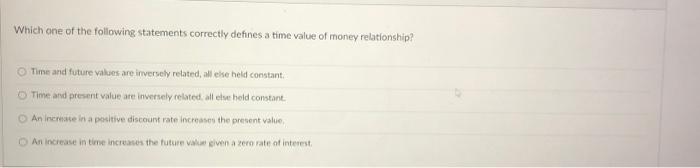

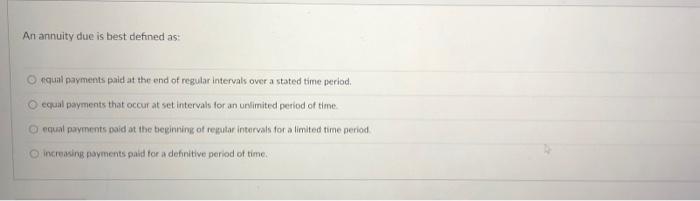

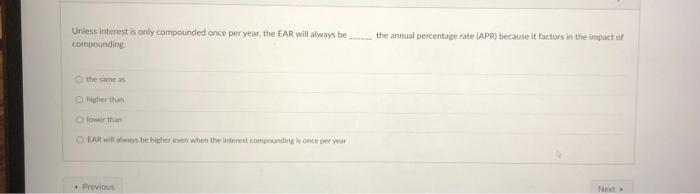

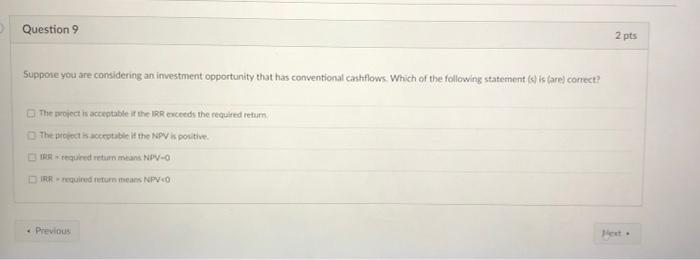

Question: Which one of the following statements is correct? NPV is very eimilar in its methodology to the paybick fule Present value of the annoty diue

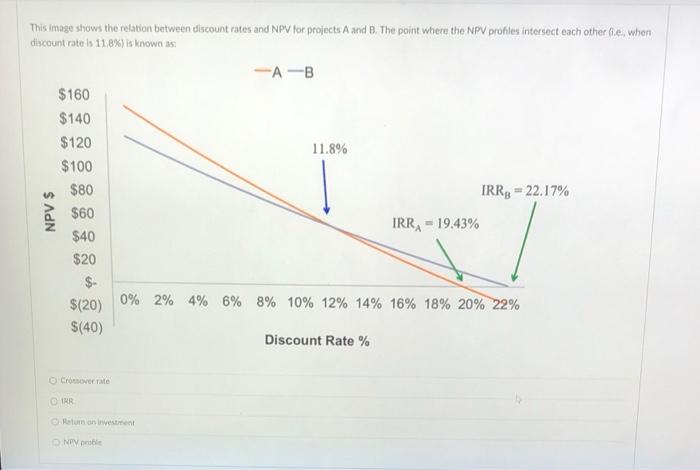

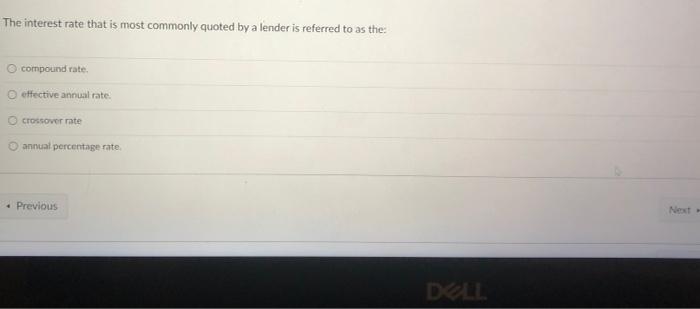

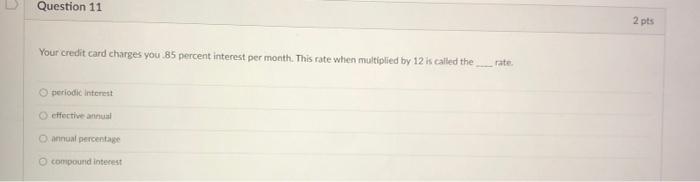

Which one of the following statements is correct? NPV is very eimilar in its methodology to the paybick fule Present value of the annoty diue is greater than the present value of the ordinary anniuity 5xvers weadd arrier monthiy compounding ewor annal compounding given the sme anial percentane rate. Dlorromirs woud pifefer snnial componnding over monthy compounding given the same annual percentage rate This image shows the relation between discount rates and NPV for projects A and B. The point where the NPV profiles intersect each other a.e, when discount rate is 118% is inown as: Crosuver tate IRR Ralian ais investifent rewy probit Project X has cash flows of $9,500,$9,000,57,500, and $7,000 foc Years 1 to 4, respectively. Project Y has cash flows of $7,000,$7,500,$9,000, and \$9,500 for Vears 1 to 4, respectively. Which of the following statements is true regarding these two projects given a positive discount rate? (No calculations needed. Project X Ias both a higher present and a hicher future valie than Project Y. Hoth grojects fiave the same NiPV Project Y has both a higher gresest and a higher tuture value than Project X. Project Ythin a higher present value thae Project X Thomson deposited $3,000 this morning into an account that pays 5 percent interest, compounded annually. Bob also deposited $3,000 this morning at 5 percent interest, compounded annually. Thomson will withdraw his interest earnings in one year and spend it as soon as possible. Bob will reinvest his interest earnings into his account. Given this, which one of the following statements is true? Thomeson will earn more interest in Year 3 than Bob Boh will earn mere interest in Year 2 than Themson. Thomson and tlob will cam the same amount ot interest in Year 4. Bob will earn inore interest in Year 1 than Thomson. Which one of the following statements correctly defines a time value of money relationship? Time and future values are inversely related, all else held constant. Time and present value are inversely related all else held constant. An inereace in a positive discount rate increases the present value. An increase in time increawes the future value elven a zero rate of interest. An annuity due is best defined as: fqual navments paid at the end of regular intervals over a stated time periad. equal payments that occur at set intervals for an unlimited period of time equal payments paid at the beginning of regular intervals for a limited time period increasing payments paid for a defnitive period of time. Unless interest is only compounded once per year, the EAR will always be the annuat percentage rate (APR) because it factors in the irppact of compounding the eare as hieher thua lowerithan EAR wil way be higher ever when the literest compounding on once oer vear Suppose you are condidering an imvestment opportunity that has conventional cakhtlows. Which of the following staternent (s) is (are) correct? The sroject is acceptable it the lRR erccedi the required reiurn. The becect is accostable if the kov is poutive. IFin ir requined retam mhans NPV =0 PR : required nitum itiears NPVeO The interest rate that is most commonly quoted by a lender is referred to as the: cornpound rate. effective annual rate. crossover mate annual percentage rate. Your credit card charges you. 85 percent interest per month. This rate when multiplied by 12 is called the rate periodicinterest effective anthua annual percentase compound interest Which one of the following statements is correct? NPV is very eimilar in its methodology to the paybick fule Present value of the annoty diue is greater than the present value of the ordinary anniuity 5xvers weadd arrier monthiy compounding ewor annal compounding given the sme anial percentane rate. Dlorromirs woud pifefer snnial componnding over monthy compounding given the same annual percentage rate This image shows the relation between discount rates and NPV for projects A and B. The point where the NPV profiles intersect each other a.e, when discount rate is 118% is inown as: Crosuver tate IRR Ralian ais investifent rewy probit Project X has cash flows of $9,500,$9,000,57,500, and $7,000 foc Years 1 to 4, respectively. Project Y has cash flows of $7,000,$7,500,$9,000, and \$9,500 for Vears 1 to 4, respectively. Which of the following statements is true regarding these two projects given a positive discount rate? (No calculations needed. Project X Ias both a higher present and a hicher future valie than Project Y. Hoth grojects fiave the same NiPV Project Y has both a higher gresest and a higher tuture value than Project X. Project Ythin a higher present value thae Project X Thomson deposited $3,000 this morning into an account that pays 5 percent interest, compounded annually. Bob also deposited $3,000 this morning at 5 percent interest, compounded annually. Thomson will withdraw his interest earnings in one year and spend it as soon as possible. Bob will reinvest his interest earnings into his account. Given this, which one of the following statements is true? Thomeson will earn more interest in Year 3 than Bob Boh will earn mere interest in Year 2 than Themson. Thomson and tlob will cam the same amount ot interest in Year 4. Bob will earn inore interest in Year 1 than Thomson. Which one of the following statements correctly defines a time value of money relationship? Time and future values are inversely related, all else held constant. Time and present value are inversely related all else held constant. An inereace in a positive discount rate increases the present value. An increase in time increawes the future value elven a zero rate of interest. An annuity due is best defined as: fqual navments paid at the end of regular intervals over a stated time periad. equal payments that occur at set intervals for an unlimited period of time equal payments paid at the beginning of regular intervals for a limited time period increasing payments paid for a defnitive period of time. Unless interest is only compounded once per year, the EAR will always be the annuat percentage rate (APR) because it factors in the irppact of compounding the eare as hieher thua lowerithan EAR wil way be higher ever when the literest compounding on once oer vear Suppose you are condidering an imvestment opportunity that has conventional cakhtlows. Which of the following staternent (s) is (are) correct? The sroject is acceptable it the lRR erccedi the required reiurn. The becect is accostable if the kov is poutive. IFin ir requined retam mhans NPV =0 PR : required nitum itiears NPVeO The interest rate that is most commonly quoted by a lender is referred to as the: cornpound rate. effective annual rate. crossover mate annual percentage rate. Your credit card charges you. 85 percent interest per month. This rate when multiplied by 12 is called the rate periodicinterest effective anthua annual percentase compound interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts