Question: Which statement below about repos is not correct? Repos are essentially short-term collateralized fed funds. The securities used as collateral most often are U.S. Treasury

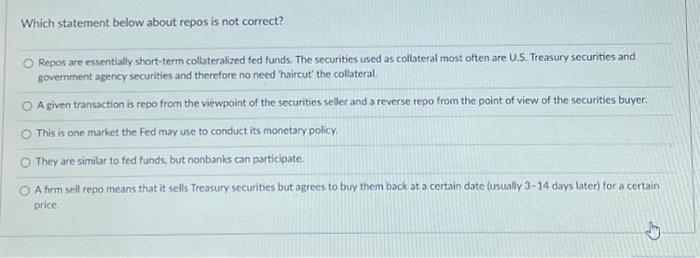

Which statement below about repos is not correct? Repos are essentially short-term collateralized fed funds. The securities used as collateral most often are U.S. Treasury securities and government agency securities and therefore no need 'haireut' the collateral. A given transaction is repo from the viewpoint of the securities seller and a reverse repo from the point of view of the securities buyer. This is one market the Fed may use to conduct its monetary policy. They are similar to fed funds, but nonbanks can participate. A firm sell repo means that it sells Treasury securities but agrees to buy them back at a certain date (usually 3 - 14 days later) for a certain price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts