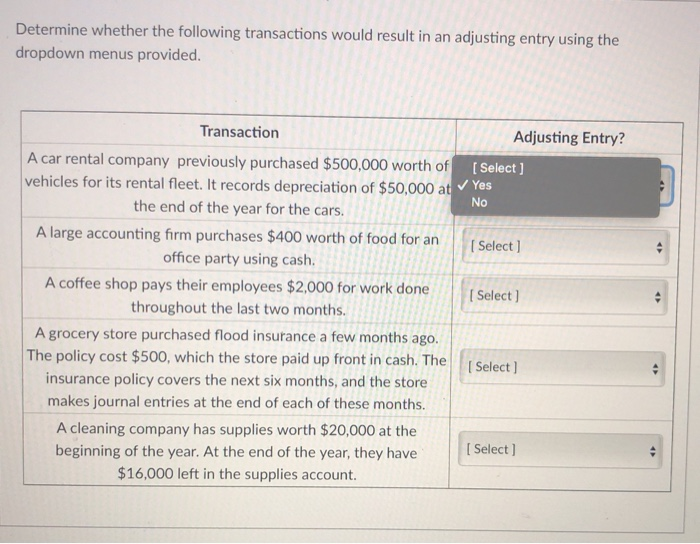

Question: which would result in an adjusting entry? Determine whether the following transactions would result in an adjusting entry using the dropdown menus provided. Transaction Adjusting

Determine whether the following transactions would result in an adjusting entry using the dropdown menus provided. Transaction Adjusting Entry? A car rental company previously purchased $500,000 worth of (Select ] vehicles for its rental fleet. It records depreciation of $50,000 at Yes the end of the year for the cars. No A large accounting firm purchases $400 worth of food for an [ Select ] office party using cash. A coffee shop pays their employees $2,000 for work done [ Select) throughout the last two months. A grocery store purchased flood insurance a few months ago The policy cost $500, which the store paid up front in cash. The [Select) insurance policy covers the next six months, and the store makes journal entries at the end of each of these months. A cleaning company has supplies worth $20,000 at the beginning of the year. At the end of the year, they have [ Select) $16,000 left in the supplies account

Step by Step Solution

There are 3 Steps involved in it

To determine which transactions require an adjusting entry lets analyze each one Car Rental Company ... View full answer

Get step-by-step solutions from verified subject matter experts