Question: Which one represents sound financial analytical reasoning: A. Using EBIT (earnings before interest, taxes) as a cashflow proxy for a company with lots of fixed

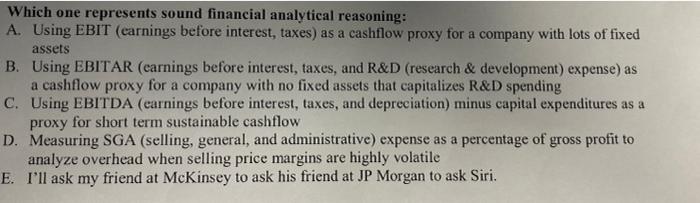

Which one represents sound financial analytical reasoning: A. Using EBIT (earnings before interest, taxes) as a cashflow proxy for a company with lots of fixed assets B. Using EBITAR (earnings before interest, taxes, and R&D (research & development) expense) as a cashflow proxy for a company with no fixed assets that capitalizes R&D spending C. Using EBITDA (earnings before interest, taxes, and depreciation) minus capital expenditures as a proxy for short term sustainable cashflow D. Measuring SGA (selling, general, and administrative) expense as a percentage of gross profit to analyze overhead when selling price margins are highly volatile E. I'll ask my friend at McKinsey to ask his friend at JP Morgan to ask Siri

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts