Question: While reviewing a company, an analyst identifies a permanent difference between taxable income and pretax income. Which of the following statements most accurately identifies the

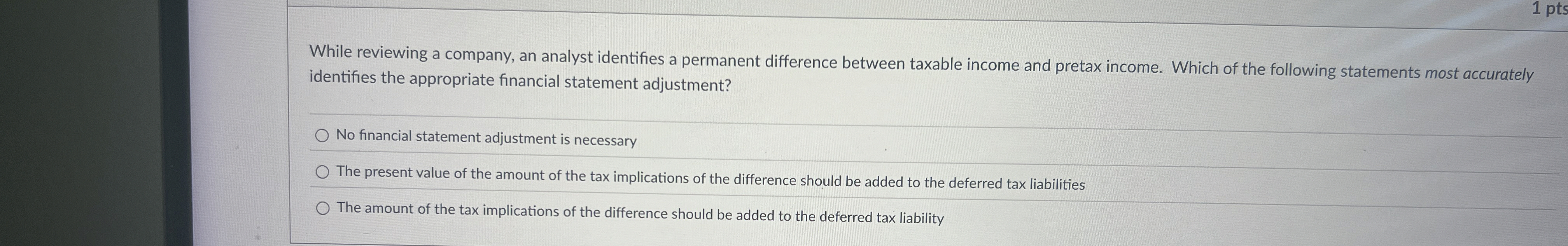

While reviewing a company, an analyst identifies a permanent difference between taxable income and pretax income. Which of the following statements most accurately identifies the appropriate financial statement adjustment?

No financial statement adjustment is necessary

The present value of the amount of the tax implications of the difference should be added to the deferred tax liabilities

The amount of the tax implications of the difference should be added to the deferred tax liability

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock