Question: Which statements are CORRECT? Check all that apply: By Dividend Discount Model (DDM), if a company never ever pays any cash in the future, its

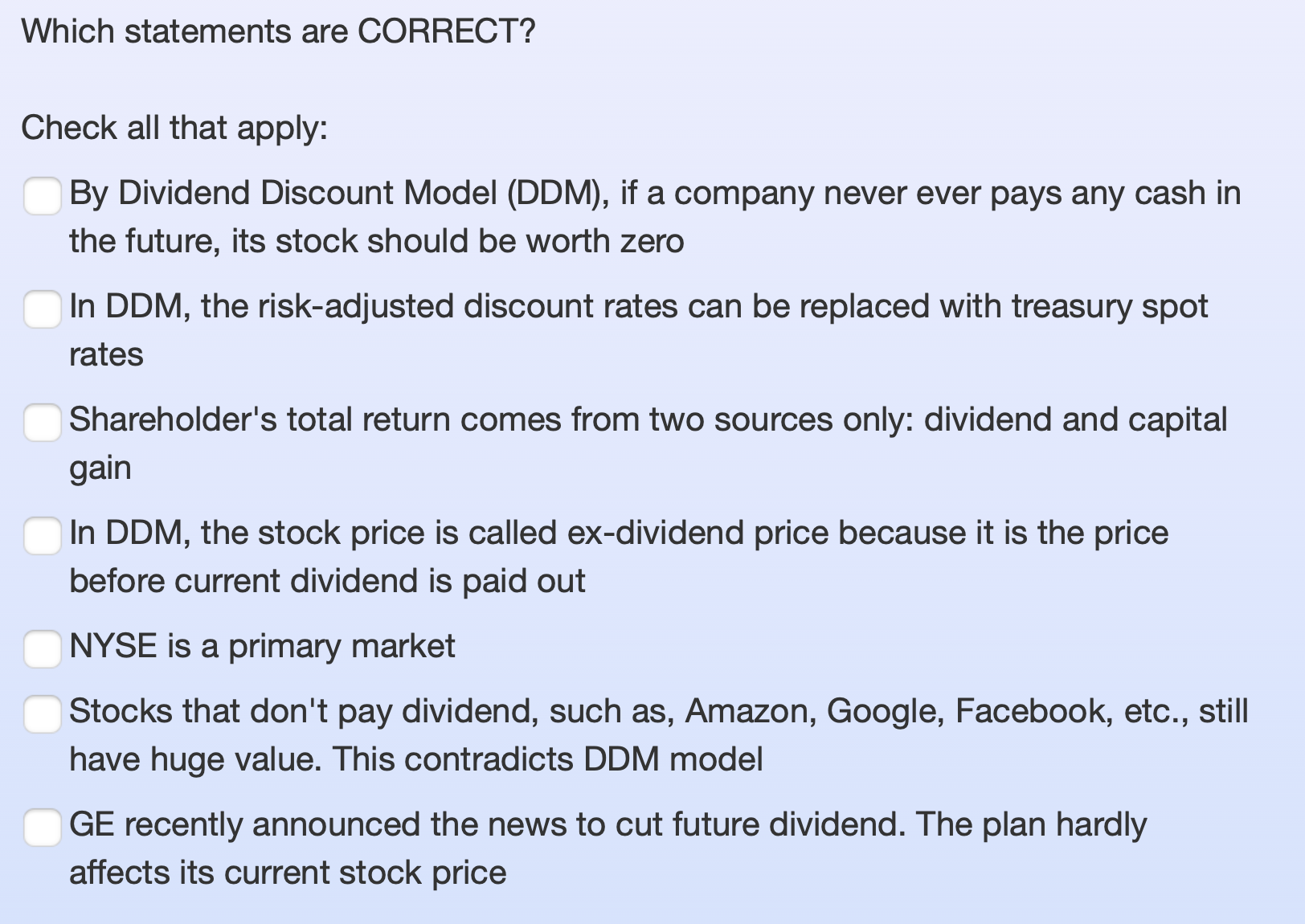

Which statements are CORRECT? Check all that apply: By Dividend Discount Model (DDM), if a company never ever pays any cash in the future, its stock should be worth zero In DDM, the risk-adjusted discount rates can be replaced with treasury spot rates Shareholder's total return comes from two sources only: dividend and capital gain In DDM, the stock price is called ex-dividend price because it is the price before current dividend is paid out NYSE is a primary market Stocks that don't pay dividend, such as, Amazon, Google, Facebook, etc., still have huge value. This contradicts DDM model GE recently announced the news to cut future dividend. The plan hardly affects its current stock price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts