Question: Which statement is FALSE regarding risk and return? For broad asset classes, the relationship between risk and return is nearly linear. Adding multiple stocks to

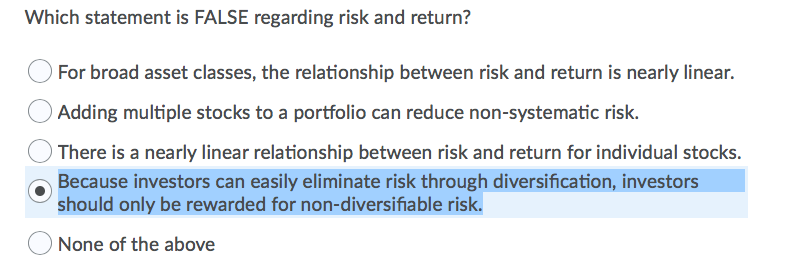

Which statement is FALSE regarding risk and return? For broad asset classes, the relationship between risk and return is nearly linear. Adding multiple stocks to a portfolio can reduce non-systematic risk. There is a nearly linear relationship between risk and return for individual stocks. Because investors can easily eliminate risk through diversification, investors should only be rewarded for non-diversifiable risk. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts