Question: Which statement does not apply to sole traders? a . A person can earn income from more than one business ( sole trader ) .

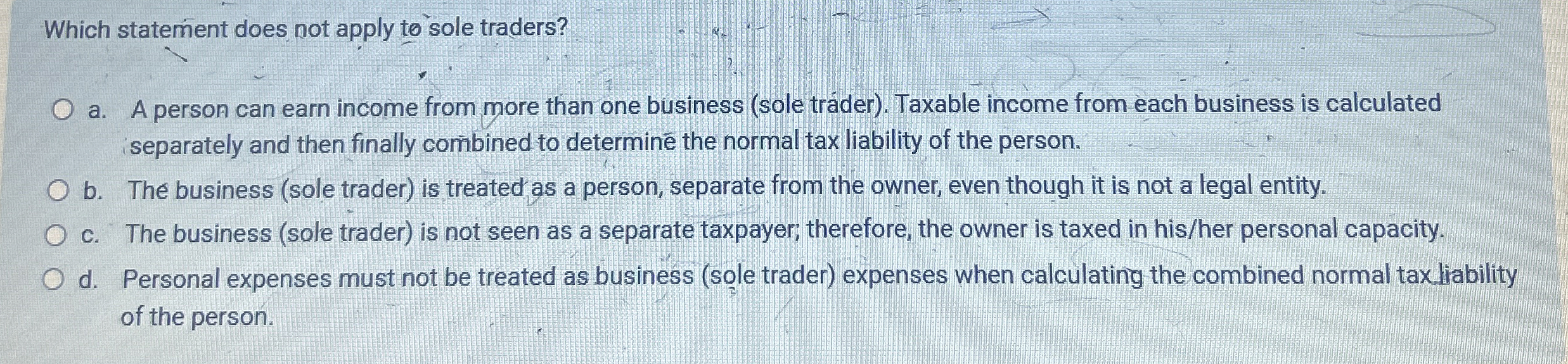

Which statement does not apply to sole traders?

a A person can earn income from more than one business sole trader Taxable income from each business is calculated

iseparately and then finally combined to determine the normal tax liability of the person.

b The business sole trader is treated as a person, separate from the owner, even though it is not a legal entity.

c The business sole trader is not seen as a separate taxpayer; therefore, the owner is taxed in hisher personal capacity.

d Personal expenses must not be treated as business sole trader expenses when calculating the combined normal tax liability

of the person.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock