Question: Which one of the following is correct when computing the price of a debt security using discount yield? An increase in the discount yield will

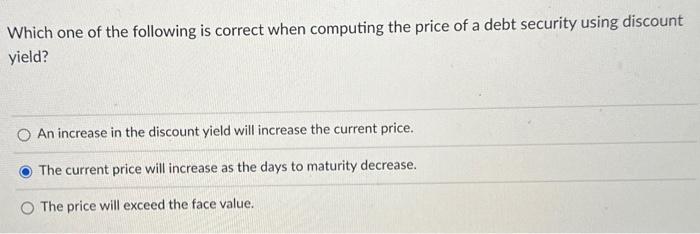

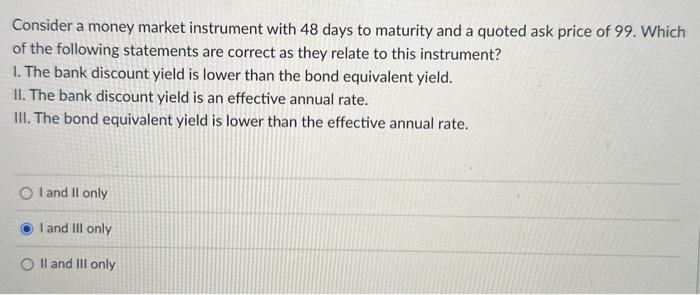

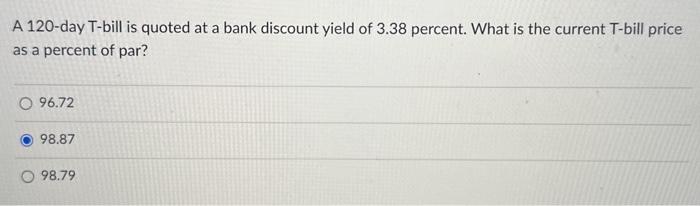

Which one of the following is correct when computing the price of a debt security using discount yield? An increase in the discount yield will increase the current price. The current price will increase as the days to maturity decrease. The price will exceed the face value. Consider a money market instrument with 48 days to maturity and a quoted ask price of 99. Which of the following statements are correct as they relate to this instrument? 1. The bank discount yield is lower than the bond equivalent yield. II. The bank discount yield is an effective annual rate. III. The bond equivalent yield is lower than the effective annual rate. 1 and 11 only I and III only II and III only A 120 -day T-bill is quoted at a bank discount yield of 3.38 percent. What is the current T-bill price as a percent of par? 96.72 98.87 98.79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts