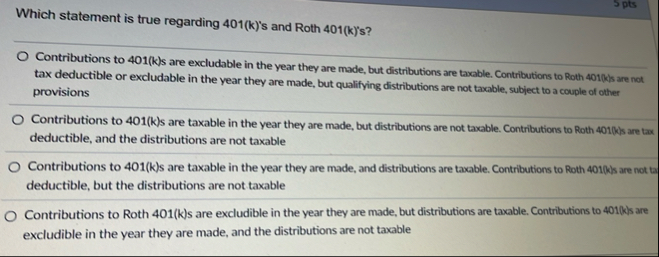

Question: Which statement is true regarding 4 0 1 ( k ) ' s and Roth 4 0 1 ( k ) ' s ? 5

Which statement is true regarding s and Roth s

pts

Contributions to are excludable in the year they are made, but distributions are taxable. Contributions to Roth are not tax deductible or excludable in the year they are made, but qualifying distributions are not taxable, subject to a couple of other provisions

Contributions to are taxable in the year they are made, but distributions are not taxable. Contributions to Roth ks are tax deductible, and the distributions are not taxable

Contributions to are taxable in the year they are made, and distributions are taxable. Contributions to Roth ks are not to deductible, but the distributions are not taxable

Contributions to Roth s are excludible in the year they are made, but distributions are taxable. Contributions to are excludible in the year they are made, and the distributions are not taxable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock