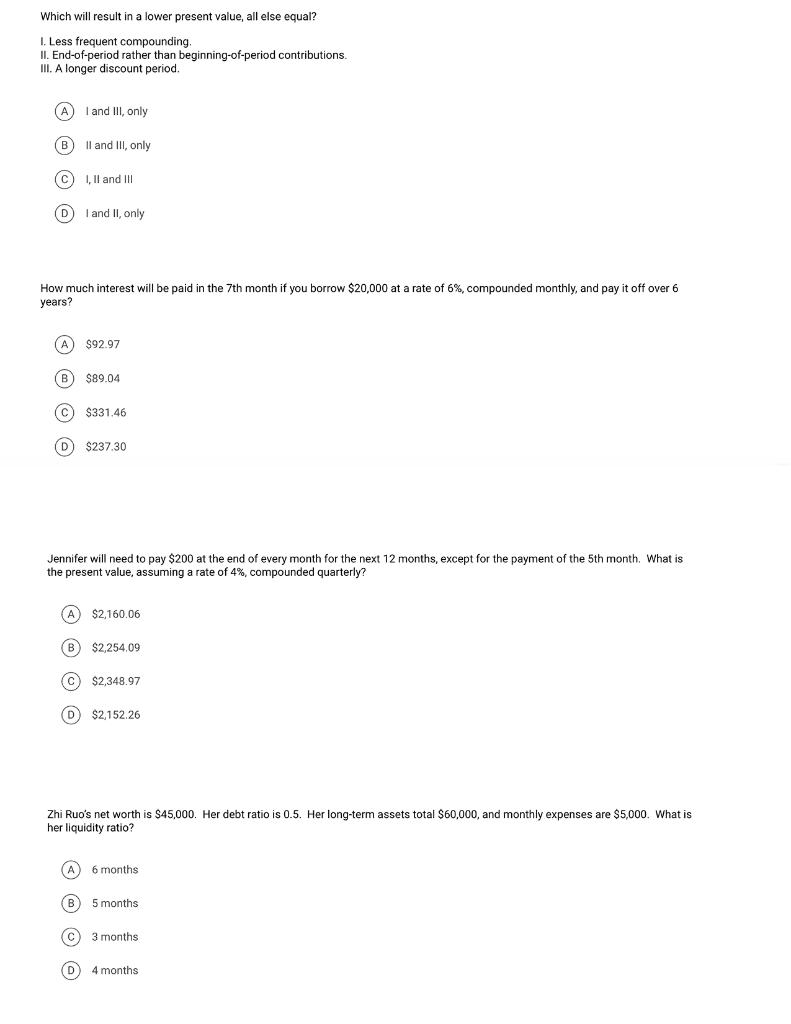

Question: Which will result in a lower present value, all else equal? I. Less frequent compounding II. End-of-period rather than beginning-of-period contributions. III. A longer discount

Which will result in a lower present value, all else equal? I. Less frequent compounding II. End-of-period rather than beginning-of-period contributions. III. A longer discount period. I and III, only II and III, only C) 1. 11 and III I and II, only How much interest will be paid in the 7th month if you borrow $20,000 at a rate of 6%, compounded monthly, and pay it off over 6 years? $92.97 ( $89.04 (c) $331.46 D) $237.30 Jennifer will need to pay $200 at the end of every month for the next 12 months, except for the payment of the 5th month. What is the present value, assuming a rate of 4%, compounded quarterly? A $2,160.06 B $2,254.09 $2.348.97 $2,152.26 Zhi Ruo's net worth is $45,000. Her debt ratio is 0.5. Her long-term assets total $60,000, and monthly expenses are $5,000. What is her liquidity ratio? A 6 months B 5 months 3 months D 4 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts