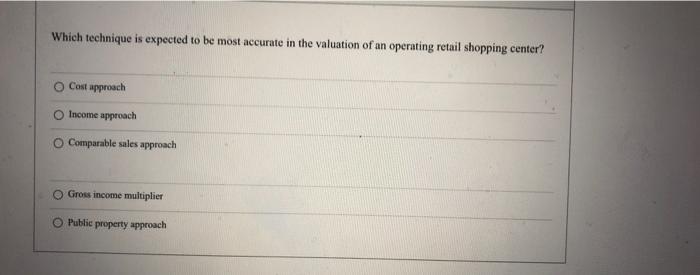

Question: Which technique is expected to be most accurate in the valuation of an operating retail shopping center? o Cost approach Income approach O Comparable sales

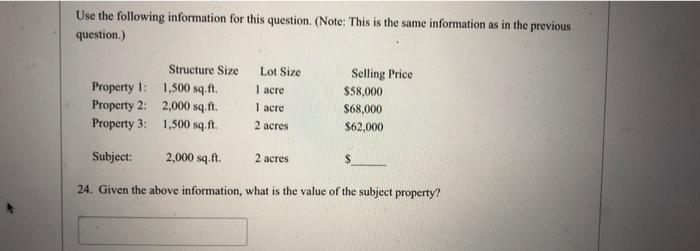

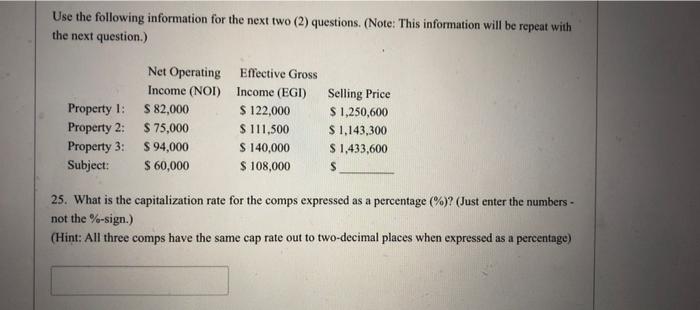

Which technique is expected to be most accurate in the valuation of an operating retail shopping center? o Cost approach Income approach O Comparable sales approach Gross income multiplier Public property approach Use the following information for this question. (Note: This is the same information as in the previous question.) Structure Size Property 1: 1,500 sq.ft Property 2: 2,000 sq.ft. Property 3: 1,500 sq.ft. Lot Size 1 acre 1 acre 2 acres Selling Price $58,000 $68,000 $62,000 Subject: 2,000 sq.ft 2 acres S 24. Given the above information, what is the value of the subject property? Use the following information for the next two (2) questions. (Note: This information will be repeat with the next question.) Property 1: Property 2: Property 3: Subject: Net Operating Effective Gross Income (NOI) Income (EGI) S 82,000 $ 122,000 $ 75,000 $ 111,500 $ 94,000 $ 140,000 $ 60,000 $ 108,000 Selling Price $ 1,250,600 $ 1,143,300 $ 1,433,600 s 25. What is the capitalization rate for the comps expressed as a percentage (%)? (Just enter the numbers - not the %-sign.) (Hint: All three comps have the same cap rate out to two-decimal places when expressed as a percentage)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts