Question: which option help please please A project has an up-front cost of $100,000. All subsequent cash flows are positive. The project's required return is 9

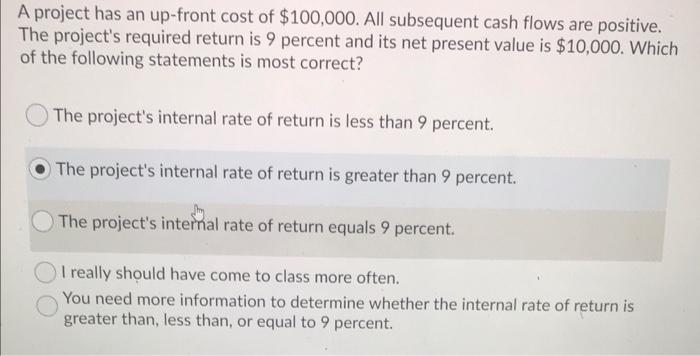

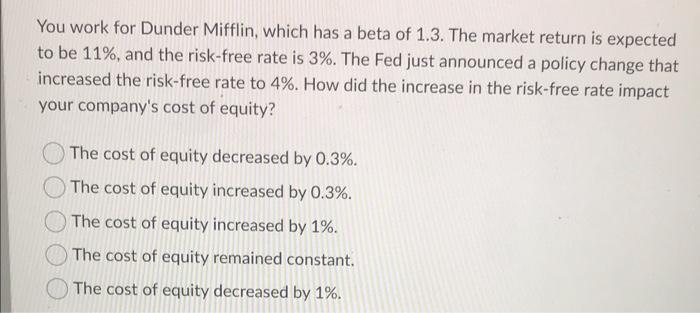

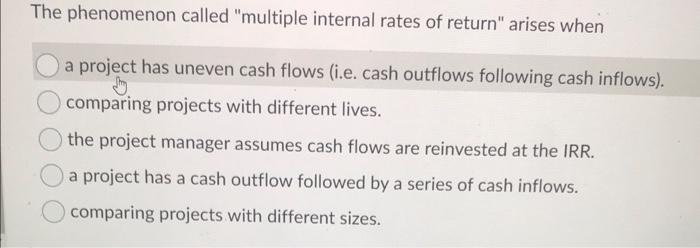

A project has an up-front cost of $100,000. All subsequent cash flows are positive. The project's required return is 9 percent and its net present value is $10,000. Which of the following statements is most correct? The project's internal rate of return is less than 9 percent. The project's internal rate of return is greater than 9 percent. The project's internal rate of return equals 9 percent. I really should have come to class more often. You need more information to determine whether the internal rate of return is greater than, less than or equal to 9 percent. You work for Dunder Mifflin, which has a beta of 1.3. The market return is expected to be 11%, and the risk-free rate is 3%. The Fed just announced a policy change that increased the risk-free rate to 4%. How did the increase in the risk-free rate impact your company's cost of equity? The cost of equity decreased by 0.3%. The cost of equity increased by 0.3%. The cost of equity increased by 1%. The cost of equity remained constant, The cost of equity decreased by 1%. The phenomenon called "multiple internal rates of return" arises when a project has uneven cash flows (i.e. cash outflows following cash inflows). comparing projects with different lives. the project manager assumes cash flows are reinvested at the IRR. a project has a cash outflow followed by a series of cash inflows. comparing projects with different sizes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts