Question: which question has an incorrect answer? Question 1 0.1 pts This term represents a business's claim to be paid by others (businesses, individuals, other organizations).

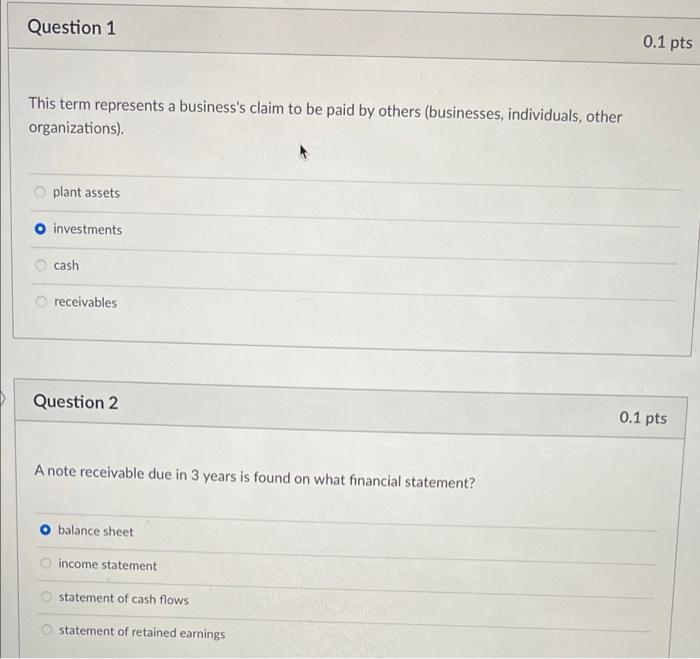

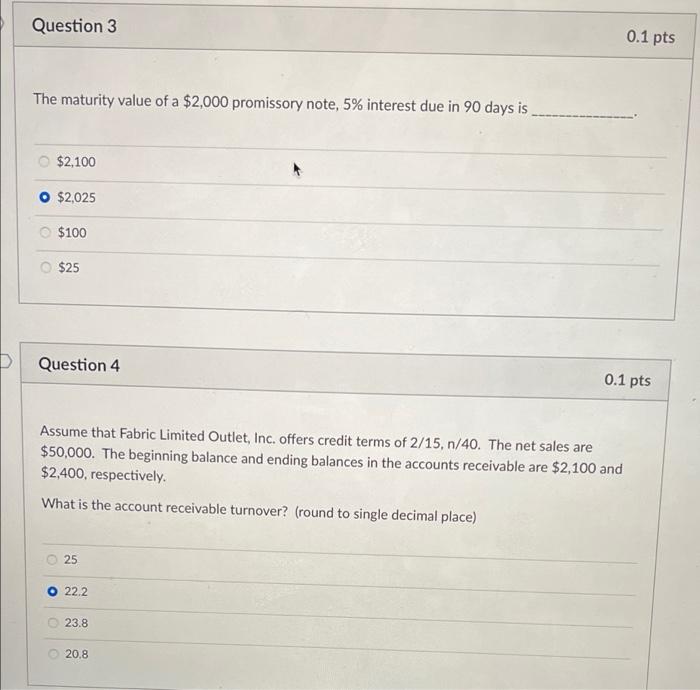

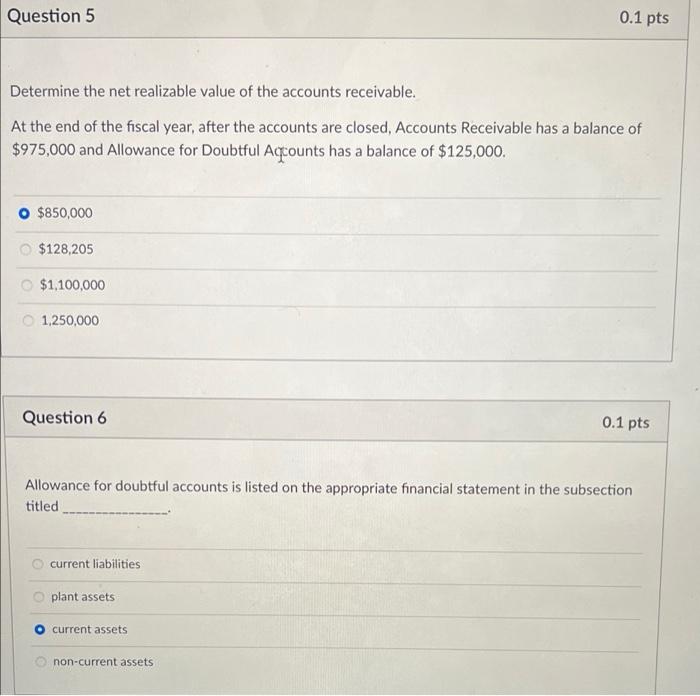

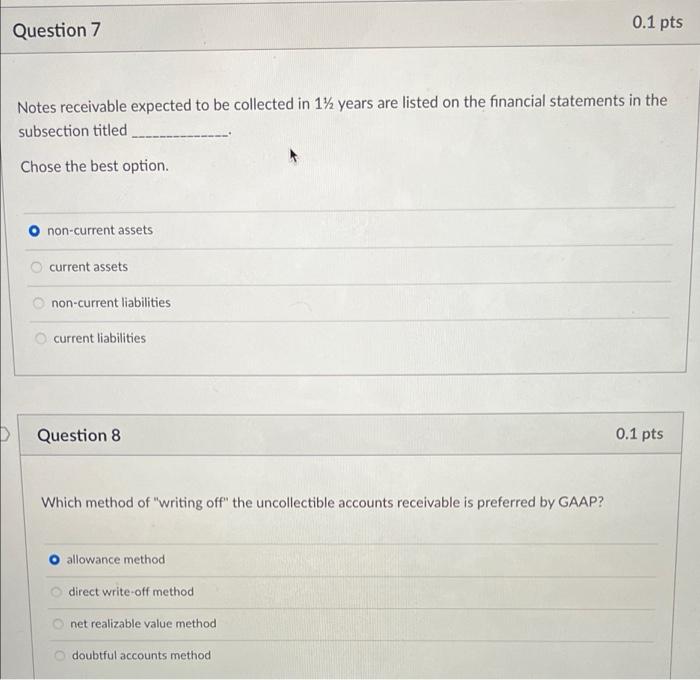

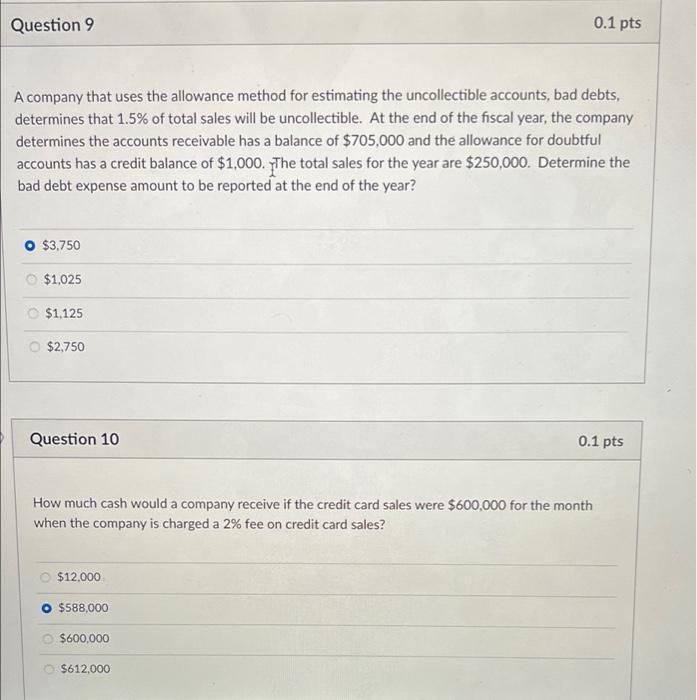

Question 1 0.1 pts This term represents a business's claim to be paid by others (businesses, individuals, other organizations). plant assets investments cash receivables Question 2 0.1 pts A note receivable due in 3 years is found on what financial statement? O balance sheet income statement statement of cash flows statement of retained earnings Question 3 0.1 pts The maturity value of a $2,000 promissory note, 5% interest due in 90 days is $2,100 $2,025 $100 $25 Question 4 0.1 pts Assume that Fabric Limited Outlet, Inc. offers credit terms of 2/15, n/40. The net sales are $50,000. The beginning balance and ending balances in the accounts receivable are $2,100 and $2,400, respectively. What is the account receivable turnover? (round to single decimal place) 25 22.2 23.8 20.8 Question 5 0.1 pts Determine the net realizable value of the accounts receivable. At the end of the fiscal year, after the accounts are closed, Accounts Receivable has a balance of $975,000 and Allowance for Doubtful Accounts has a balance of $125,000. o $850,000 $128,205 $1,100,000 1,250,000 Question 6 0.1 pts Allowance for doubtful accounts is listed on the appropriate financial statement in the subsection titled current liabilities plant assets current assets non-current assets 0.1 pts Question 7 Notes receivable expected to be collected in 14 years are listed on the financial statements in the subsection titled Chose the best option. non-current assets current assets non-current liabilities current liabilities Question 8 0.1 pts Which method of "writing off the uncollectible accounts receivable is preferred by GAAP? allowance method direct write-off method net realizable value method doubtful accounts method Question 9 0.1 pts A company that uses the allowance method for estimating the uncollectible accounts, bad debts, determines that 1.5% of total sales will be uncollectible. At the end of the fiscal year, the company determines the accounts receivable has a balance of $705,000 and the allowance for doubtful accounts has a credit balance of $1,000. The total sales for the year are $250,000. Determine the bad debt expense amount to be reported at the end of the year? $3.750 $1,025 $1,125 $2,750 Question 10 0.1 pts How much cash would a company receive if the credit card sales were $600,000 for the month when the company is charged a 2% fee on credit card sales? $12.000 $588,000 $600,000 $612.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts