Question: Which one is correct? 2.High P/E ratios can be expected when investors expect A. a high rate of growth in earnings. B. low earnings. relative

Which one is correct?

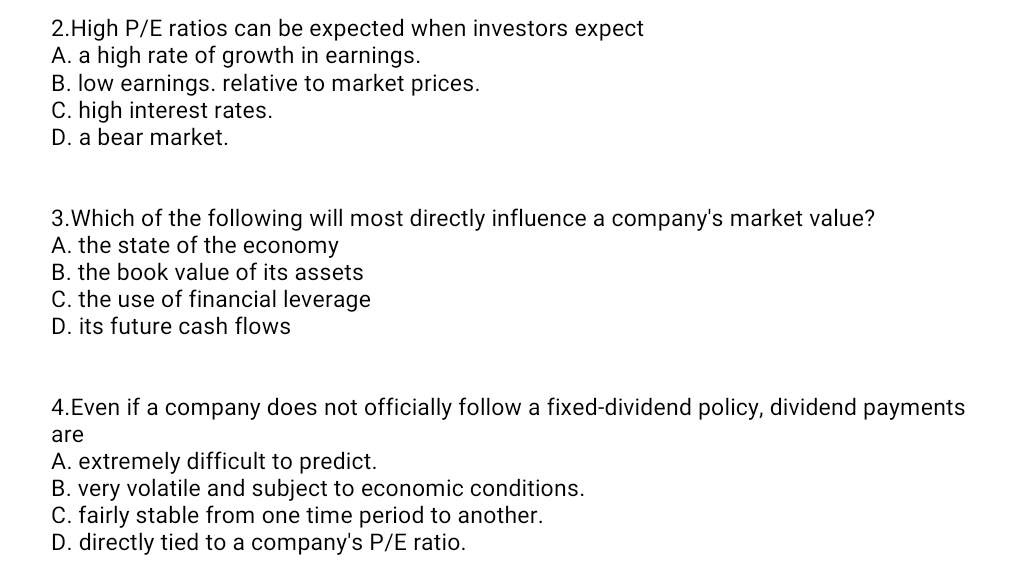

2.High P/E ratios can be expected when investors expect A. a high rate of growth in earnings. B. low earnings. relative to market prices. C. high interest rates. D. a bear market. 3. Which of the following will most directly influence a company's market value? A. the state of the economy B. the book value of its assets C. the use of financial leverage D. its future cash flows 4.Even if a company does not officially follow a fixed-dividend policy, dividend payments are A. extremely difficult to predict. B. very volatile and subject to economic conditions. C. fairly stable from one time period to another. D. directly tied to a company's P/E ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts