Question: In thinking about theories of capital structure, which of the following statements is INCORRECT? A. In the case of no corporate taxes or bankruptcy

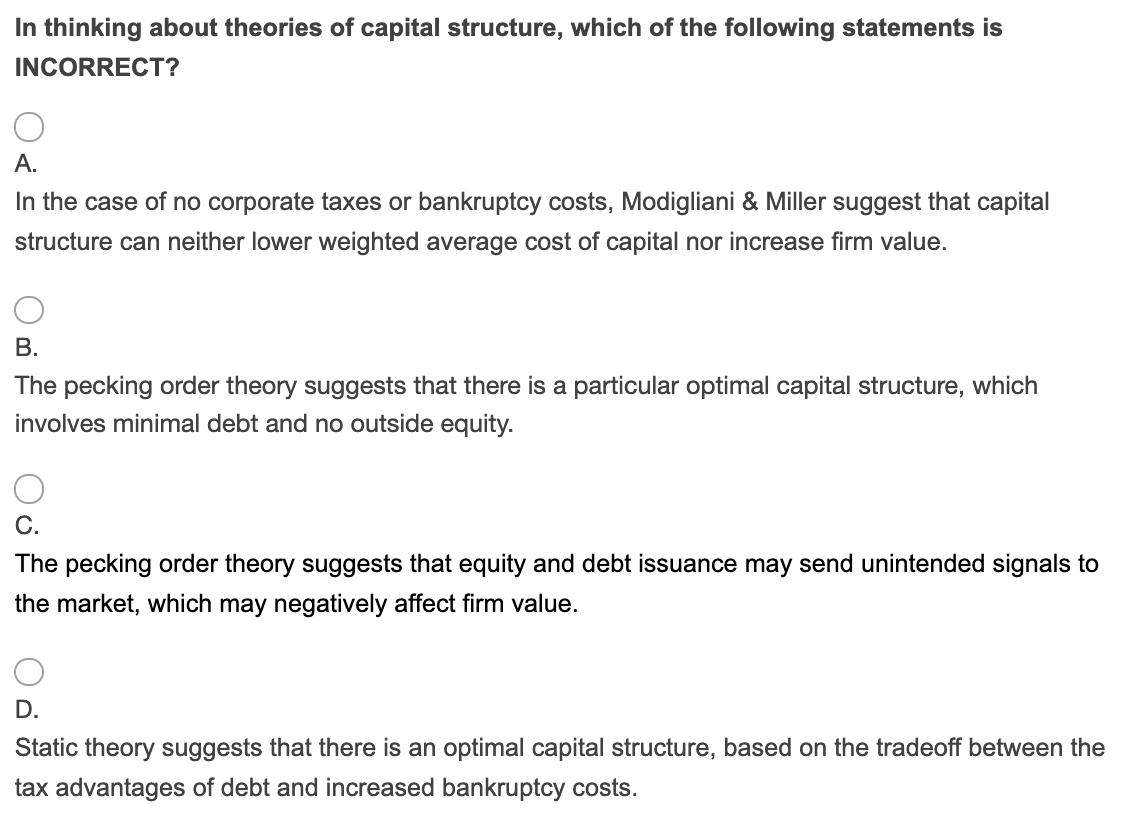

In thinking about theories of capital structure, which of the following statements is INCORRECT? A. In the case of no corporate taxes or bankruptcy costs, Modigliani & Miller suggest that capital structure can neither lower weighted average cost of capital nor increase firm value. B. The pecking order theory suggests that there is a particular optimal capital structure, which involves minimal debt and no outside equity. C. The pecking order theory suggests that equity and debt issuance may send unintended signals to the market, which may negatively affect firm value. D. Static theory suggests that there is an optimal capital structure, based on the tradeoff between the tax advantages of debt and increased bankruptcy costs.

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

A In the case of no corporate taxes or bankruptcy costs Mod igl iani Miller suggest that capital str... View full answer

Get step-by-step solutions from verified subject matter experts