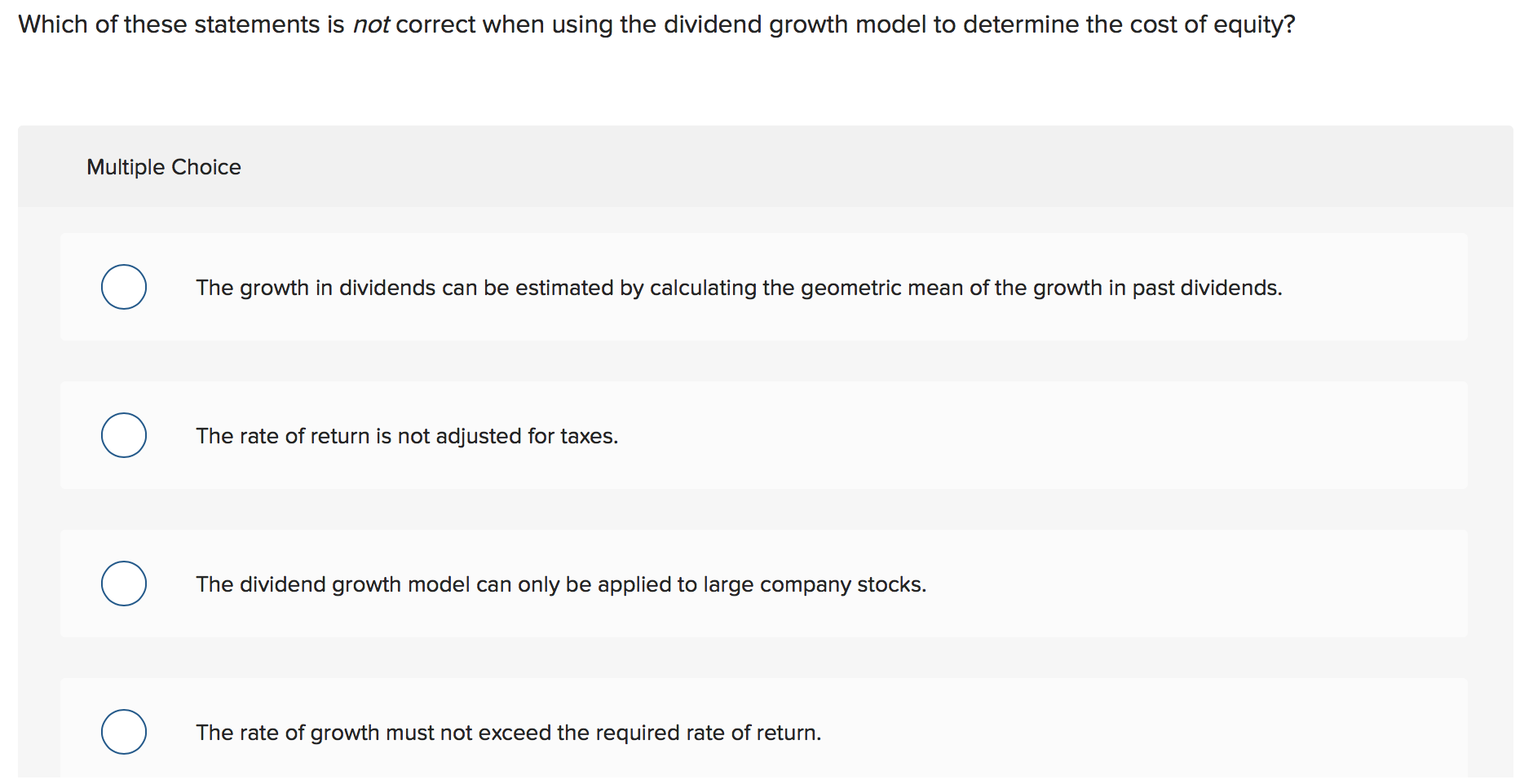

Question: Which of these statements is not correct when using the dividend growth model to determine the cost of equity? Multiple Choice The growth in dividends

Which of these statements is not correct when using the dividend growth model to determine the cost of equity? Multiple Choice The growth in dividends can be estimated by calculating the geometric mean of the growth in past dividends. The rate of return is not adjusted for taxes. The dividend growth model can only be applied to large company stocks. The rate of growth must not exceed the required rate of return. The annual dividend used in the computation must be for Year 1 if you use Time O's stock price to compute the return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock