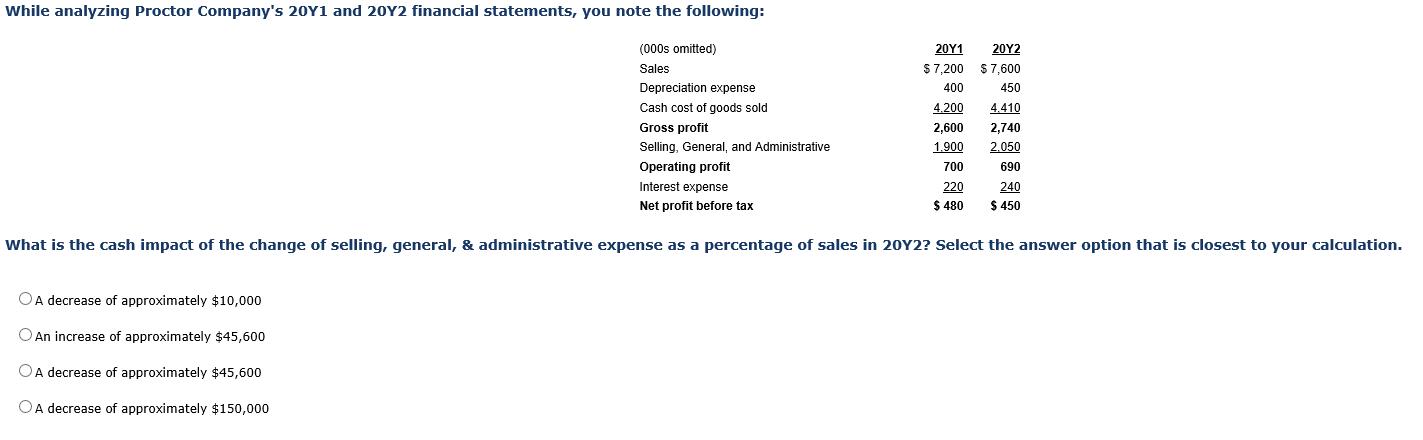

Question: While analyzing Proctor Company's 20Y1 and 20Y2 financial statements, you note the following: (000s omitted) Sales Depreciation expense Cash cost of goods sold Gross

While analyzing Proctor Company's 20Y1 and 20Y2 financial statements, you note the following: (000s omitted) Sales Depreciation expense Cash cost of goods sold Gross profit Selling, General, and Administrative Operating profit Interest expense Net profit before tax OA decrease of approximately $10,000 An increase of approximately $45,600 OA decrease of approximately $45,600 OA decrease of approximately $150,000 20Y1 $ 7,200 400 20Y2 $7,600 450 4.410 2,740 4.200 2,600 1.900 2.050 690 700 220 240 $ 480 $ 450 What is the cash impact of the change of selling, general, & administrative expense as a percentage of sales in 20Y2? Select the answer option that is closest to your calculation.

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

To calculate the cash impact of the change in selling ... View full answer

Get step-by-step solutions from verified subject matter experts