Question: Which version of a project's payback period should the CFO use when evaluating Project Omega, given its theoretical superiority? The discounted payback period The regular

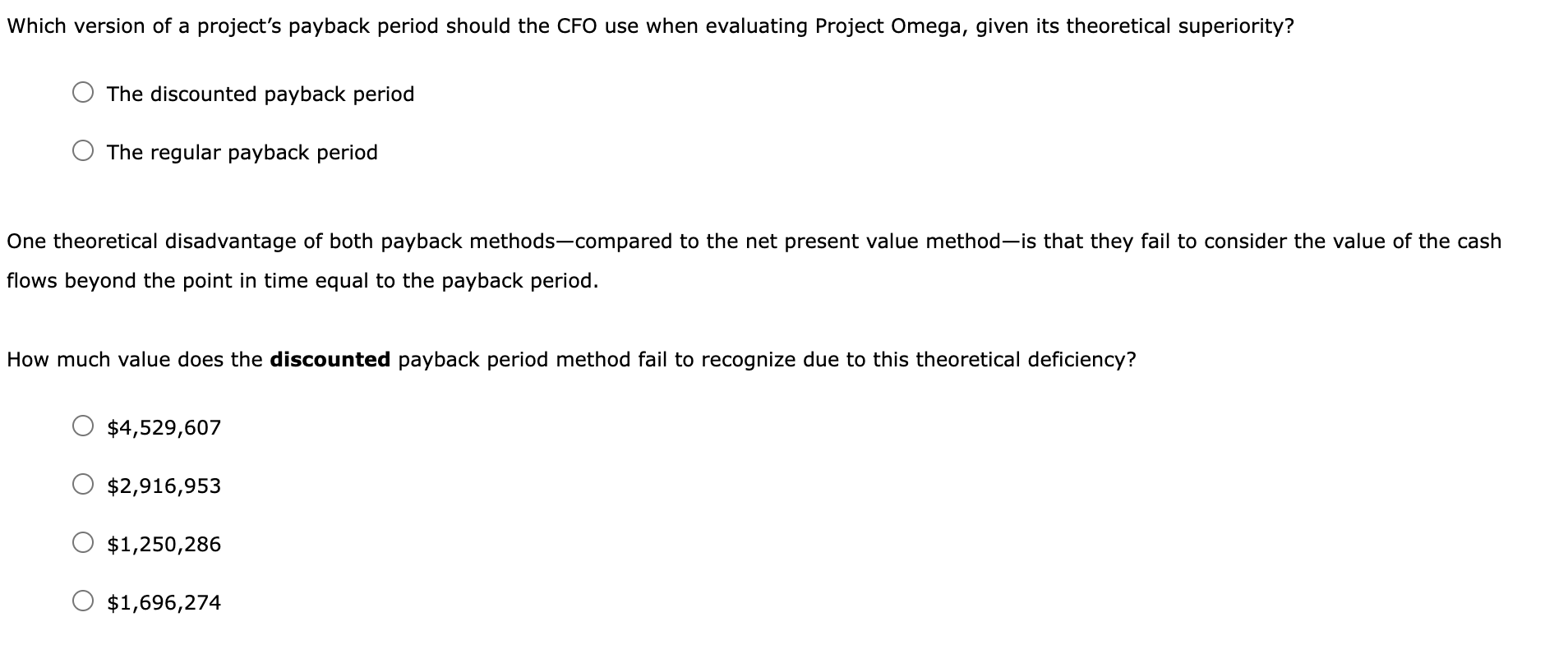

Which version of a project's payback period should the CFO use when evaluating Project Omega, given its theoretical superiority? The discounted payback period The regular payback period One theoretical disadvantage of both payback methods-compared to the net present value method-is that they fail to consider the value of the cash flows beyond the point in time equal to the payback period. How much value does the discounted payback period method fail to recognize due to this theoretical deficiency? $4,529,607$2,916,953$1,250,286$1,696,274

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock