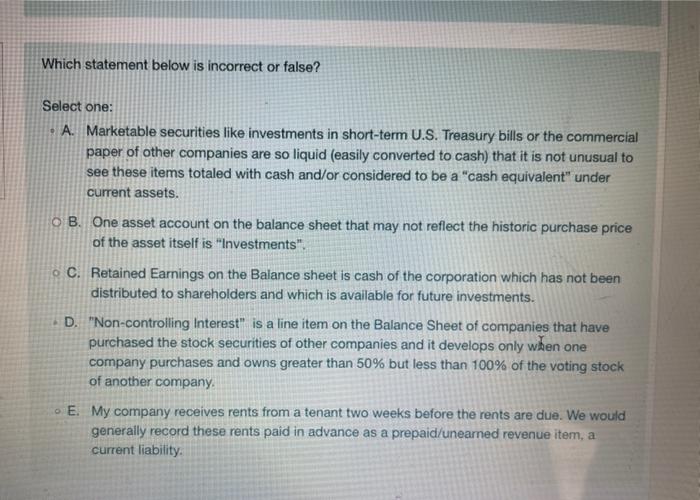

Question: Which statement below is incorrect or false? Select one: A. Marketable securities like investments in short-term U.S. Treasury bills or the commercial paper of other

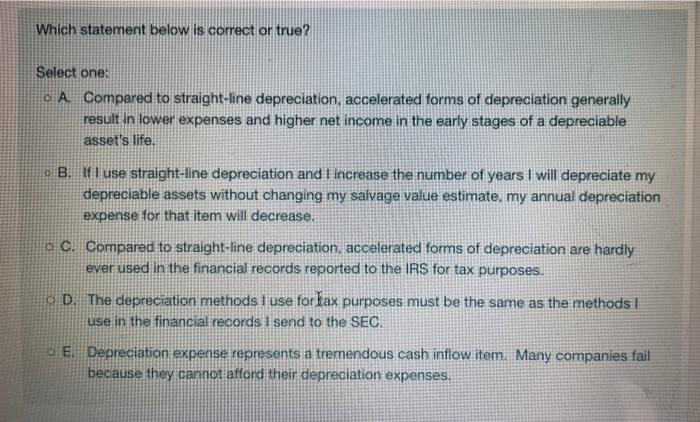

Which statement below is incorrect or false? Select one: A. Marketable securities like investments in short-term U.S. Treasury bills or the commercial paper of other companies are so liquid (easily converted to cash) that it is not unusual to see these items totaled with cash and/or considered to be a "cash equivalent" under current assets. OB. One asset account on the balance sheet that may not reflect the historic purchase price of the asset itself is "Investments" . C. Retained Earnings on the Balance sheet is cash of the corporation which has not been distributed to shareholders and which is available for future investments. D. "Non-controlling Interest" is a line item on the Balance Sheet of companies that have purchased the stock securities of other companies and it develops only when company purchases and owns greater than 50% but less than 100% of the voting stock of another company o E. My company receives rents from a tenant two weeks before the rents are due. We would generally record these rents paid in advance as a prepaid/unearned revenue item, a current liability one Which statement below is correct or true? Select one: A. Compared to straight-line depreciation, accelerated forms of depreciation generally result in lower expenses and higher net income in the early stages of a depreciable asset's life. 6 B. If I use straight-line depreciation and I increase the number of years I will depreciate my depreciable assets without changing my salvage value estimate, my annual depreciation expense for that item will decrease. a C. Compared to straight-line depreciation, accelerated forms of depreciation are hardly ever used in the financial records reported to the IRS for tax purposes. a D. The depreciation methods I use for Fax purposes must be the same as the methods use in the financial records I send to the SEC GE. Depreciation expense represents a tremendous cash inflow item. Many companies fail because they cannot afford their depreciation expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts