Question: Which strategy is, on average, more profitable for the firm? A. Aggressive Strategy B. Friendly Strategy C. It cannot be determined D. The Strategies are

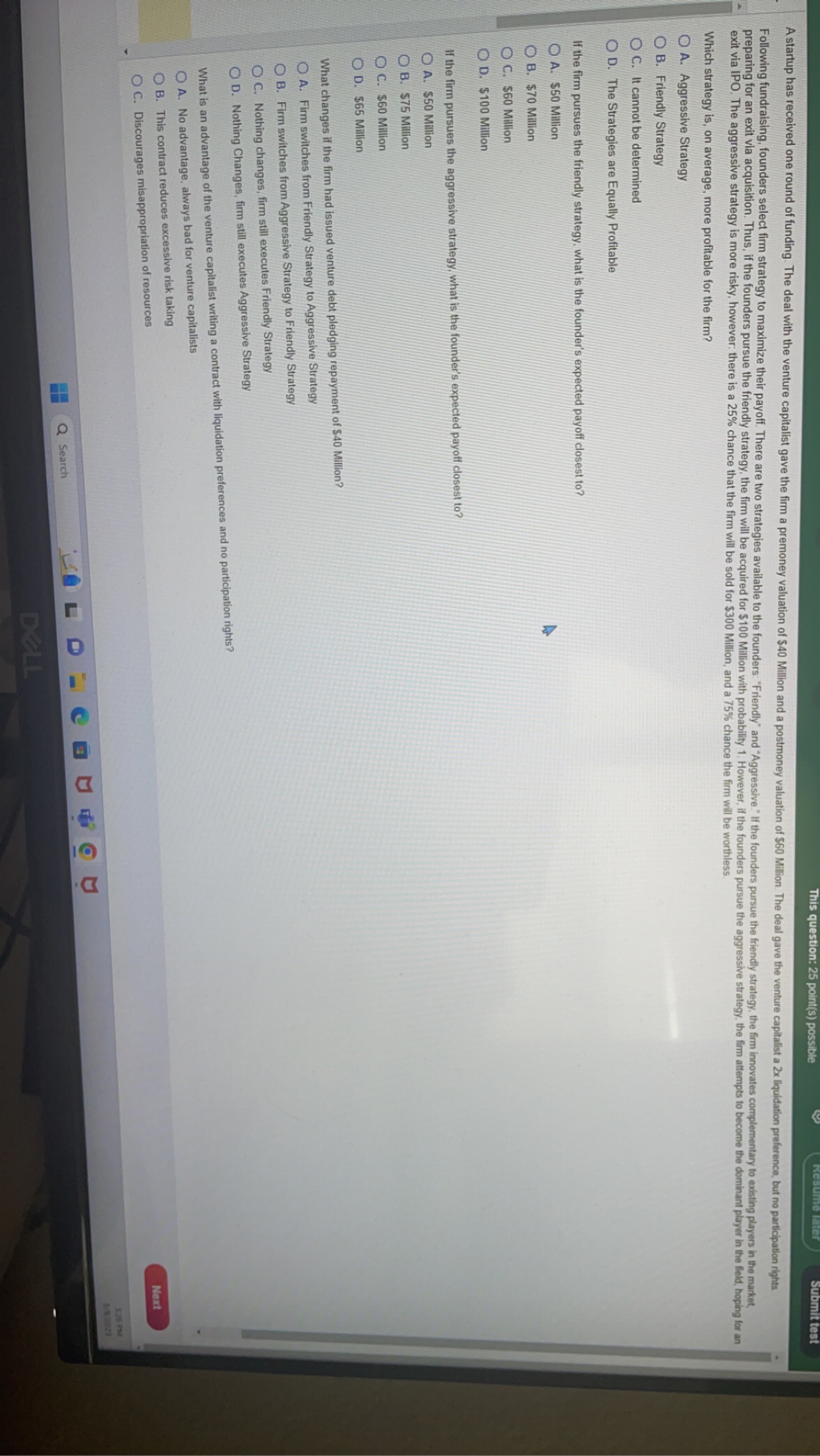

Which strategy is, on average, more profitable for the firm? A. Aggressive Strategy B. Friendly Strategy C. It cannot be determined D. The Strategies are Equally Profitable If the firm pursues the friendly strategy, what is the founder's expected payoff closest to? A. $50 Million B. $70 Million C. $60 Million D. $100 Million If the firm pursues the aggressive strategy, what is the founder's expected payoff closest to? A. $50 Million B. $75 Million C. $60 Million D. $65 Million What changes if the firm had issued venture debt pledging repayment of $40 Million? A. Firm switches from Friendly Strategy to Aggressive Strategy B. Firm switches from Aggressive Strategy to Friendly Strategy C. Nothing changes, firm still executes Friendly Strategy D. Nothing Changes, firm still executes Aggressive Strategy What is an advantage of the venture capitalist writing a contract with liquidation preferences and no participation rights? A. No advantage, always bad for venture capitalists B. This contract reduces excessive risk taking C. Discourages misappropriation of resources

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts