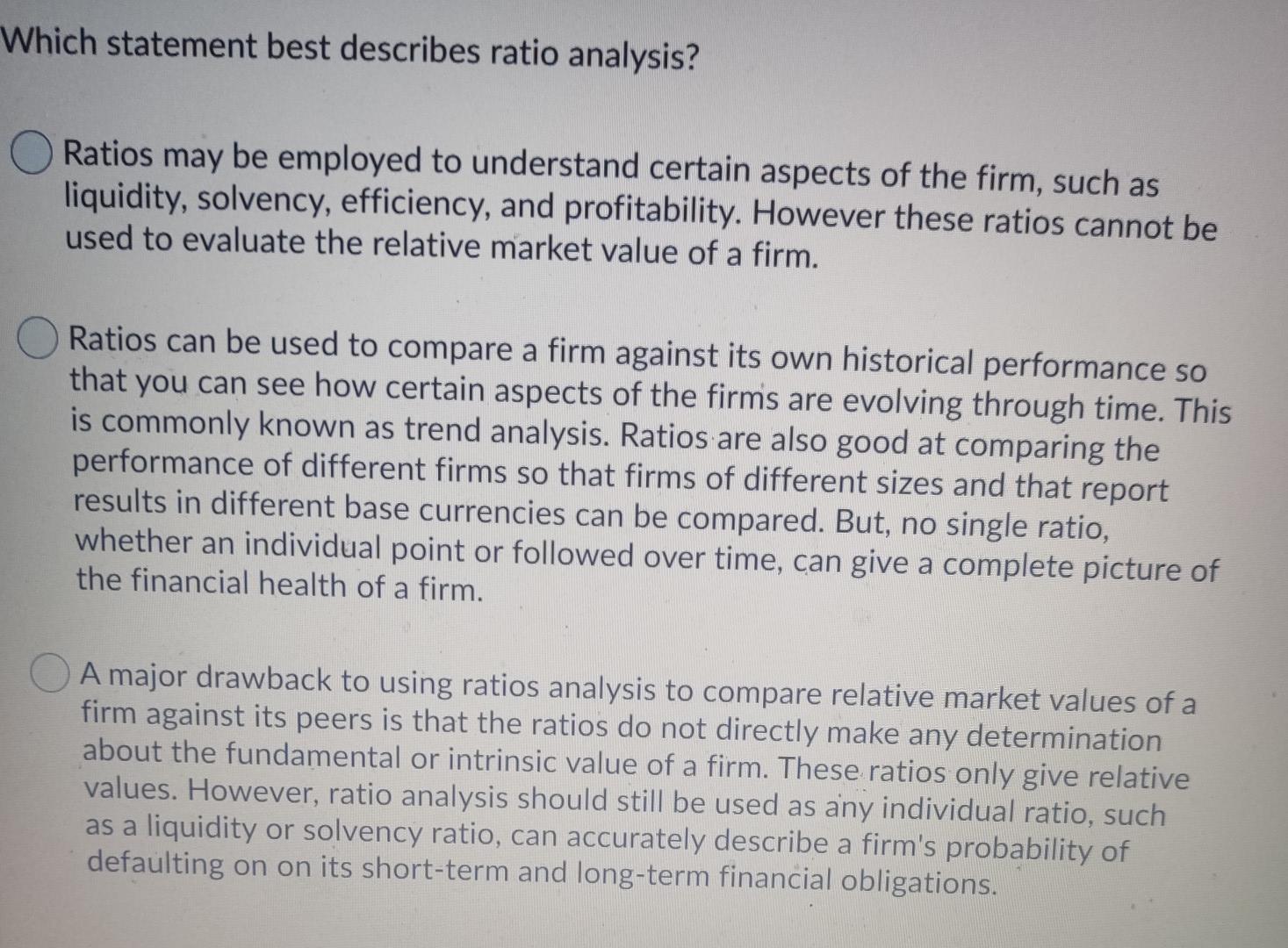

Question: Which statement best describes ratio analysis? Ratios may be employed to understand certain aspects of the firm, such as liquidity, solvency, efficiency, and profitability. However

Which statement best describes ratio analysis? Ratios may be employed to understand certain aspects of the firm, such as liquidity, solvency, efficiency, and profitability. However these ratios cannot be used to evaluate the relative market value of a firm. Ratios can be used to compare a firm against its own historical performance so that you can see how certain aspects of the firms are evolving through time. This is commonly known as trend analysis. Ratios are also good at comparing the performance of different firms so that firms of different sizes and that report results in different base currencies can be compared. But, no single ratio, whether an individual point or followed over time, can give a complete picture of the financial health of a firm. A major drawback to using ratios analysis to compare relative market values of a firm against its peers is that the ratios do not directly make any determination about the fundamental or intrinsic value of a firm. These ratios only give relative values. However, ratio analysis should still be used as any individual ratio, such as a liquidity or solvency ratio, can accurately describe a firm's probability of defaulting on on its short-term and long-term financial obligations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts