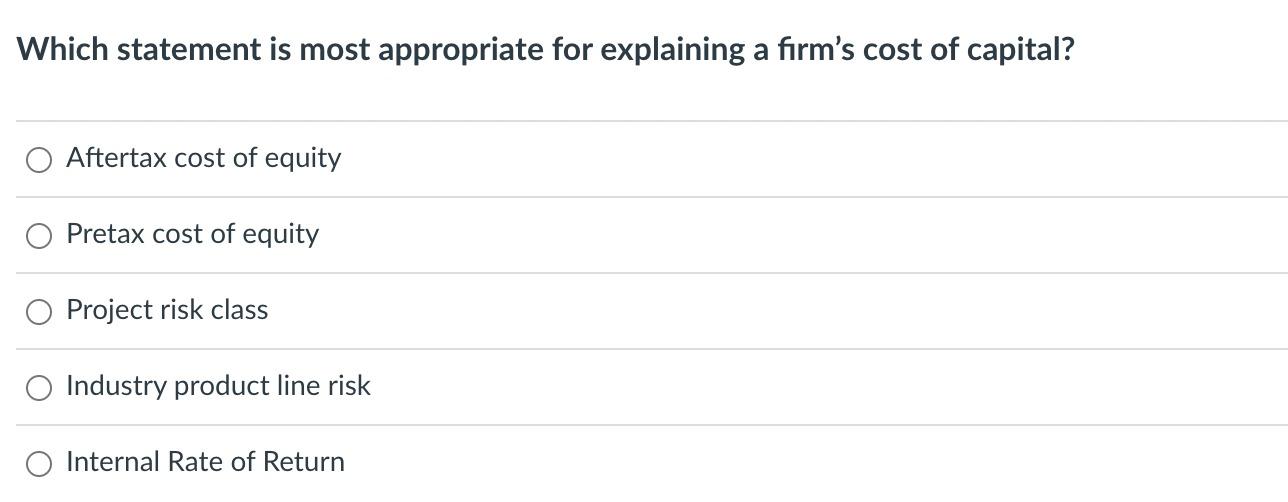

Question: Which statement is most appropriate for explaining a firm's cost of capital? Aftertax cost of equity Pretax cost of equity O Project risk class Industry

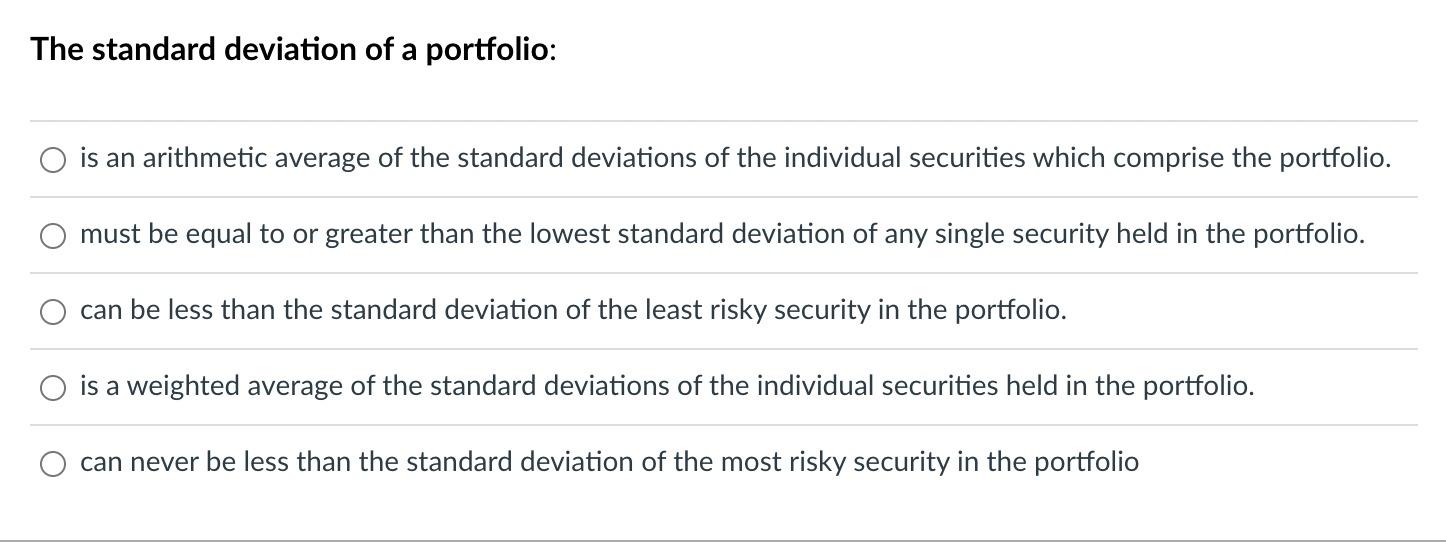

Which statement is most appropriate for explaining a firm's cost of capital? Aftertax cost of equity Pretax cost of equity O Project risk class Industry product line risk Internal Rate of Return The standard deviation of a portfolio: is an arithmetic average of the standard deviations of the individual securities which comprise the portfolio. must be equal to or greater than the lowest standard deviation of any single security held in the portfolio. can be less than the standard deviation of the least risky security in the portfolio. is a weighted average of the standard deviations of the individual securities held in the portfolio. can never be less than the standard deviation of the most risky security in the portfolio Which statement is most appropriate for explaining a firm's cost of capital? Aftertax cost of equity Pretax cost of equity O Project risk class Industry product line risk Internal Rate of Return The standard deviation of a portfolio: is an arithmetic average of the standard deviations of the individual securities which comprise the portfolio. must be equal to or greater than the lowest standard deviation of any single security held in the portfolio. can be less than the standard deviation of the least risky security in the portfolio. is a weighted average of the standard deviations of the individual securities held in the portfolio. can never be less than the standard deviation of the most risky security in the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts