Question: Which statement regarding choice of entity considerations is incorrect? C corporations have a flat tax rate of 2 1 % , but are subject to

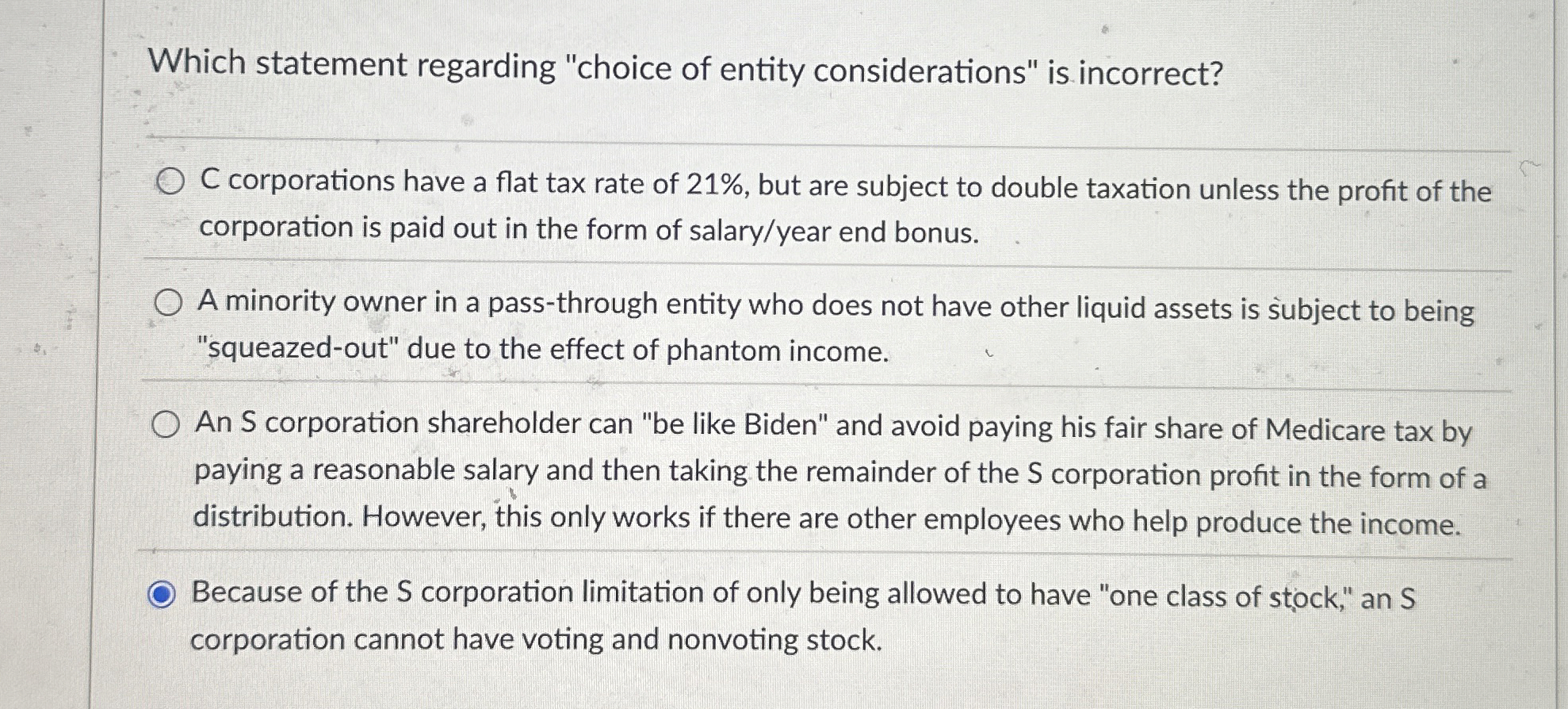

Which statement regarding "choice of entity considerations" is incorrect?

C corporations have a flat tax rate of but are subject to double taxation unless the profit of the

corporation is paid out in the form of salaryyear end bonus.

A minority owner in a passthrough entity who does not have other liquid assets is subject to being

"squeazedout" due to the effect of phantom income.

An S corporation shareholder can be like Biden" and avoid paying his fair share of Medicare tax by

paying a reasonable salary and then taking the remainder of the corporation profit in the form of a

distribution. However, this only works if there are other employees who help produce the income.

Because of the S corporation limitation of only being allowed to have "one class of stock," an S

corporation cannot have voting and nonvoting stock.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock