Question: Which statement is true about IRA contribution limits ? Contributions to Traditional and Roth IRAs are treated the same for tax purposes The combined total

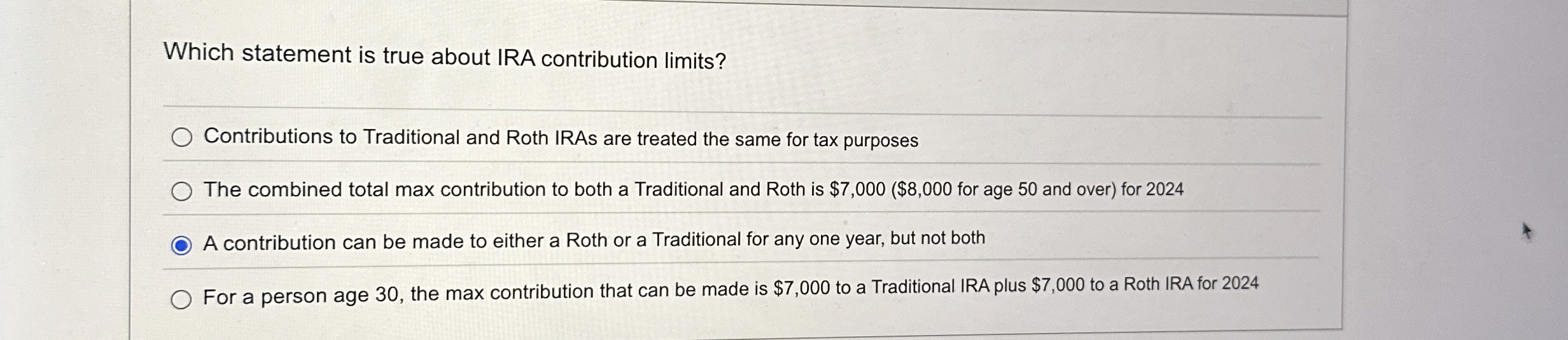

Which statement is true about IRA contribution limits

Contributions to Traditional and Roth IRAs are treated the same for tax purposes

The combined total max contribution to both a Traditional and Roth is $ $ for age and over for

A contribution can be made to either a Roth or a Traditional for any one year, but not both

For a person age the max contribution that can be made is $ to a Traditional IRA plus $ to a Roth IRA for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock