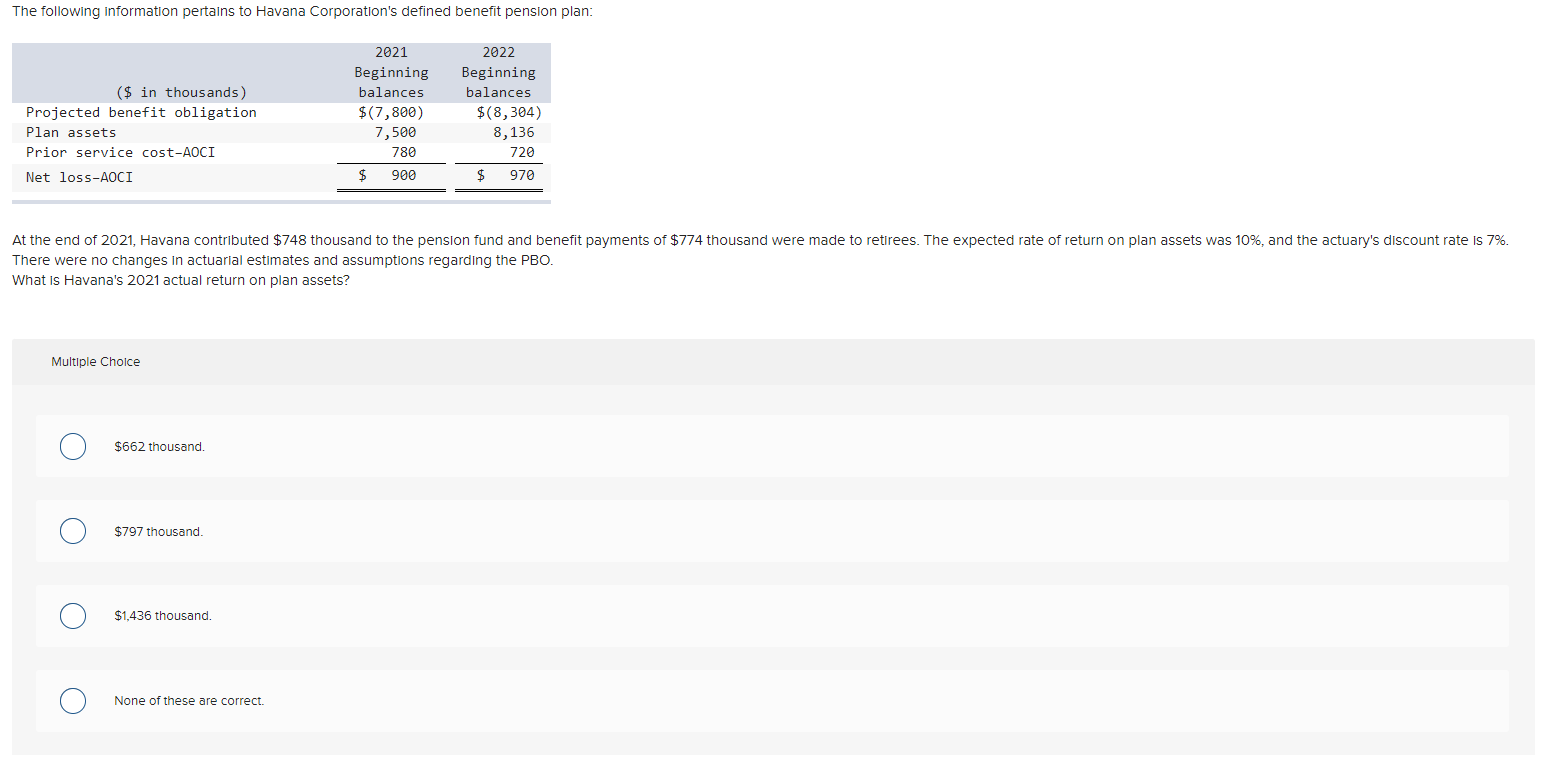

Which of the following statements typifies defined contribution plans? Multiple Choice Investment risk is borne by the corporation sponsoring the plan. The plans are more complex than defined benefit plans. Present value factors are used to determine the annual contributions to the plan. The employer's obligation is satisfied by making the periodic contribution to the plan. Interest cost will: Multiple Choice Increase the PBO and Increase pension expense. Increase pension expense and reduce plan assets. O Increase the PBO and reduce plan assets. O Increase pension expense and reduce the return on plan assets. The following information pertains to Havana Corporation's defined benefit pension plan: ($ in thousands) Projected benefit obligation Plan assets Prior service cost-AOCI Net loss-AOCI 2021 Beginning balances $(7,800) 7,500 780 $ 900 2022 Beginning balances $(8,304) 8,136 720 $ 970 At the end of 2021, Havana contributed $748 thousand to the pension fund and benefit payments of $774 thousand were made to retirees. The expected rate of return on plan assets was 10%, and the actuary's discount rate is 7%. There were no changes in actuarial estimates and assumptions regarding the PBO. What is Havana's 2021 actual return on plan assets? Multiple Choice $662 thousand. $797 thousand $1,436 thousand. O None of these are correct. An overfunded pension plan means that the Multiple Choice PBO is less than plan assets. PBO exceeds plan assets. ABO is less than plan assets. ABO exceeds plan assets. O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts