Question: Which statement about capital structure is the most correct? a. A company should always try to reduce its debt because of the high bankruptcy risk

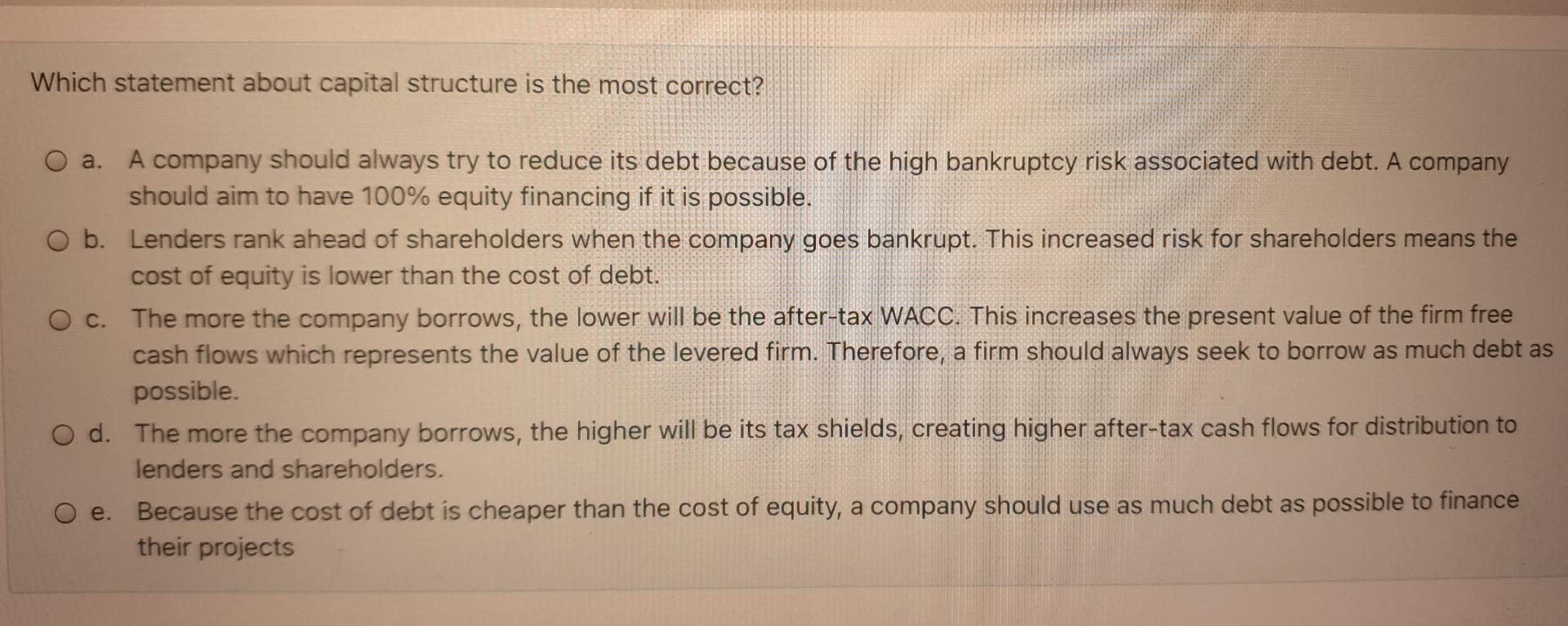

Which statement about capital structure is the most correct? a. A company should always try to reduce its debt because of the high bankruptcy risk associated with debt. A company should aim to have 100% equity financing if it is possible. O b. Lenders rank ahead of shareholders when the company goes bankrupt. This increased risk for shareholders means the cost of equity is lower than the cost of debt. O c. The more the company borrows, the lower will be the after-tax WACC. This increases the present value of the firm free cash flows which represents the value of the levered firm. Therefore, a firm should always seek to borrow as much debt as possible. O d. The more the company borrows, the higher will be its tax shields, creating higher after-tax cash flows for distribution to lenders and shareholders. O e. Because the cost of debt is cheaper than the cost of equity, a company should use as much debt as possible to finance their projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts