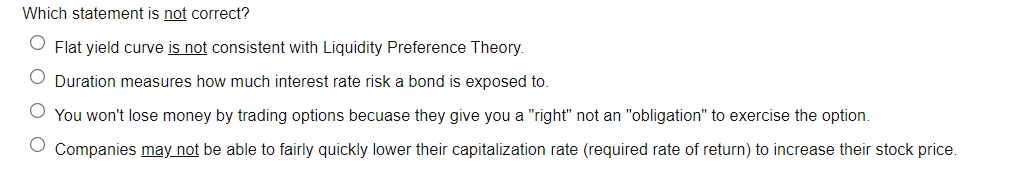

Question: Which statement is not correct? Flat yield curve is not consistent with Liquidity Preference Theory Duration measures how much interest rate risk a bond is

Which statement is not correct? Flat yield curve is not consistent with Liquidity Preference Theory Duration measures how much interest rate risk a bond is exposed to You won't lose money by trading options becuase they give you a "right" not an "obligation" to exercise the option. Companies may not be able to fairly quickly lower their capitalization rate (required rate of return) to increase their stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts