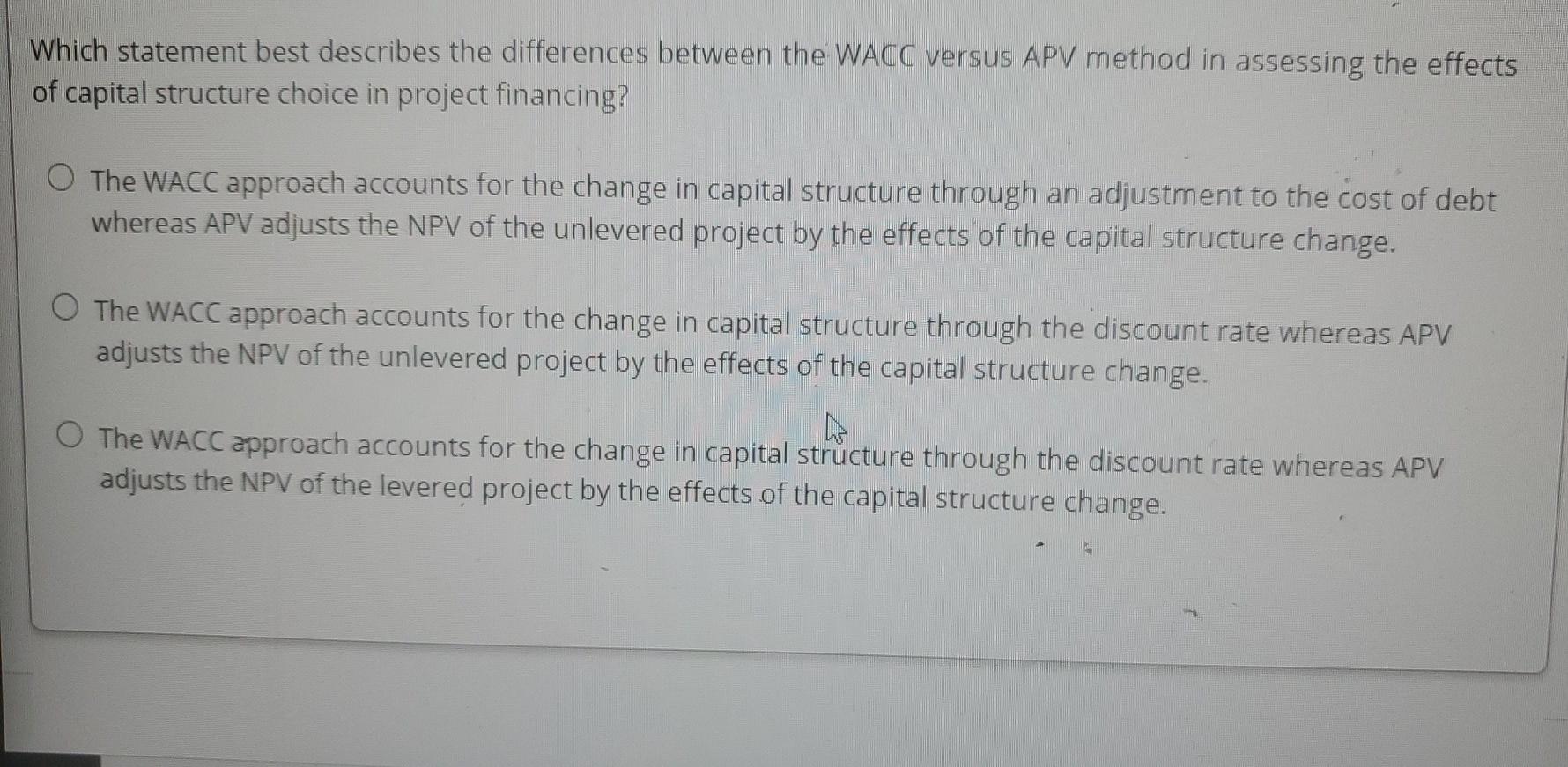

Question: Which statement best describes the differences between the WACC versus APV method in assessing the effects of capital structure choice in project financing? The WACC

Which statement best describes the differences between the WACC versus APV method in assessing the effects of capital structure choice in project financing? The WACC approach accounts for the change in capital structure through an adjustment to the cost of debt whereas APV adjusts the NPV of the unlevered project by the effects of the capital structure change. The WACC approach accounts for the change in capital structure through the discount rate whereas APV adjusts the NPV of the unlevered project by the effects of the capital structure change. The WACC approach accounts for the change in capital structure through the discount rate whereas APV adjusts the NPV of the levered project by the effects of the capital structure change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts