Question: Which results in a lower total interest charge, borrowing $1,910 to be repaid 12 months later as a single-payment loan or borrowing $1,910 to

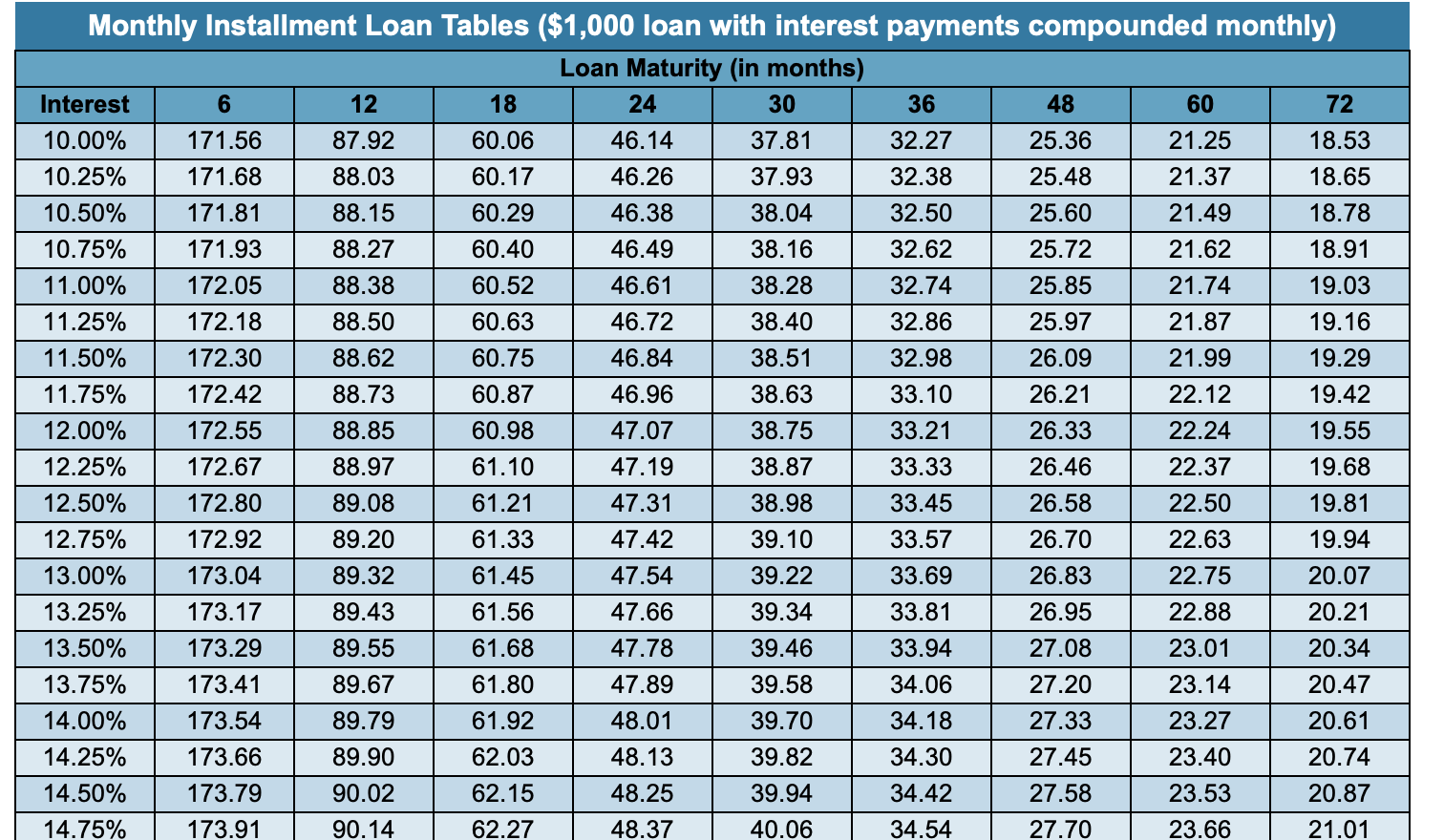

Which results in a lower total interest charge, borrowing $1,910 to be repaid 12 months later as a single-payment loan or borrowing $1,910 to be repaid as a 12-month installment loan? Assume a simple interest method of calculation at 11.75 percent interest. Defend your answer. Note: Round intermediate computations to at least five (5) decimal places. Click on the table icon to view the Monthly Installment Loan Payment Factor (MILPF) table: . The amount of interest on the single-payment loan is $ 224.43. (Round to the nearest cent.) The amount of interest on the 12-month installment loan is $ (Round to the nearest cent.) Monthly Installment Loan Tables ($1,000 loan with interest payments compounded monthly) Loan Maturity (in months) Interest 6 12 18 24 30 36 48 60 72 10.00% 171.56 87.92 60.06 46.14 37.81 32.27 25.36 21.25 18.53 10.25% 171.68 88.03 60.17 46.26 37.93 32.38 25.48 21.37 18.65 10.50% 171.81 88.15 60.29 46.38 38.04 32.50 25.60 21.49 18.78 10.75% 171.93 88.27 60.40 46.49 38.16 32.62 25.72 21.62 18.91 11.00% 172.05 88.38 60.52 46.61 38.28 32.74 25.85 21.74 19.03 11.25% 172.18 88.50 60.63 46.72 38.40 32.86 25.97 21.87 19.16 11.50% 172.30 88.62 60.75 46.84 38.51 32.98 26.09 21.99 19.29 11.75% 172.42 88.73 60.87 46.96 38.63 33.10 26.21 22.12 19.42 12.00% 172.55 88.85 60.98 47.07 38.75 33.21 26.33 22.24 19.55 12.25% 172.67 88.97 61.10 47.19 38.87 33.33 26.46 22.37 19.68 12.50% 172.80 89.08 61.21 47.31 38.98 33.45 26.58 22.50 19.81 12.75% 172.92 89.20 61.33 47.42 39.10 33.57 26.70 22.63 19.94 13.00% 173.04 89.32 61.45 47.54 39.22 33.69 26.83 22.75 20.07 13.25% 173.17 89.43 61.56 47.66 39.34 33.81 26.95 22.88 20.21 13.50% 173.29 89.55 61.68 47.78 39.46 33.94 27.08 23.01 20.34 13.75% 173.41 89.67 61.80 47.89 39.58 34.06 27.20 23.14 20.47 14.00% 173.54 89.79 61.92 48.01 39.70 34.18 27.33 23.27 20.61 14.25% 173.66 89.90 62.03 48.13 39.82 34.30 27.45 23.40 20.74 14.50% 173.79 90.02 62.15 48.25 39.94 34.42 27.58 23.53 20.87 14.75% 173.91 90.14 62.27 48.37 40.06 34.54 27.70 23.66 21.01

Step by Step Solution

There are 3 Steps involved in it

To determine which option results in a lower total interest charge lets calculate the amount of inte... View full answer

Get step-by-step solutions from verified subject matter experts